Vodafone 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 41

Treasury shares

The Companies Act 1985 permits companies to purchase their own shares out of

distributable reserves and to hold shares with a nominal value not to exceed 10% of the

nominal value of their issued share capital in treasury. If shares in excess of this limit are

purchased they must be cancelled. Whilst held in treasury, no voting rights or pre-

emption rights accrue and no dividends are paid in respect of treasury shares. Treasury

shares may be sold for cash, transferred (in certain circumstances) for the purposes of an

employee share scheme, or cancelled. If treasury shares are sold, such sales are deemed

to be a new issue of shares and will accordingly count towards the 5% of share capital

which the Company is permitted to issue on a non pre-emptive basis in any one year as

approved by its shareholders at the AGM. The proceeds of any sale of treasury shares up

to the amount of the original purchase price, calculated on a weighted average price

method, is attributed to distributable profits which would not occur in the case of the

sale of non-treasury shares. Any excess above the original purchase price must be

transferred to the share premium account.

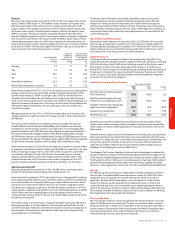

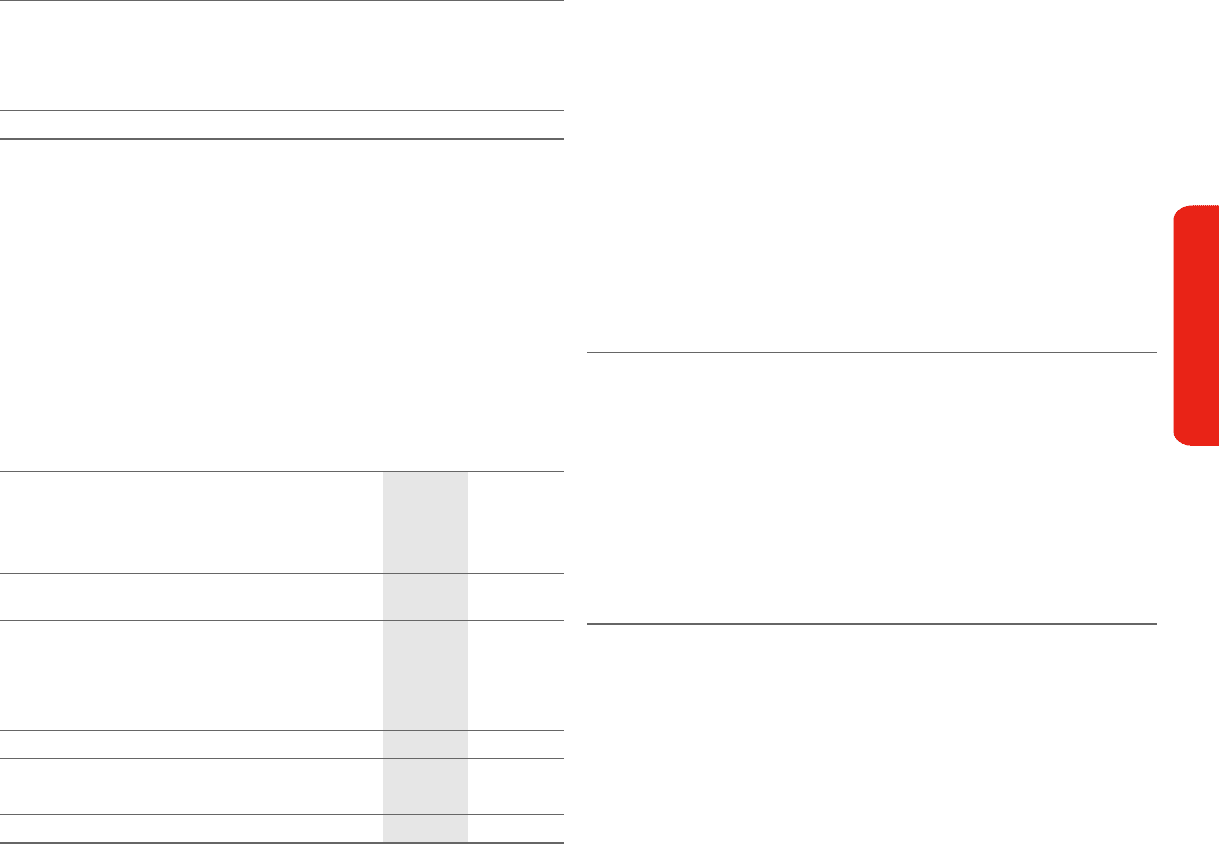

Shares purchased are held in treasury in accordance with section 162 of the Companies

Act 1985. The movement in treasury shares during the financial year is shown below:

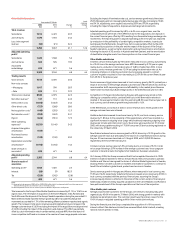

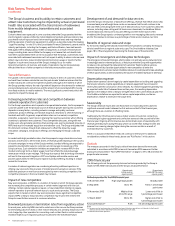

Number

million £m

1 April 2005 3,814 5,121

Repurchase of shares 4,848 6,500

Cancellation of shares (2,250) (3,053)

Re-issue of shares (279) (370)

31 March 2006 6,133 8,198

Vodafone Italy share purchase

On 19 April 2005, the board of directors of Vodafone Italy approved a proposal to buy

back issued and outstanding shares for approximately €7.9 billion (£5.4 billion), which

was subsequently approved by the shareholders of Vodafone Italy. The buy back took

