Vodafone 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 Vodafone Group Plc Annual Report 2006

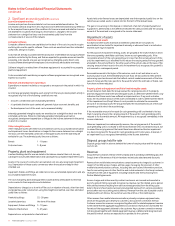

Notes to the Consolidated Financial Statements

continued

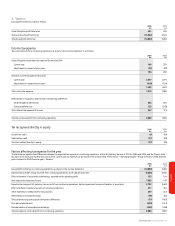

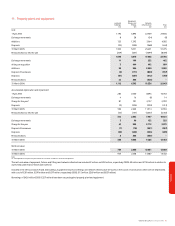

6. Taxation continued

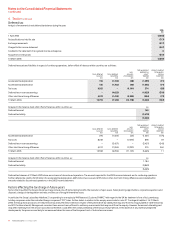

Deferred tax

Analysis of movements in net deferred tax balance during the year:

2006

£m

1 April 2005 (3,665)

Reclassification as held for sale (717)

Exchange movements (217)

Charged to the income statement (567)

Credited to the statement of recognised income and expense 8

Acquisitions and disposals (372)

31 March 2006 (5,530)

Deferred tax assets and liabilities in respect of continuing operations, before offset of balances within countries, are as follows:

Net recognised Amount credited

Less: deferred tax /(charged) in

Gross deferred Gross deferred amounts asset/ income

tax asset tax liability unrecognised (liability) statement

£m £m £m £m £m

Accelerated tax depreciation 155 (1,702) (48) (1,595) (91)

Accelerated tax depreciation 155 (1,702) (48) (1,595) (91)

Tax losses 9,565 – (9,191) 374 (85)

Deferred tax on overseas earnings – (4,025) – (4,025) (318)

Other short term timing differences 4,073 (1,418) (2,939) (284) (73)

31 March 2006 13,793 (7,145) (12,178) (5,530) (567)

Analysed in the balance sheet, after offset of balances within countries, as: £m

Deferred tax asset 140

Deferred tax liability (5,670)

(5,530)

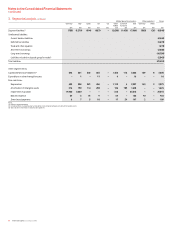

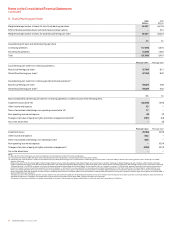

Net recognised Amount credited

Less: deferred tax /(charged) in

Gross deferred Gross deferred amounts asset/ income

tax asset tax liability unrecognised (liability) statement

£m £m £m £m £m

Accelerated tax depreciation 293 (1,604) (20) (1,331) (175)

Tax losses 8,248 – (7,370) 878 69

Deferred tax on overseas earnings – (3,427) – (3,427) (245)

Other short term timing differences 5,017 (1,065) (3,737) 215 362

31 March 2005 13,558 (6,096) (11,127) (3,665) 11

Analysed in the balance sheet, after offset of balances within countries, as: £m

Deferred tax asset 1,184

Deferred tax liability (4,849)

(3,665)

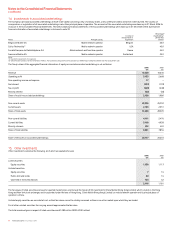

Deferred tax balances at 31 March 2005 above are inclusive of discontinued operations. The amounts reported for the 2005 income statement are for continuing operations.

Further deferred tax credits of £35 million for accelerated tax depreciation, £433 million tax losses and £103 million other short term timing differences are included within

amounts related to discontinued operations in the 2005 income statement.

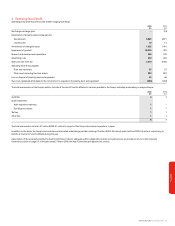

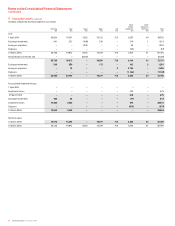

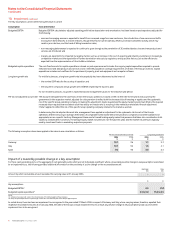

Factors affecting the tax charge in future years

Factors that may affect the Group’s future tax charge include one-off restructuring benefits, the resolution of open issues, future planning opportunities, corporate acquisitions and

disposals, changes in tax legislation and rates, and the use of brought forward tax losses.

In particular, the Group’s subsidiary Vodafone 2 is responding to an enquiry by HM Revenue & Customs (“HMRC”) with regard to the UK tax treatment of one of its Luxembourg

holding companies under the controlled foreign companies (“CFC”) rules. Further details in relation to this enquiry are included in note 31 “Contingent Liabilities”. At 31 March

2006, the Group holds provisions of £1,822 million tax and £276 million interest in respect of the potential UK tax liability that may arise from this enquiry (2005: £1,600 million tax

and £157 million interest). Management considers these amounts are sufficient to settle any assessments that may result from the enquiry. However, the amount ultimately paid

may differ materially from the amount accrued and, therefore, could affect the overall profitability of the Group in future periods. In the absence of any material unexpected

developments, the provisions are likely to be reassessed when the views of the European Court of Justice become known.