Vodafone 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 31

Revenue

Revenue in the mobile business increased by 9.3%, or 6.7% on an organic basis, for the

year to 31 March 2006 due to a 7.2% increase in service revenue on an organic basis

offset by lower growth in other revenue. Service revenue growth reflected a 15.2%

organic increase in the average customer base of the controlled mobile networks and

the Group’s share of jointly controlled mobile networks, offset by the impact of lower

ARPU in a number of the Group’s markets. Competitive pressures have intensified

recently following a significant number of new market entrants and greater competition

from incumbents, specifically in the mature markets of Western Europe. Many of these

markets have penetration rates over 100% which, together with termination rate cuts

and a higher proportion of lower spending prepaid customers across the Group, have led

to the decline in ARPU. The estimated impact of termination rate cuts on the growth in

service revenue in the current financial year is as follows:

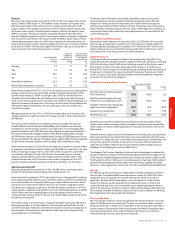

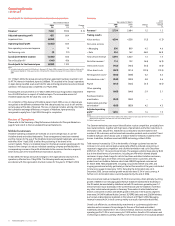

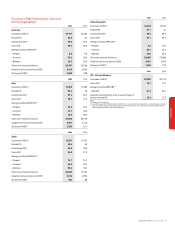

Impact of Service revenue

termination growth excluding

Reported growth rate cut on the impact of

in service service revenue termination rate

revenue growth cuts

%%%

Germany 1.4 1.7 3.1

Italy 1.9 3.4 5.3

Spain 22.0 2.9 24.9

UK 1.6 1.6 3.2

Other Mobile Operations 22.3 2.7 25.0

Mobile telecommunications business 9.9 2.4 12.3

Voice revenue increased by 8.1%, or by 5.3% on an organic basis, due to by the growth in

average customers and a successful usage stimulation programme leading to 24.6%

growth in total minutes, or 18.9% on an organic basis, offset by tariff declines from

competition and termination rate cuts. Revenue from outgoing calls was the primary

driver of voice revenue growth, whilst incoming voice revenue increased marginally as a

significant increase in the proportion of incoming calls from other mobile networks was

offset by the impact of termination rate cuts, particularly in the second half of the

current financial year.

Messaging revenue rose by 13.1%, or 10.6% on an organic basis, as an increase in the

average customer base and the number of messages sent per customer was offset by

tariff declines.

The success of 3G, Vodafone live! and offerings in the business segment, including

Vodafone Mobile Connect data cards and BlackBerry from Vodafone, were the main

contributors to a 61.2% increase, or 60.4% on an organic basis, in non-messaging data

revenue. An additional 6,321,000 3G devices were registered on the Group’s networks in

the current financial year, bringing the total to 7,721,000 at 31 March 2006, including

660,000 business devices such as Vodafone Mobile Connect 3G/GPRS data cards. Prior to

the announcement of the disposal of Vodafone Japan in March 2006, the Group registered

its ten millionth consumer 3G device, when including 100% of the devices in Italy.

Other revenue increased to £2,256 million, principally due to growth in revenue related

to acquisition and retention activities in Spain, partially offset by a reduction in net other

revenue, resulting principally from to a fall in the number of customers connected to

non-Vodafone networks in the UK. A 32.5% rise in the number of gross customer

additions, partially offset by a fall in the average revenue for handset sales to new

prepaid customers and a 24.3% increase in the number of upgrades, led to a 4.7%

growth in revenue related to acquisition and retention activities to £1,724 million.

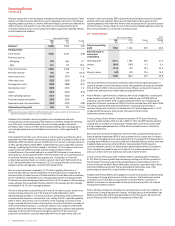

Adjusted operating profit

Adjusted operating profit increased by 11.4% to £9,280 million, comprising organic

growth of 10.3% and favourable exchange rate movements of 1.1%.

Interconnect costs increased by 7.2% on an organic basis, as strong growth in outgoing

voice usage was partially offset by cuts in termination rates in a number of markets and

an increased proportion of outgoing traffic being to other Vodafone customers, which

does not result in interconnect expense. The rise in the number of upgrades and the

increased cost of upgrading customers to 3G were the primary contributors to an 9.4%

organic growth in acquisition and retention costs, net of attributable revenue, to £2,985

million. Payroll and other operating expenses as a percentage of service revenue

continued to fall, reaching 22.2% for the year to 31 March 2006 compared to 22.4% for

the previous financial year.

