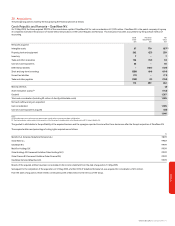

Vodafone 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2006 103

Financials

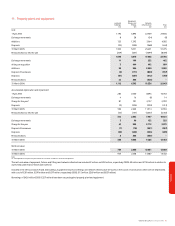

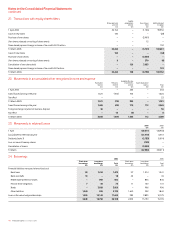

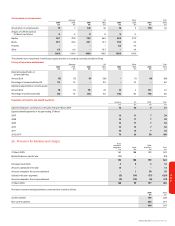

Maturity of borrowings

The maturity profile of the Group’s non-derivative financial liabilities, using undiscounted cash flows and which, therefore, differs to both the carrying value and fair value, is as

follows:

Redeemable Finance Loans in fair

Bank preference lease Other value hedge

loans shares obligations Bonds liabilities relationships Total

£m £m £m £m £m £m £m

Within one year 58 49 12 167 1,858 2,164 4,308

In one to two years 36 49 11 2,044 295 1,521 3,956

In two to three years 36 49 11 936 – 1,187 2,219

In three to four years 39 49 11 55 – 5,548 5,702

In four to five years 1,290 49 10 55 – 267 1,671

In more than five years 13 1,387 42 1,375 – 7,428 10,245

1,472 1,632 97 4,632 2,153 18,115 28,101

Effect of discount/financing rates – (730) (22) (704) – (6,447) (7,903)

31 March 2006 1,472 902 75 3,928 2,153 11,668 20,198

Within one year 27 45 21 43 1,683 590 2,409

In one to two years 1,176 45 21 43 192 2,143 3,620

In two to three years 4 45 20 43 – 1,488 1,600

In three to four years 5 45 18 43 – 1,056 1,167

In four to five years 8 45 17 43 10 5,619 5,742

In more than five years 21 1,323 76 1,196 – 4,806 7,422

1,241 1,548 173 1,411 1,885 15,702 21,960

Effect of discount/financing rates – (703) (32) (505) – (5,527) (6,767)

31 March 2005 1,241 845 141 906 1,885 10,175 15,193

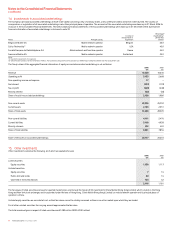

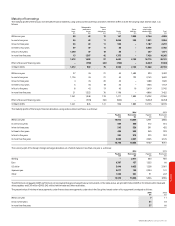

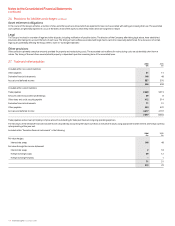

The maturity profile of the Group’s financial derivatives, using undiscounted cash flows, is as follows:

2006 2005

Payable Receivable Payable Receivable

£m £m £m £m

Within one year 14,012 14,009 5,701 5,855

In one to two years 609 600 412 515

In two to three years 545 556 391 435

In three to four years 456 523 345 393

In four to five years 332 315 273 357

In more than five years 2,839 2,851 2,045 2,176

18,793 18,854 9,167 9,731

The currency split of the Group’s foreign exchange derivatives, all of which mature in less than one year, is as follows:

2006 2005

Payable Receivable Payable Receivable

£m £m £m £m

Sterling – 2,971 350 920

Euro 6,387 157 1,553 66

US dollar 3,646 9,655 1,258 3,961

Japanese yen 2,017 190 2,054 141

Other 1,323 361 91 247

13,373 13,334 5,306 5,335

The £39 million net payable (2005: £29 million net receivable) foreign exchange financial instruments, in the table above, are split £69 million (2005: £13 million) within trade and

other payables and £30 million (2005: £42 million) within trade and other receivables.

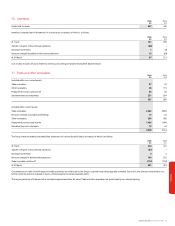

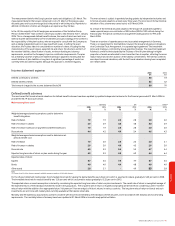

The present value of minimum lease payments under finance lease arrangements under which the Group has leased certain of its equipment is analysed as follows:

2006 2005

£m £m

Within one year 711

In two to five years 31 64

In more than five years 37 66