Vodafone 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 123

Financials

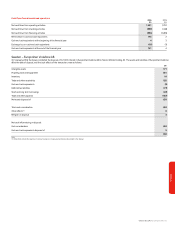

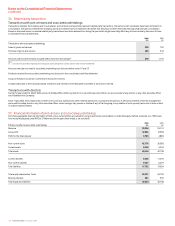

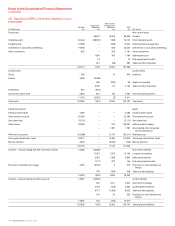

US GAAP condensed consolidated statement of operations 2006 2006 2005

Restated

Reference $m £m £m

Revenue 41,319 23,756 21,370

Cost of sales (48,920) (28,126) (27,803)

Selling, general and administrative expense (7,552) (4,342) (3,779)

Operating loss (15,153) (8,712) (10,212)

Share of results in investments accounted for under the equity method (1,816) (1,044) (2,179)

Non-operating income and expense (1,151) (662) (465)

Loss before income taxes (18,120) (10,418) (12,856)

Income tax benefit 5,614 3,228 4,994

Minority interests (170) (98) (108)

Loss from continuing operations (12,676) (7,288) (7,970)

Discontinued operations, net of taxes (10,405) (5,982) 590

Cumulative effect of changes in accounting principles, net of taxes ––(6,372)

Net loss (23,081) (13,270) (13,752)

Basic and diluted loss per share: Cents Pence Pence

Loss from continuing operations (20.25) (11.64) (12.03)

Discontinued operations (16.62) (9.56) 0.89

Cumulative effect of changes in accounting principles ––(9.63)

Net loss k(36.87) (21.20) (20.77)

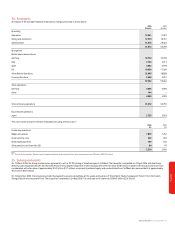

Discontinued operations

As discussed in note 29, the Group disposed of its interests in Vodafone Sweden during

the year ended 31 March 2006. Vodafone Sweden has been classified as discontinued

under US GAAP.

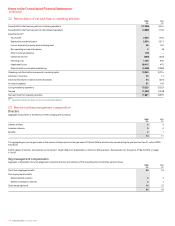

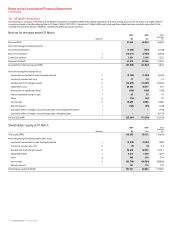

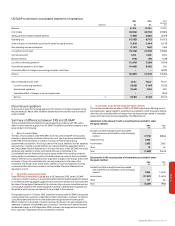

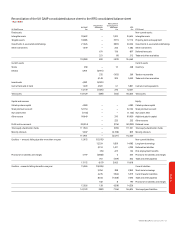

Summary of differences between IFRS and US GAAP

The Consolidated Financial Statements are prepared in accordance with IFRS, which

differ in certain material respects from US GAAP. The differences that are material to the

Group relate to the following:

a. Basis of consolidation

The basis of consolidation under IFRS differs from that under US GAAP. The Group has

interests in several jointly controlled entities, the most significant being Vodafone Italy.

Under IFRS, the Group reports its interests in jointly controlled entities using

proportionate consolidation. The Group’s share of the assets, liabilities, income, expenses

and cash flows of jointly controlled entities are combined with the equivalent items in

the Consolidated Financial Statements on a line-by-line basis. Under US GAAP, the results

and assets and liabilities of jointly controlled entities are incorporated in the

Consolidated Financial Statements using the equity method of accounting. Under the

equity method, investments in jointly controlled entities are carried in the consolidated

balance sheet at cost as adjusted for post-acquisition changes in the Group’s share of the

net assets of the jointly controlled entity, less any impairment in the value of the

investment. The Group’s share of the assets, liabilities, income and expenses of jointly

controlled entities which are included in the Consolidated Financial Statements are

reported in note 13.

b. Connection revenues and costs

Under IFRS and, for transactions subsequent to 30 September 2003, under US GAAP,

customer connection revenue is recognised together with the related equipment revenue

to the extent that the aggregate equipment and connection revenue does not exceed the

fair value of the equipment delivered to the customer. Any customer connection revenue

not recognised together with related equipment revenue is deferred and recognised over

the period in which services are expected to be provided to the customer.

For transactions prior to 1 October 2003, connection revenue under US GAAP is recognised

over the period that a customer is expected to remain connected to a network. Connection

costs directly attributable to the income deferred are recognised over the same period.

Where connection costs exceed connection revenue, the excess costs were charged in the

statement of operations immediately upon connection. The balances of deferred revenue

and deferred charges as of 30 September 2003 continue to be recognised over the period

that a customer is expected to remain connected to a network.

