Vodafone 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 Vodafone Group Plc Annual Report 2006

Notes to the Consolidated Financial Statements

continued

Employee benefits – actuarial gains and losses (IAS 19, “Employee Benefits”)

The Group has elected to recognise all cumulative actuarial gains and losses in relation

to employee benefit schemes at the date of transition.

Share-based payments (IFRS 2, “Share-based Payment”)

The Group has elected to apply IFRS 2 to all relevant share-based payment transactions

granted but not fully vested at 1 April 2004.

Financial instruments (IAS 39, “Financial Instruments: Recognition and

Measurement” and IFRS 7, “Financial Instruments: Disclosures”)

The Group has applied IAS 32 and IAS 39 for all periods presented and has therefore not

taken advantage of the exemption in IFRS 1 that would enable the Group to only apply

these standards from 1 April 2005.

Cumulative translation differences (IAS 21, “The Effects of Changes in Foreign

Exchange Rates”)

The Group has deemed the cumulative translation differences at the date of transition

to IFRS to be zero. As a result, the gain or loss of a subsequent disposal of any foreign

operation will exclude the translation differences that arose before the date of transition

to IFRS.

If the Group had not applied the exemption, the gain or loss on any disposals after the

transition date would include additional cumulative transaction differences relating to

the businesses disposed of.

Fair value or revaluation as deemed cost (IAS 16, “Property, Plant and Equipment”

and IAS 38, “Intangible Assets”)

The Group has not elected to measure any item of property, plant and equipment or

intangible asset at the date of transition to IFRS at its fair value.

40. Transition to IFRS on first-time adoption

Basis of preparation of IFRS financial information

The Group’s Annual Report for the year ended 31 March 2006 is the first annual

Consolidated Financial Statements that comply with IFRS. The Consolidated Financial

Statements have been prepared in accordance with the significant accounting policies

described in note 2. The Group has applied IFRS 1, “First-time Adoption of International

Financial Reporting Standards” in preparing these statements.

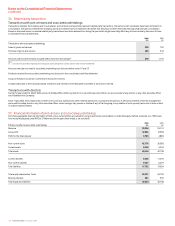

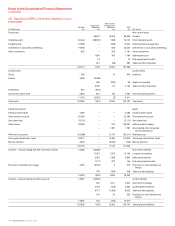

IFRS 1 exemptions

IFRS 1 sets out the procedures that the Group must follow when it adopts IFRS for the

first time as the basis for preparing its Consolidated Financial Statements. The Group is

required to establish its IFRS accounting policies as at 31 March 2006 and, in general,

apply these retrospectively to determine the IFRS opening balance sheet at its date of

transition, 1 April 2004. This standard provides a number of optional exemptions to this

general principle. These are set out below, together with a description in each case of

the exemption adopted by the Group.

Business combinations that occurred before the opening IFRS balance sheet date

(IFRS 3, “Business Combinations”)

The Group has elected not to apply IFRS 3 retrospectively to business combinations that

took place before the date of transition. As a result, in the opening balance sheet,

goodwill arising from past business combinations remains as stated under UK GAAP at

31 March 2004.

If the Group had elected to apply IFRS 3 retrospectively, the purchase consideration would

have been allocated to the following major categories of acquired intangible assets and

liabilities based on their fair values: licence and spectrum fees, brands, customer bases, and

deferred tax liabilities. Goodwill would have been recognised as the excess of the purchase

consideration over the fair values of acquired assets and liabilities – retrospective

application may have resulted in an increase or decrease to goodwill. The fair values of the

acquired intangible assets would have been amortised over their respective useful lives.

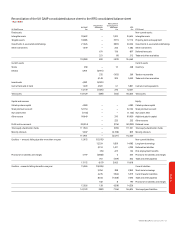

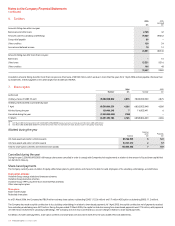

Impact of transition to IFRS

The following is a summary of the effects of the differences between IFRS and UK GAAP on the Group’s total equity shareholders’ funds and profit for the financial year for the years

previously reported under UK GAAP following the date of transition to IFRS.

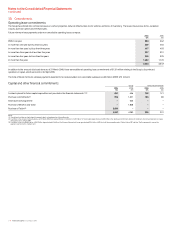

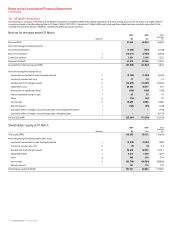

Total equity shareholders’ funds 1 April 2004 31 March 2005

Note £m £m

Total equity shareholders’ funds (UK GAAP) 111,924 99,317

Measurement and recognition differences:

Intangible assets a (164) 13,986

Proposed dividends b 728 1,395

Financial instruments c 385 350

Share-based payments d1263

Defined benefit pension schemes e (257) (361)

Deferred and current taxes f (1,011) (774)

Other (66) (176)

Total equity shareholders’ funds (IFRS) 111,551 113,800

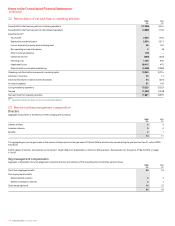

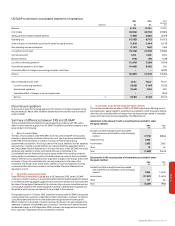

Profit for the year ended 31 March 2005 Note £m

Loss on ordinary activities after taxation (UK GAAP) (6,938)

Measurement and recognition differences:

Intangible assets a 14,263

Financial instruments c (174)

Share-based payments d (91)

Defined benefit pension schemes e7

Deferred and current taxes f10

Other (130)

Presentation differences:

Presentation of equity accounted investments g (45)

Presentation of joint ventures h (384)

Profit for the financial year (IFRS) 6,518

There were no significant differences between IFRS and UK GAAP on the Group’s cash flow statement for the year ended 31 March 2005.