Vodafone 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 Vodafone Group Plc Annual Report 2006

Board’s Report to Shareholders on Directors’ Remuneration

continued

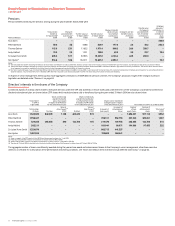

Pensions

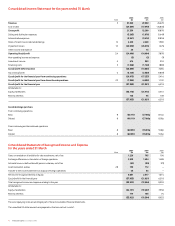

Pension benefits earned by the directors serving during the year ended 31 March 2006 were:

Employer

Transfer value allocation/

Change in transfer of change in contribution to

Total accrued Change in value over year Change in accrued accrued benefit to defined

benefit at accrued benefit Transfer value at Transfer value at less member benefit in excess net of member contribution

31 March 2006(1) over the year(1) 31 March 2005(1) 31 March 2006(2) contributions of inflation contributions plans

Name of Director £’000 £’000 £’000 £’000 £’000 £’000 £’000 £’000

Arun Sarin –––– – – – 360.0

Peter Bamford 30.8 3.5 348.8 529.9 177.4 2.8 44.2 202.4

Thomas Geitner 115.8 23.1 1,163.2 1,971.4 808.2 20.6 350.7 –

Andy Halford 13.3 2.3 110.1 182.8 69.0 2.0 23.7 73.6

Sir Julian Horn-Smith 605.2 57.1 9,090.3 13,231.0 4,106.2 42.3 890.0 –

Ken Hydon(3) 516.6 10.4 10,241.1 12,637.2 2,396.1 – – 79.2

Notes:

(1) The accrued pension benefits earned by the directors are those which would be paid annually on retirement, based on service to the end of the year, at the normal retirement age. The increase in accrued pension excludes any increase for inflation.

(2) The transfer values have been calculated on the basis of actuarial advice in accordance with the Faculty and Institute of Actuaries’ Guidance Note GN11. No director elected to pay additional voluntary contributions. The transfer values disclosed above

do not represent a sum paid or payable to the individual director. Instead they represent a potential liability of the pension scheme.

(3) Ken Hydon reached 60 years of age on 3 November 2004 and retired from the Company following the AGM on 26 July 2005. In accordance with the standard rules of the scheme, he received an immediate pension based on his accrued benefit without

actuarial reduction or any enhancement. From 1 December 2004, Ken Hydon accrued a cash allowance equivalent to 30% of his base salary, which ceased on leaving the Company.

In respect of senior management, the Group has made aggregate contributions of £829,582 into pension schemes. The Company’s proposals in light of the changes in pension

legislation are detailed under “Pensions” on page 63.

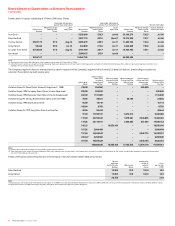

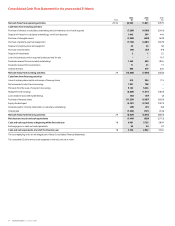

Directors’ interests in the shares of the Company

Short term incentives

Conditional awards of ordinary shares made to executive directors under the STIP, and dividends on those shares paid under the terms of the Company’s scrip dividend scheme and

dividend reinvestment plan, are shown below. STIP shares which vested and were sold or transferred during the year ended 31 March 2006 are also shown below.

Shares conditionally Shares conditionally

awarded during the awarded during the year

Total interest year as base award as enhancement shares Shares sold or transferred

in STIP at in respect of STIP awards in respect of STIP awards during the year in respect

1 April 2005 for the 2005 financial year for the 2005 financial year of the 2003 financial year(1) Total interest in STIP as at 31 March 2006

Value at Value at In respect of Number Number of

Total number date of award(2)(3) date of award((3) In respect of enhancement of base enhancement Total value(4)

of shares Number £’000 Number £’000 base awards shares award shares shares £’000

Arun Sarin 1,520,600 840,498 1,148 420,249 574 – – 1,854,231 927,116 3,352

Peter Bamford 1,958,447––––704,311 352,155 601,320 300,661 1,087

Thomas Geitner 329,205 285,453 390 142,726 195 219,470 109,735 285,453 142,726 516

Andy Halford 565,211––––181,941 90,971 194,866 97,433 352

Sir Julian Horn-Smith 1,324,070––––882,713 441,357–––

Ken Hydon 1,081,324––––720,883 360,441–––

Notes:

(1) Shares in respect of the STIP awards for the 2003 financial year were transferred on 1 July 2005.

(2) Previously disclosed within directors’ emoluments for the year ended 31 March 2005.

(3) Value at date of award is based on the price of the Company’s ordinary shares on 1 July 2005 of 136.25p.

(4) The value at 31 March 2006 is calculated using the closing middle market price of the Company’s ordinary shares at 31 March 2006 of 120.5p.

The aggregate number of shares conditionally awarded during the year as base award and enhancement shares to the Company‘s senior management, other than executive

directors, is 514,603. For a description of the performance and vesting conditions, see “Short and medium term incentive: annual deferred share bonus” on page 62.