Vodafone 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 Vodafone Group Plc Annual Report 2006

Risk Factors, Trends and Outlook

continued

The Group’s business and its ability to retain customers and

attract new customers may be impaired by actual or perceived

health risks associated with the transmission of radiowaves

from mobile telephones, transmitters and associated

equipment.

Concerns have been expressed in some countries where the Group operates that the

electromagnetic signals emitted by mobile telephone handsets and base stations may

pose health risks at exposure levels below existing guideline levels and may interfere

with the operation of electronic equipment. In addition, as described under the heading

“Legal Proceedings” in note 31 to the Consolidated Financial Statements, several mobile

industry participants, including the Company and Verizon Wireless, have had lawsuits

filed against them alleging various health consequences as a result of mobile phone

usage, including brain cancer. While the Company is not aware that such health risks

have been substantiated, there can be no assurance that the actual, or perceived, risks

associated with radiowave transmission will not impair its ability to retain customers and

attract new customers, reduce mobile telecommunications usage or result in further

litigation. In such event, because of the Group’s strategic focus on mobile

telecommunications, its business and results of operations may be more adversely

affected than those of other companies in the telecommunications sector.

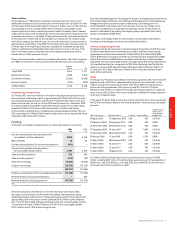

Trend Information

The growth in the mobile telecommunications industry in terms of customers, revenue

and cash flows has been substantial over the past decade. Vodafone believes that the

mobile industry will continue to experience growth, although as the markets in which

the Group operates mature, the rate of growth will depend on the demand for enhanced

voice and data products and services and the amount of voice and data traffic moving

from fixed networks to mobile networks. The most significant current trends which are

expected to impact the Group are:

Increasing penetration rates and competition between

network operators for customers

For the Group’s operations which operate in less penetrated markets, the Group expects

customer growth to be the principal source of revenue growth. Gaining new customers

depends on many factors, including network coverage and quality, customer

satisfaction, product offerings and handset range but a key factor is often the pricing of

handsets and tariffs. In general, as penetration rates rise in a market, competition

intensifies as operators invest more in retaining their existing customers whilst offering

incentives to potential new customers. These competitive pressures, along with new

mobile users who generally spend less than existing users, exert a downward pressure on

ARPU and result in increased acquisition and retention costs. The Group anticipates that

this trend will continue, though it will endeavour to offset the impact by usage

stimulation campaigns, new product offerings and leveraging the Group’s scale and

scope.

In markets with high penetration rates, the Group expects usage stimulation and new

products and services to be the main drivers of revenue growth. Building on the success

of recent campaigns in many of the Group’s markets, bundled offerings are expected to

expand to provide better value to customers and encourage increased use of the

Group’s services. Such stimulation initiatives are expected to increase ARPU in the

medium and longer term as higher usage more than offsets the reduced average

revenue per minute or per message. The Group also expects that technology innovation

will lead to the improved integration of PC’s and laptops with mobile services and

provide opportunities for the Group to expand its product offering, resulting in a larger

market for its services.

A number of national regulators are considering allocating additional spectrum or

offering new licences for the provision of mobile telecommunications services. If the

additional spectrum or new licences are acquired by new or existing competitors, the

competitive pressures in the local market may increase.

Impact of new competitors

New service providers, or MVNOs, in a number of markets in which the Group operates

are increasing the competitive pressures in certain market segments with low cost

offerings. Certain national regulators require, or have stated their intention to require,

network operators to provide network access to such service providers. The Group

expects that in markets in which new service providers have a significant competitive

impact, ARPU is likely to reduce and this competition may result in the need for the

Group to invest further amounts in customer retention.

Downward pressure on termination rates from regulatory action

In recent years, action by NRA’s has led to reductions in the income the Group receives

for terminating calls from fixed or other mobile networks and, similarly, reductions in the

cost charged by other operators for connecting a call on their fixed or mobile network.

Vodafone expects such regulatory pressure to persist for the foreseeable future.

