Vodafone 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 Vodafone Group Plc Annual Report 2006

Notes to the Consolidated Financial Statements

continued

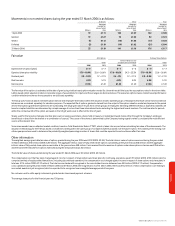

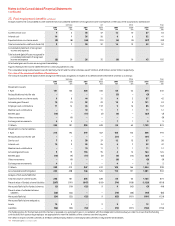

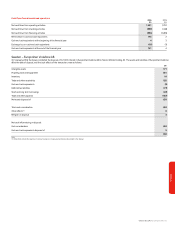

25. Post employment benefits continued

Charges made to the consolidated income statement and consolidated statement of recognised income and expense on the basis of the assumptions stated above:

Germany UK Other Total

2006 2005 2006 2005 2006 2005 2006 2005

£m £m £m £m £m £m £m £m

Current service cost 7638 37 12 10 57 53

Interest cost 10 936 26 6652 41

Expected return on scheme assets (9) (8) (44) (31) (4) (3) (57) (42)

Total included within staff costs (note 34) 8730 32 14 13 52 52

Consolidated statement of recognised

income and expense:

Total actuarial (gains)/losses recognised in

consolidated statement of recognised

income and expense (5) 20 56 72 (8) 10 43 102

All actuarial gains and losses are recognised immediately.

Figures relating to the income statement are for continuing operations only.

The cumulative recognised actuarial losses for Germany, the UK and the other schemes was £15 million, £128 million and £2 million respectively.

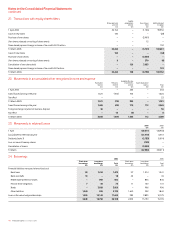

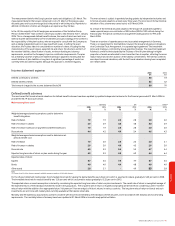

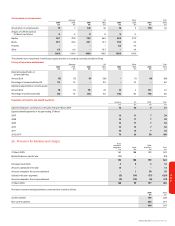

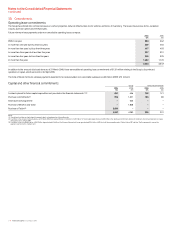

Fair value of the assets and liabilities of the schemes

The amount included in the balance sheet arising from the Group’s obligations in respect of its defined benefit retirement schemes is as follows:

Germany UK Other Total

2006 2005 2006 2005 2006 2005 2006 2005

£m £m £m £m £m £m £m £m

Movement in assets:

1 April 181 165 628 433 65 42 874 640

Reclassification as held for sale ––––(3) –(3) –

Expected return on scheme assets 9844 31 4357 42

Actuarial gains/(losses) 10 (1) 99 23 12 2121 24

Employer cash contributions 11 14 65 137 916 85 167

Member cash contributions ––10 11 1111 12

Benefits paid (10) – (11) (7) (6) –(27) (7)

Other movements –(9) –––––(9)

Exchange rate movements 44––1155

31 March 205 181 835 628 83 65 1,123 874

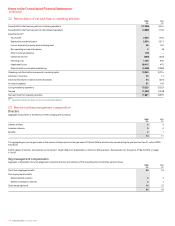

Movement in scheme liabilities:

1 April 213 192 619 457 166 145 998 794

Reclassification as held for sale ––––(31) –(31) –

Service cost 7638 37 12 15 57 58

Interest cost 10 936 26 6752 42

Member cash contributions ––10 11 1111 12

Actuarial (gains)/losses 519 155 95 412 164 126

Benefits paid (10) (9) (11) (7) (6) (14) (27) (30)

Other movements –(9) ––(8) –(8) (9)

