Vodafone 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 25

Performance

Introduction

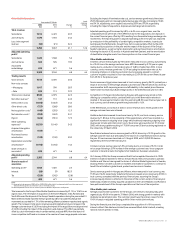

The following discussion is based on the Consolidated Financial Statements included

elsewhere in this Annual Report.

On 19 July 2002, the European Parliament adopted Regulation No. 1606/2002 requiring

listed companies in the Member States of the European Union to prepare their

Consolidated Financial Statements in accordance with IFRS from 2005. This is the first

time the Company’s Annual Report has been prepared under IFRS. Consequently,

financial information for the year ended 31 March 2005, presented as comparative

figures in this report, has been restated from UK GAAP in accordance with IFRS, as

disclosed in note 40 to the Consolidated Financial Statements.

The Consolidated Financial Statements, which are prepared in accordance with IFRS,

differ in certain significant respects from US GAAP. Reconciliations of the material

differences in the IFRS Consolidated Financial Statements to US GAAP are disclosed in

note 38 to the Consolidated Financial Statements, “US GAAP information”.

The Group faces a number of significant risks that may impact on its future performance

and activities. Please see “Risk Factors, Trends and Outlook”.

Foreign Currency Translation

The Company publishes its Consolidated Financial Statements in pounds sterling.

However, the majority of the Company’s subsidiaries, joint ventures and associated

undertakings report their revenue, costs, assets and liabilities in currencies other than

pounds sterling and the Company translates the revenue, costs, assets and liabilities of

those subsidiaries, joint ventures and associated undertakings into pounds sterling when

preparing its Consolidated Financial Statements. Consequently, fluctuations in the value

of pounds sterling versus other currencies could materially affect the amount of these

items in the Consolidated Financial Statements, even if their value has not changed in

their original currency.

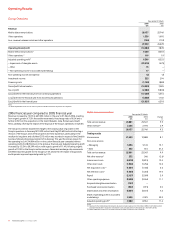

The following table sets out the pounds sterling exchange rates of the other principal

currencies of the Group, being: “euros”, “€” or “eurocents”, the currency of the EU

Member States which have adopted the euro as their currency, and “US dollars”, “$”,

“cents” or “¢”, the currency of the United States.

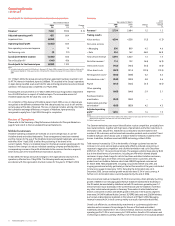

At / year ended 31 March Change

Currency (=£1) 2006 2005 %

Average:

Euro 1.47 1.47 –

US dollar 1.79 1.84 (2.7)

At 31 March:

Euro 1.43 1.46 (2.1)

US dollar 1.74 1.89 (7.9)

Merely for convenience, this Annual Report contains translations of certain pounds

sterling amounts into US dollars at specified rates. These translations should not be

construed as representations that the pounds sterling amounts actually represent such

US dollar amounts or could be converted into US dollars at the rate indicated or at any

other rate. Unless otherwise indicated, the translations of pounds sterling into US dollars

have been made at $1.7393: £1.00, the Noon Buying Rate in the City of New York for

cable transfers in sterling amounts as certified for customs purposes by the Federal

Reserve Bank of New York (the “Noon Buying Rate”) on 31 March 2006. The Noon

Buying Rate on 26 May 2006 was $1.8566: £1.00.

The following table sets out, for the periods and dates indicated, the period end, average,

high and low Noon Buying Rates for pounds sterling expressed in US dollars: £1.00, to

two decimal places.

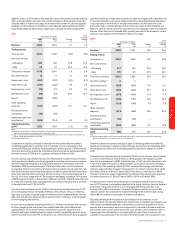

Years ended 31 March Period end Average High Low

2002 1.42 1.43 1.48 1.37

2003 1.58 1.54 1.65 1.43

2004 1.84 1.69 1.90 1.55

2005 1.89 1.85 1.96 1.75

2006 1.74 1.79 1.92 1.71

Month High Low

November 2005 1.78 1.71

December 2005 1.78 1.72

January 2006 1.79 1.74

February 2006 1.78 1.73

March 2006 1.76 1.73

April 2006 1.82 1.74

May 2006(1) 1.89 1.83

Note:

(1) In respect of May 2006, for the period from 1 May to 26 May 2006, inclusive.

Inflation

Inflation has not had a significant effect on the Group’s results of operations and

financial condition during the two years ended 31 March 2006.

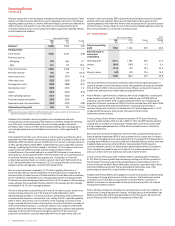

Presentation of Information

In the discussion of the Group’s reported financial position and results, information in

addition to that contained within the Consolidated Financial Statements is presented.

Refer to page 49 for definition of terms.

Contents

Page

Performance Introduction 25

Critical Accounting Estimates 26

Key Performance Indicators 29

Operating Results 30

– Group Overview 30

– Review of Operations 32

– US GAAP Reconciliation 36

– Summary of Key Performance Indicators for Principal Markets 37

Financial Position and Resources 38

– Balance Sheet 38

– Equity Dividends 38

– Contractual Obligations 39

– Contingencies 39

– Liquidity and Capital Resources 39

Risk Factors, Trends and Outlook 43

Cautionary Statement Regarding Forward-Looking Statements 46

Non-GAAP Information 47

Definition of Terms 49