Development of and demand for data services

Since the Group’s introduction of data service offerings, revenue from these services has

increased each year, although there can be no assurance that this will continue to be

the case. With continued growth in the use of data services as more customers utilise 3G

services, including video calling and full track music downloads, the Vodafone Mobile

Connect data card, new business focused offerings and the recent launch of 3G

broadband, the Group expects continued growth in non-messaging data service revenue

and for this revenue to increase as a percentage of total service revenue over time.

Benefits of regional scale and scope

As the world’s leading international mobile telecommunications company, the Group is

able to benefit from its regional scale and scope. The One Vodafone initiatives (see

pages 18 to 19) are targeted at maximising the future value of these benefits.

Impact of convergence and disruptive technologies

The emergence of new technologies, which enable core and radio access networks to be

increasingly based on internet protocols, is likely to provide the Group with opportunities

to reduce costs and target the replacement of customers’ fixed line phone services.

However, they will also provide opportunities for new competitors to enter the

telecommunications services market. Vodafone believes it is well placed to take advantage

of these opportunities, as demonstrated by the launch of Vodafone Zuhause in Germany.

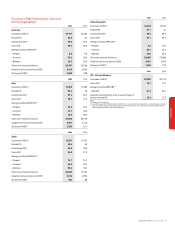

Depreciation expense

Depreciation expense is driven largely by capital expenditure on building and upgrading

the Group’s networks. Capital expenditure on network equipment has increased in

recent years with the construction of 3G networks. As network equipment generally has

an expected useful life of between three and ten years, the resulting depreciation

expense in the medium term is likely to be higher than in the current financial year. The

One Vodafone initiatives are expected to reduce capital expenditure, and hence

depreciation, relative to revenue in the longer term.

Seasonality

The Group’s financial results and cash flows have not, historically, been subject to

significant seasonal trends between the first and second half of the financial year,

although there are a number of offsetting trends.

Traditionally, the Christmas period sees a higher volume of customer connections,

contributing to higher equipment and connection revenue in the second half of the

financial year. Ongoing airtime revenue also demonstrates signs of seasonality, with

revenue generally lower during February, which is a shorter than average month, and

revenue from roaming charges higher during the summer months as a result of

increased travel by customers.

There is no assurance that these trends will continue in the future. For additional

considerations related to these trends, please see “Risk Factors” in this section.

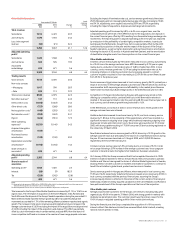

Outlook

The measures presented in the Group’s outlook have been derived from amounts

calculated in accordance with IFRS but are not themselves IFRS measures. Further

disclosures are provided in “Non-GAAP Information” on pages to 47 to 48 and below for

proportionate measures.

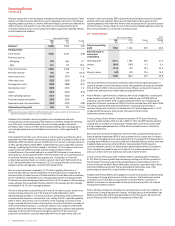

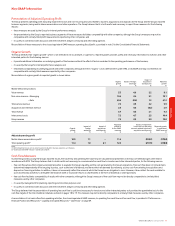

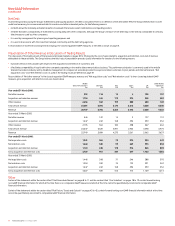

2006 financial year

The following sets out the previously disclosed outlooks provided by the Group in

respect of the 2006 financial year and the Group’s actual performance:

Proportionate Proportionate

mobile revenue mobile EBITDA margin

organic growth(1) organic growth(1)

Outlooks provided for the 2006 financial year:

16 November 2004 High single digit growth Broadly stable

24 May 2005 6% to 9% Flat to 1 percentage

point lower

15 November 2005 Middle of the Lower end of flat to

6% to 9% range 1 percentage point lower

17 March 2006(2) 8% to 9% Higher end of flat to

1 percentage point lower

Actual performance(2) 9.0% 0.3 percentage points lower

Notes:

(1) Assumes constant exchange rates and excludes the impact of business acquisitions and disposals for the financial

measures and adjusted to reflect like-for-like ownership levels in both years.

(2) Excludes discontinued operations.