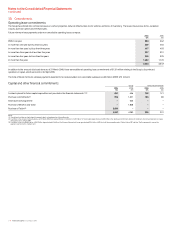

c. Investments accounted for under the equity method

This line item includes the net effect of IFRS to US GAAP adjustments affecting net loss

and shareholders’ equity related to investments accounted for under the equity method,

other than the cumulative effect of change in accounting principle related to intangible

assets, which has been disclosed separately. The differences are:

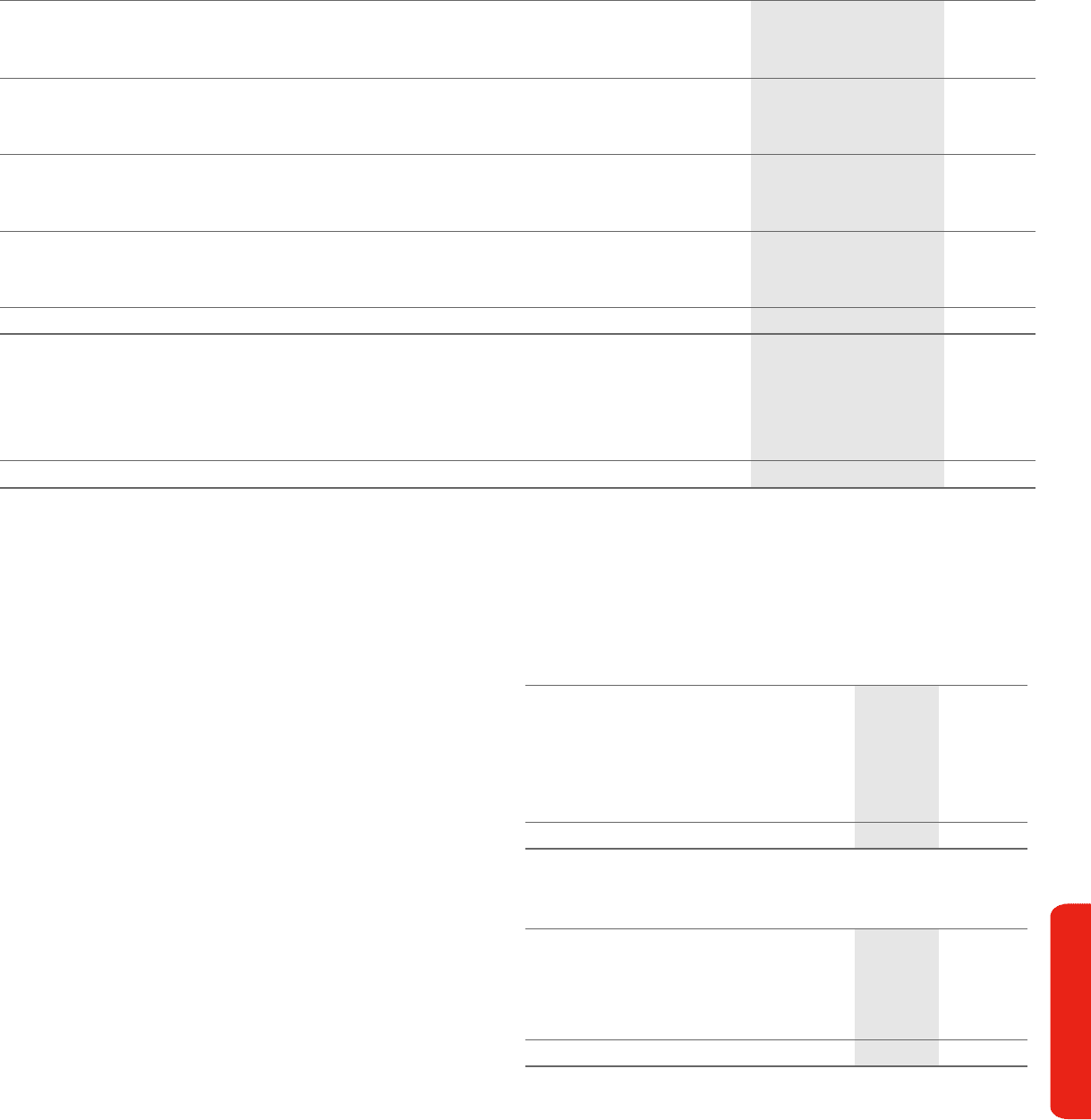

Adjustment to the share of results in investments accounted for under

the equity method 2006 2005

£m £m

Goodwill and other intangible assets associated

with investments accounted for under the equity

method (7,772) (8,864)

Impairment loss 3,600 –

Income taxes 2,863 3,362

Other 79 62

Total (1,230) (5,440)

Adjustments to the carrying value of investments accounted for under

the equity method 2006 2005

£m £m

Goodwill and other intangible assets associated

with investments accounted for under the equity

method 9,539 13,549

Income taxes (11,997) (14,615)

Other 171 84

Total (2,287) (982)