Exchange rate movements 45––4–85

31 March 229 213 847 619 148 166 1,224 998

Accumulated benefit obligation 222 208 746 545 113 151 1,081 904

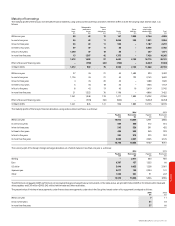

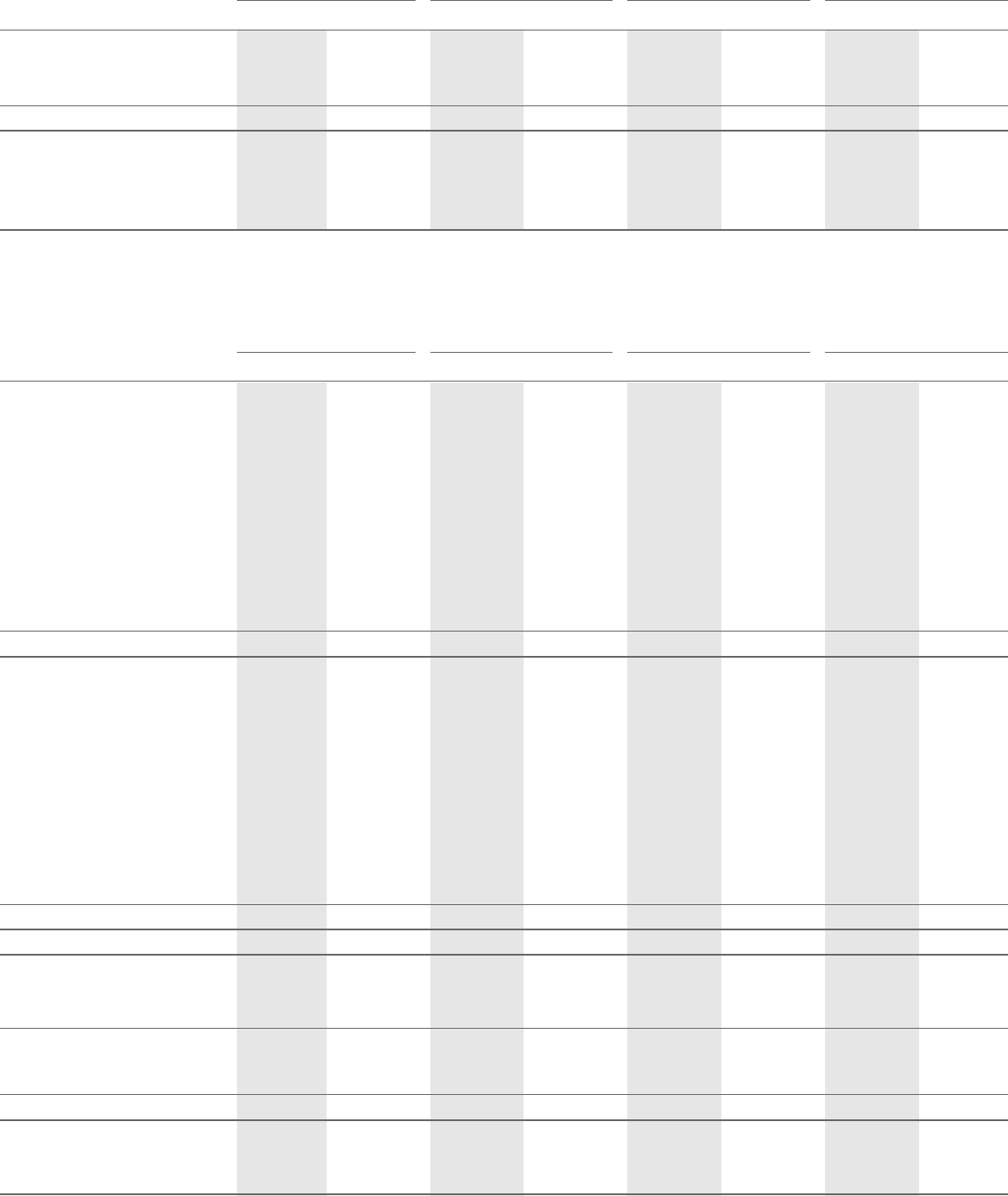

Analysis of net assets/(deficits):

Total fair value of scheme assets 205 181 835 628 83 65 1,123 874

Present value of funded scheme liabilities (207) (191) (847) (619) (74) (108) (1,128) (918)

Net assets/(deficits) for funded schemes (2) (10) (12) 99(43) (5) (44)

Present value of unfunded scheme

liabilities (22) (22) ––(74) (58) (96) (80)

Net assets/(deficits) (24) (32) (12) 9(65) (101) (101) (124)

Net assets/(deficits) are analysed as:

Assets 10 3–99–19 12

Liabilities (34) (35) (12) –(74) (101) (120) (136)

The funding policy for the German and UK schemes is reviewed on a systematic basis in consultation with the independent scheme actuary in order to ensure that the funding

contributions from sponsoring employers are appropriate to meet the liabilities of the schemes over the long term.

The deficit in respect of other schemes at 31 March 2006 primarily relates to internally funded schemes in Italy and the United States.