Vodafone 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28 Vodafone Group Plc Annual Report 2006

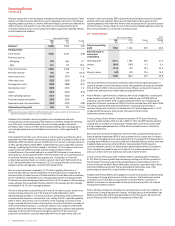

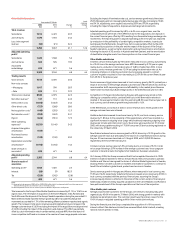

Critical Accounting Estimates

continued

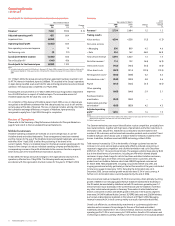

Revenue recognition and presentation

Revenue from mobile telecommunications comprises amounts charged to customers in

respect of monthly access charges, airtime charges, messaging, the provision of other

mobile telecommunications services, including data services and information provision,

fees for connecting users of other fixed line and mobile networks to the Group’s network,

revenue from the sale of equipment, including handsets, and revenue arising from the

Group’s Partner Market agreements.

Deferral period

Customer connection fees, when combined with related equipment revenue, in excess

of the fair value of the equipment are deferred and recognised over the expected life of

the customer relationship. The life is determined by reference to historical customer

churn rates. An increase in churn rates would reduce the customer relationship life and

accelerate revenue recognition. Historically, changes in churn rates have been

insufficient to impact the expected customer relationship life.

Any excess upgrade or tariff migration fees over the fair value of equipment provided are

deferred over the average upgrade or tariff migration period as appropriate. This time

period is calculated based on historical activity of customers who upgrade or change

tariffs. An increase in the time period would extend the period over which revenue is

recognised.

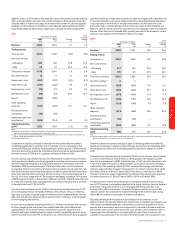

Presentation

When deciding the most appropriate basis for presenting revenue or costs of revenue,

both the legal form and substance of the agreement between the Group and its

business partners are reviewed to determine each party’s respective role in the

transaction.

Where the Group’s role in a transaction is that of principal, revenue is recognised on a

gross basis. This requires turnover to comprise the gross value of the transaction billed

to the customer, after trade discounts, with any related expenditure charged as an

operating cost.

Where the Group’s role in a transaction is that of an agent, revenue is recognised on a

net basis, with turnover representing the margin earned.

Allowance for bad and doubtful debts

The allowance for bad and doubtful debts reflects management’s estimate of losses

arising from the failure or inability of the Group’s customers to make required payments.

The estimate is based on the ageing of customer accounts, customer credit worthiness

and the Group’s historical write-off experience.

Changes to the allowance may be required if the financial condition of the Group’s

customers improves or deteriorates. An improvement in financial condition may result in

lower actual write-offs.

Historically, changes to the estimate of losses have not been material to the Group’s

financial position and results.