place in two tranches, the first on 24 June 2005 and the second on 7 November 2005.

As a result, Vodafone received €6.1 billion (£4.2 billion) and Verizon Communications

received €1.8 billion (£1.2 billion). After the transaction, Vodafone and Verizon

Communications shareholdings in Vodafone Italy remained at approximately 77% and

23%, respectively. At 31 March 2006, Vodafone Italy had net cash on deposit with Group

companies of €2.3 billion (£1.6 billion).

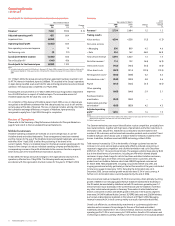

Funding

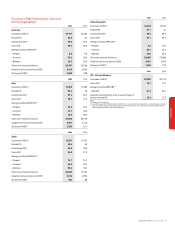

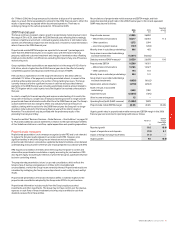

The Group’s consolidated net debt position for continuing operations is as follows:

2006 2005

£m £m

Cash and cash equivalents (as presented in the

consolidated cash flow statement) 2,932 3,726

Bank overdrafts 18 43

Cash and cash equivalents for discontinued operations (161) –

Cash and cash equivalents (as presented in

the consolidated balance sheet) 2,789 3,769

Trade and other receivables(1) 310 408

Trade and other payables(1) (219) (79)

Short-term borrowings (3,448) (2,003)

Long-term borrowings (16,750) (13,190)

(20,107) (14,864)

Net debt as extracted from the consolidated balance sheet (17,318) (11,095)

Net debt related to discontinued operations –920

Net debt related to continuing operations (17,318) (10,175)

Note:

(1) Trade and other receivables and payables include certain derivative financial instruments (see notes 17 and 27).

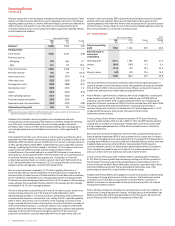

Net debt increased to £17,318 million, from £10,175 million at 31 March 2005,

principally as a result of the cash flow items noted above, share purchases, equity

dividend payments and £34 million of foreign exchange movements. This represented

approximately 24% of the Group’s market capitalisation at 31 March 2006 compared

with 11% at 31 March 2005. Average net debt at month end accounting dates over the

12 month period ended 31 March 2006 was £13,391 million, and ranged between

£9,551 million and £17,318 million during the year.

