Vodafone 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Vodafone Group Plc Annual Report 2006

Financial Position and Resources

continued

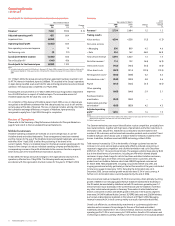

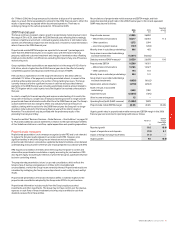

Committed facilities

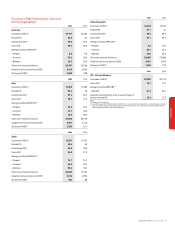

The following table summarises the committed bank facilities available to the Group at

31 March 2006:

Committed Bank Facilities Amounts drawn

24 June 2004

$5.9 billion Revolving Credit Facility, No drawings have been made against

maturing 24 June 2009. this facility. The facility supports the

Group’s commercial paper

programmes and may be used for

general corporate purposes including

acquisitions.

24 June 2005

$5.0 billion Revolving Credit Facility, No drawings have been made against

maturing 22 June 2012. this facility. The facility supports the

Group’s commercial paper

programmes and may be used for

general corporate purposes including

acquisitions.

21 December 2005

¥259 billion Term Credit Facility, The facility was drawn down in full on

maturing 16 March 2011, entered into by 21 December 2005. The facility is

Vodafone Finance K.K. and guaranteed available for general corporate

by the Company. purposes, although amounts drawn

must be on-lent to the Company.

Under the terms and conditions of the $10.9 billion committed bank facilities, lenders

have the right, but not the obligation, to cancel their commitments and have

outstanding advances repaid no sooner than 30 days after notification of a change of

control of the Company. The facility agreements provide for certain structural changes

that do not affect the obligations of the Company to be specifically excluded from the

definition of a change of control. This is in addition to the rights of lenders to cancel

their commitment if the Company has committed an event of default.

Substantially the same terms and conditions apply in the case of Vodafone Finance

K.K.’s ¥259 billion term credit facility, although the change of control provision is

applicable to any guarantor of borrowings under the term credit facility. As of 31 March

2006, the Company was the sole guarantor.

In addition, Vodafone Japan has a fully drawn bilateral facility totalling ¥8 billion (£39 million)

which expires in January 2007 and which was included in the sale of Vodafone Japan.

Furthermore, three of the Group’s subsidiary undertakings are funded by external facilities

which are non-recourse to any member of the Group other than the borrower, due to the

level of country risk involved. These facilities may only be used to fund their operations.

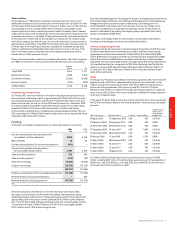

Vodafone Egypt has a partly drawn (EGP250 million (£25 million)) syndicated bank facility

of EGP900 million (£90 million) that fully expires in September 2007. On 1 April 2006 the

undrawn EGP 650 million (£65 million) element of the facility lapsed. Vodafone Albania

has a fully drawn (€60 million (£42 million)) syndicated bank facility that expires at

various dates up to and including October 2012. Vodafone Romania has a fully drawn

€200 million syndicated bank facility that expires at various dates up to October 2010.

In aggregate, the Group has committed facilities of approximately £7,833 million, of

which £6,362 million was undrawn and £1,471 million was drawn at 31 March 2006.

The Group believes that it has sufficient funding for its expected working capital

requirements. Further details regarding the maturity, currency and interest rates of the

Group’s gross borrowings at 31 March 2006 are included in note 24 to the Consolidated

Financial Statements.

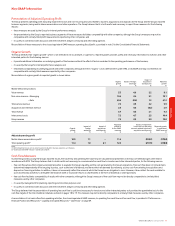

Financial assets and liabilities

Analyses of financial assets and liabilities, including the maturity profile of debt, currency

and interest rate structure, are included in notes 18 and 24 to the Consolidated Financial

Statements. Details of the Group’s treasury management and policies are included

within note 24 to the Consolidated Financial Statements.

