Vodafone 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 91

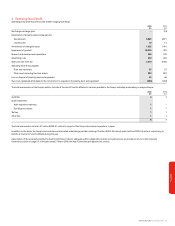

10. Impairment

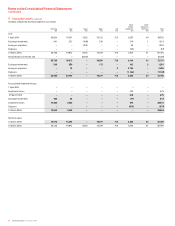

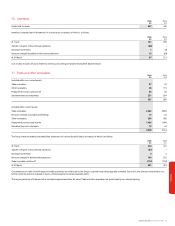

The following cash-generating units, being the lowest level of asset for which there are separately identifiable cash flows, have carrying amounts of goodwill that are considered

significant in comparison with the Group’s total goodwill balance:

2006 2005

£m £m

Germany 16,518 35,765

Italy 16,475 19,812

Spain 10,571 10,399

Japan(1) –8,295

43,564 74,271

Multiple units without significant goodwill 9,042 6,728

52,606 80,999

Note:

(1) Goodwill of £8,295 million relating to the Group’s mobile operations in Japan has been reclassified to assets included in the disposal group held for sale, following the Group’s announcement of its intention to dispose of its operations in Japan on

17 March 2006.

In accordance with accounting standards, the Group undertakes an annual test for impairment of its cash generating units. The most recent test was undertaken at 31 January 2006.

The tests in the years ended 31 March 2006 and 2005 were based on value in use calculations.

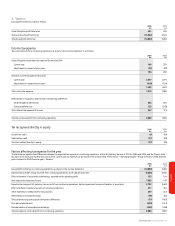

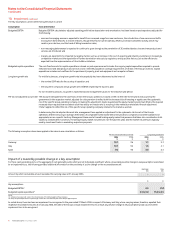

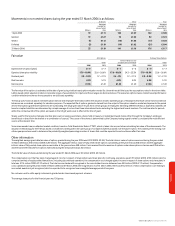

Impairment losses

The impairment losses recognised in the income statement, as a separate line item within operating profit, in respect of goodwill are as follows:

2006 2005

£m £m

Germany 19,400 –

Italy 3,600 –

Other Mobile Operations – Sweden 515 475

23,515 475

Germany and Italy

The carrying value of goodwill of the Group’s mobile operations in Germany and Italy, with each representing a reportable segment, has been impaired due to Vodafone having

revised its view of longer term trends for these businesses given certain developments in the current market environment.

The German market has seen recent intensification in price competition, principally from new market entrants, together with high levels of penetration and continued regulated

reductions in incoming call rates.

In Italy, competitive pressures are increasing with the mobile network operators competing aggressively on subsidies and, increasingly, on price.

The impairment losses were determined as part of the annual test for impairment and were based on value in use calculations using the pre-tax risk adjusted discount rates

disclosed on page 92.

Sweden

The impairment of the carrying value of goodwill of the Group’s mobile operation in Sweden in the years ended 31 March 2006 and 2005 resulted from fierce competition in the

Swedish market combined with onerous 3G licence obligations. Vodafone Sweden forms part of the Group’s Other Mobile Operations, which is a reportable segment.

Prior to its disposal in the year in the year ended 31 March 2006, the carrying value of goodwill was tested for impairment at an interim date as increased competition provided an

indicator that the goodwill may have been further impaired. The recoverable amount of the goodwill was determined as the fair value less costs to sell, reflecting the

announcement on 31 October 2005 that the Group’s 100% interest in Vodafone Sweden was to be sold for €953 million (£653 million). The sale completed on 5 January 2006.

In the year ended 31 March 2005, the impairment was determined as part of the annual test for impairment and was based on value in use calculations. A pre-tax risk adjusted

discount rate of 9.7% was used in the value in use calculation.

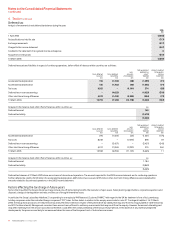

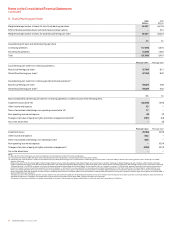

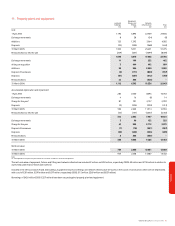

Key assumptions used in the value in use calculations

The Group prepares and internally approves formal ten year plans for its businesses. For the year ended 31 March 2005, the Group used these plans for its value in use calculations.

The plans included cash flow projections for the mobile businesses which were expected to have growth rates in excess of the long-term average growth rates, beyond an initial five

year period, for the markets in which they operate.

In the year ended 31 March 2006, the most recent management plans have shown that the need to reflect a differing growth profile beyond an initial five year period has

diminished in a number of the Group’s key operating companies as the Group has revised its view of longer term trends. Accordingly, the directors believe it is now appropriate to

use projections of five years for its value in use calculations, except in markets which are forecast to grow ahead of the long term growth rate for the market. At 31 March 2006, the

value in use calculation for the Group’s joint venture in India used a ten year plan reflecting the low penetration of mobile telecommunications in the country and the expectation

of strong revenue growth throughout the ten year plan.

Financials