Consistent with development of its strategy, the Group is now targeting low single A long

term credit ratings from Moody’s, Fitch Ratings and Standard & Poor’s having previously

managed the capital structure at single A credit ratings. Credit ratings are not a

recommendation to purchase, hold or sell securities, in as much as ratings do not

comment on market price or suitability for a particular investor, and are subject to

revision or withdrawal at any time by the assigning rating organisation. Each rating

should be evaluated independently.

The Group’s credit ratings enable it to have access to a wide range of debt finance,

including commercial paper, bonds and committed bank facilities.

Commercial paper programmes

The Group currently has US and euro commercial paper programmes of $15 billion and

£5 billion, respectively, which are available to be used to meet short term liquidity

requirements and which were undrawn at 31 March 2005. At 31 March 2006, $696

million (£400 million) was drawn under the US commercial paper programme and $80

million (£46 million) and £285 million were drawn under the euro commercial paper

programme. The commercial paper facilities are supported by $10.9 billion (£6.3 billion)

of committed bank facilities, comprised of a $5.9 billion Revolving Credit Facility that

matures on 24 June 2009 and a $5.0 billion Revolving Credit Facility that matures on

22 June 2012. At 31 March 2006 and 31 March 2005, no amounts had been drawn

under either bank facility.

Bonds

The Group has a €15 billion Euro Medium Term Note programme, a $12 billion US shelf

programme and a ¥600 billion Japanese shelf programme, which are used to meet

medium to long term funding requirements. At 31 March 2006, the total amounts in

issue under these programmes split by currency were $13.4 billion, £1.5 billion,

€8.7 billion and ¥3 billion. In addition, the Group’s discontinued operation in Japan had

bonds in issue of ¥125 billion, which were transferred to SoftBank following completion

of the sale of Vodafone Japan.

In the year to 31 March 2006, bonds with a nominal value £5.2 billion were issued under

the US Shelf and the Euro Medium Term Note programme. The bonds issued during the

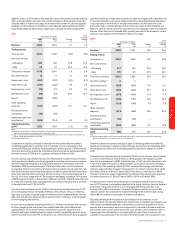

year were:

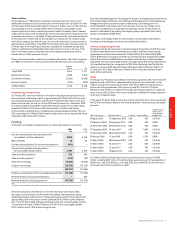

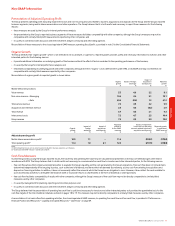

US Shelf / Euro

Medium Term

Note (“EMTN”)

Date of bond issue Maturity of bond Currency Amount Million programme

8 August 2005 15 September 2015 USD 750 US Shelf

8 September 2005 8 September 2014 GBP 350 EMTN

29 November 2005 29 November 2012 EUR 750 EMTN

29 December 2005 29 June 2007 USD 1,850 US Shelf

29 December 2005 28 December 2007 USD 750 US Shelf

8 February 2006 17 July 2008 EUR 1,250 EMTN

16 March 2006 28 December 2007 USD 750 US Shelf

16 March 2006 15 June 2011 USD 350 US Shelf

16 March 2006 15 June 2011 USD 750 US Shelf

16 March 2006 15 March 2016 USD 750 US Shelf

At 31 March 2006, the Group had bonds in issue with a nominal value of £15,389

million, including $207 million of bonds that were assumed as part of the acquisition of

MobiFon S.A. and Oscar Mobil a.s. on 31 May 2005, plus a further ¥125 billion bonds in

the Group’s discontinued operations in Japan.

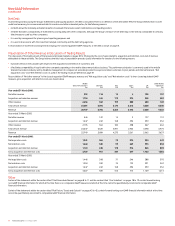

Performance