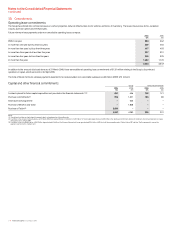

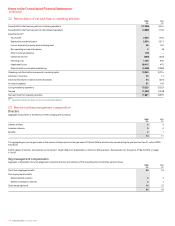

Vodafone 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 Vodafone Group Plc Annual Report 2006

Notes to the Consolidated Financial Statements

continued

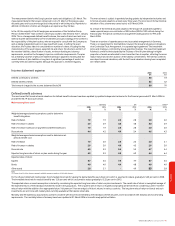

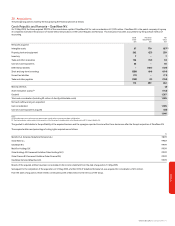

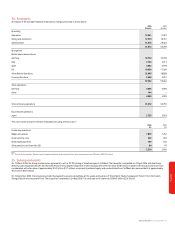

29. Discontinued operations and disposals

Japan – Vodafone K.K.

On 17 March 2006, the Group announced an agreement to sell its 97.7% holding in Vodafone K.K. to SoftBank. The transaction completed on 27 April 2006 with the Group receiving

cash of approximately ¥1.42 trillion (£6.9 billion) including the repayment of intercompany debt of ¥0.16 trillion (£0.8 billion). In addition, the Group received non-cash consideration

with a fair value of approximately ¥0.23 trillion (£1.1 billion), comprised of preferred equity and a subordinated loan. SoftBank also assumed debt of approximately ¥0.13 trillion (£0.6

billion). Vodafone K.K. represented a separate geographical area of operation. On this basis, Vodafone K.K. has been treated as a discontinued operation.

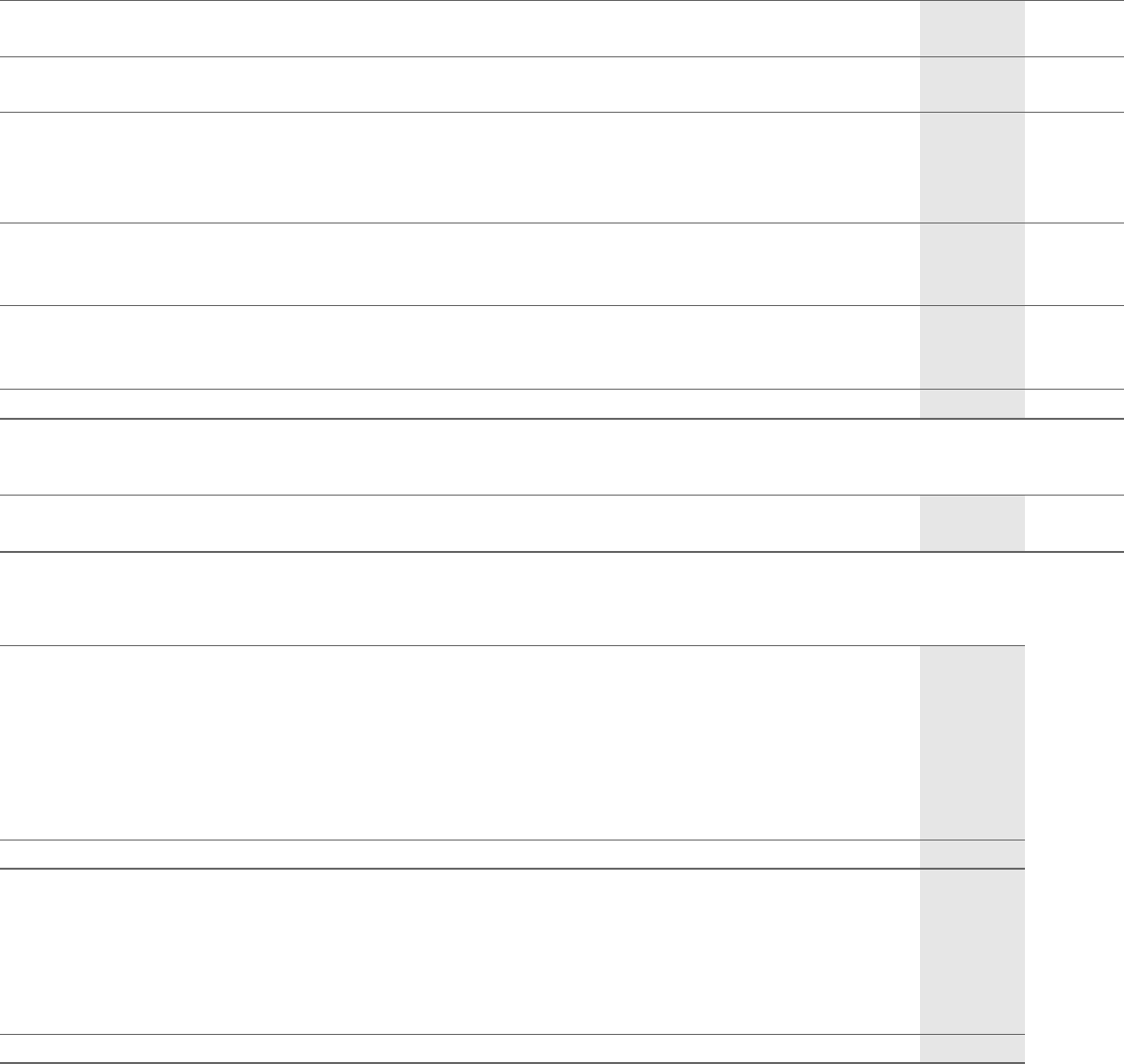

Income statement and segment analysis of discontinued operation 2006 2005

£m £m

Service revenue 5,264 5,610

Equipment and other revenue 2,004 1,786

Segment revenue 7,268 7,396

Inter-segment revenue (2) (1)

Net revenue 7,266 7,395

Operating expenses (5,667) (5,417)

Depreciation and amortisation(1) (1,144) (1,314)

Impairment loss (4,900) –

Operating (loss)/profit (4,445) 664

Non operating income and expense –13

Net financing costs (3) (11)

(Loss)/profit before taxation (4,448) 666

Taxation relating to performance of discontinued operations 7436

Taxation relating to the classification of the discontinued operations (147) –

(Loss)/profit for the financial year from discontinued operations (4,588) 1,102

(Loss)/earnings per share from discontinued operations 2006 2005

Pence per share Pence per share

Basic (loss)/earnings per share (7.35) 1.56

Diluted (loss)/earnings per share (7.35) 1.56

Note:

(1) including gains and losses on disposal of fixed assets

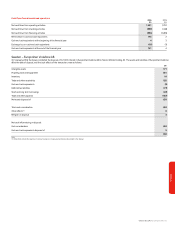

Assets and liabilities of disposal group at 31 March 2006 2006

£m

Intangible assets 3,957

Property, plant and equipment 4,546

Other investments 29

Cash and cash equivalents 161

Inventory 131

Trade and other receivables 1,113

Deferred tax asset 655

Total assets 10,592

Current taxation liability (1)

Short and long-term borrowings (677)

Trade and other payables (1,579)

Deferred tax liabilities (246)

Other liabilities (40)

Total liabilities (2,543)