The charge relating to the amortisation of acquired intangible assets was £157 million

following acquisitions in the Czech Republic, India, Romania and South Africa in the

current financial year. Depreciation and other amortisation increased, principally due to

the net impact of the acquisitions and disposal in the current financial year and the

ongoing expansion of 3G networks.

Performance

The Group’s share of the result in associated undertakings, before non-recurring

amounts related to business acquisitions and disposals, grew by 20.2% after the

deduction of interest, tax and minority interest, and 16.8% before the deductions,

primarily due to growth at Verizon Wireless in the US. The Group’s share of the result in

Verizon Wireless increased by 25.5% to £2,112 million, before deduction of interest, tax

and minority interest, with a particularly strong performance in the second half of the

current financial year.

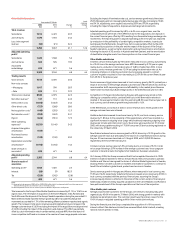

Non-mobile telecommunications

Revenue from Other Operations increased by 22.3% to £1,339 million for the current

financial year, principally due to growth in Arcor, the Group’s non-mobile operation in

Germany. Adjusted operating profit increased to £119 million from £19 million in the

previous financial year as a result of the revenue growth and cost efficiencies in Arcor

and a reduced loss in the Group’s other non-mobile operations.

Impairment losses

The Group recorded an impairment charge to the carrying value of goodwill in the

current financial year of £23,515 million in respect of the Group’s operations in Germany

(£19,400 million) and Italy (£3,600 million) reflecting a revision of the Group’s view of

the prospects for these businesses, particularly in the medium to long term, and a

further £515 million in respect of the Swedish business following the announcement of

its disposal. An impairment loss was recognised in the previous financial year of £475

million in respect of the Group’s Swedish operations and reflected fierce competition

along with onerous 3G licence obligations.

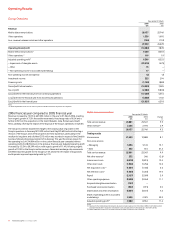

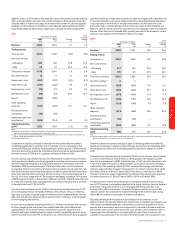

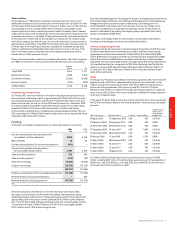

Investment income and financing costs Years ended 31 March

2006 2005 Change

£m £m %

Net financing costs before dividends

from investments (318) (293) 8.5

Potential interest charges arising on

settlement of outstanding tax issues (329) (245) 34.3

Changes in the fair value of equity put

rights and similar arrangements (161) (67) 140.3

Dividends from investments 41 19 115.8

Net financing costs (767) (586) 30.9

Net financing costs before dividends from investments increased by 8.5% to £318

million as an increase in average net debt compared to the previous year was partially

offset by gains on mark-to-market adjustments on financial instruments in the current

financial year.

Potential interest charges arising on the settlement of outstanding tax issues represents

the Group’s estimate of any interest that may be due to tax authorities when the issues

are settled. This charge varies due to the interest rates applied by the tax authorities, the

timing of tax payments and status of discussions on tax issues with the relevant tax

authorities. At 31 March 2006, the provision for potential interest charges arising on

settlement of outstanding tax issues was £896 million.

The change in the fair value of equity put rights and similar arrangements comprises the

fair value movement in relation to the potential put rights held by Telecom Egypt over its

25.5% interest in Vodafone Egypt and the fair value of a financial liability in relation to the

minority partners of Arcor, the Group’s non-mobile operation in Germany. Further details in

respect of these arrangements are provided in the section titled “Liquidity and Capital

Resources – Option agreements” and in note 24 to the Consolidated Financial Statements.

Taxation

The effective tax rate for the year to 31 March 2006 is (16.0)% compared to 25.7% for

the prior year. The negative effective tax rate arises as a result of the £23,515 million

impairment losses recognised in the current financial year. These losses are not

expected to be deductible for tax purposes so are not expected to create a future

benefit. The effective tax rate, exclusive of the impairment losses, is 27.5% for the

current financial year, which is lower than the Group’s weighted average tax rate as a

result of the repurchase of shares in Vodafone Italy and favourable tax settlements, but

has increased compared to the previous year as the prior year benefited from finalising

the reorganisation of the Group’s German operations.

Basic loss per share

Basic earnings per share from continuing operations fell from 8.12 pence to a loss per

share of 27.66 pence for the current year. The basic loss per share is after a charge of

37.56 pence per share in relation to an impairment of the carrying value of goodwill, a

further charge of 0.26 pence per share for the change in fair value of equity put rights

and similar arrangements, and a credit of 0.05 pence per share for non-recurring

amounts relating to business acquisitions and disposals.