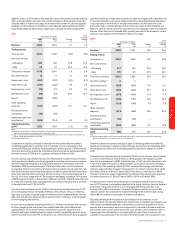

Option agreements and similar arrangements

Potential cash inflows

As part of the agreements entered into upon the formation of Verizon Wireless, the

Company entered into an Investment Agreement with Verizon Communications,

formerly Bell Atlantic Corporation, and Verizon Wireless. Under this agreement, dated

3 April 2000, the Company has the right to require Verizon Communications or Verizon

Wireless to acquire interests in the Verizon Wireless partnership from the Company with

an aggregate market value of up to $20 billion during certain periods up to August 2007,

dependent on the value of the Company’s 45% stake in Verizon Wireless. This represents

a potential source of liquidity to the Group.

Exercise of the option could have occurred in either one or both of two phases. The Phase I

option expired in August 2004 without being exercised. The Phase II option may be

exercised during the periods commencing 30 days before and ending 30 days after any

one or more of 10 July 2006 and 10 July 2007. The Phase II option also limits the

aggregate amount paid to $20 billion and caps the payments under single exercises to

$10 billion. Determination of the market value of the Company’s interests will be by

mutual agreement of the parties to the transaction or, if no such agreement is reached

within 30 days of the valuation date, by appraisal. If an initial public offering takes place and

the common stock trades in a regular and active market, the market value of the

Company’s interest will be determined by reference to the trading price of common stock.

Potential cash outflows

In respect of the Group’s interest in the Verizon Wireless partnership, an option granted

to Price Communications, Inc. by Verizon Communications is exercisable at any time up

to and including 15 August 2006. The option gives Price Communications, Inc. the right

to exchange its preferred limited partnership interest in Verizon Wireless of the East LP

for either equity of Verizon Wireless (if an initial public offering of such equity occurs), or

common stock of Verizon Communications. If the exercise occurs, Verizon

Communications has the right, but not the obligation, to contribute the preferred

interest to the Verizon Wireless partnership, diluting the Group’s interest. However, the

Group also has the right to contribute further capital to the Verizon Wireless partnership

in order to maintain its percentage partnership interest at the level just prior to the

exercise of the option. Such amount is expected to be $1.0 billion.

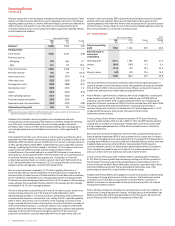

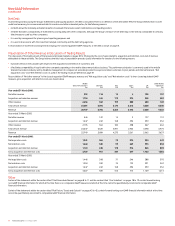

During the 2005 financial year, the Group sold 16.9% of Vodafone Egypt to Telecom Egypt,

reducing the Group’s effective interest to 50.1%. Both parties also signed a shareholder

agreement setting out the basis under which the Group and Telecom Egypt would each

contribute a 25.5% interest in Vodafone Egypt to a newly formed company to be 50%

owned by each party. Within this shareholder agreement, Telecom Egypt was granted a put

option over its entire interest in Vodafone Egypt giving Telecom Egypt the right to put its

shares back to the Group at fair market value. On 31 October 2005, the shareholder

agreement between Telecom Egypt and Vodafone expired and the associated rights and

obligations contained in the shareholder agreement terminated, including the

aforementioned put option. However, the original shareholders agreement contained an

obligation on both parties to use reasonable efforts to renegotiate a revised shareholder

agreement for their direct shareholding in Vodafone Egypt on substantially the same terms

as the original agreement, which may or may not lead to a new agreement containing a

put option under the terms described above. As of 31 March 2006, the parties have not

agreed to abandon such efforts and as such, the financial liability relating to the initial

shareholder agreement has been retained in the Group’s balance sheet at 31 March 2006.

In respect of Arcor, the Group’s non-mobile operation in Germany, the capital structure

provides all partners, including the Group, the right to withdraw capital from

31 December 2026 onwards and this right in relation to the minority partners has been

recognised as a financial liability.

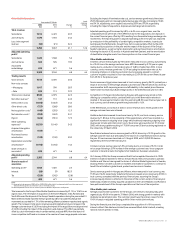

Off-balance sheet arrangements

The Group does not have any material off-balance sheet arrangements, as defined by

the SEC. Please refer to notes 30 and 31 to the Consolidated Financial Statements for a

discussion of the Group’s commitments and contingent liabilities.

Quantitative and qualitative disclosures about market risk

A discussion of the Group’s financial risk management objectives and policies and the

exposure of the Group to liquidity, market and credit risk is included within note 24 to

the Consolidated Financial Statements.