Vodafone 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report

for the year ended 31 March 2006

mobile

Expanding the power of

communication

Table of contents

-

Page 1

mobile Expanding the power of communication Vodafone Group Plc Annual Report for the year ended 31 March 2006 -

Page 2

To enrich our customers' lives through the unique, expanding power of mobile communication. This constitutes the Annual Report of Vodafone Group Plc (the "Company") in accordance with International Financial Reporting Standards ("IFRS") and with those parts of the Companies Act 1985 applicable to ... -

Page 3

...Key Performance Indicators Operating Results Financial Position and Resources Risk Factors, Trends and Outlook Cautionary Statement Regarding Forward-Looking Statements Non-GAAP Information Deï¬nition of Terms 25 26 29 30 38 43 46 47 49 Board of Directors and Group Management Corporate Governance... -

Page 4

... Balance Sheet Data IFRS Total assets Total equity Total equity shareholders' funds Total liabilities 220,435 148,383 148,580 72,052 126,738 85,312 85,425 41,426 147,197 113,648 113,800 33,549 US GAAP Shareholders' equity 151,291 86,984 107,295 129,141 140,580 141,016 2 Vodafone Group Plc Annual... -

Page 5

... Consolidated Financial Statements for further details on these changes in accounting policy. (3) 2002 net loss includes the cumulative effect of accounting changes related to derivative ï¬nancial instruments reducing net loss by £17 million or 0.02p per ordinary share. (4) Amounts reported refer... -

Page 6

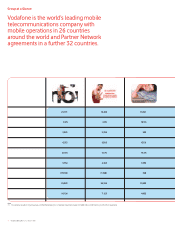

Group at a Glance Vodafone is the world's leading mobile telecommunications company with mobile operations in 26 countries around the world and Partner Network agreements in a further 32 countries. Germany Italy Spain Closing proportionate customers ('000) Average proportionate customer growth ... -

Page 7

... Total Mobile 16.304 23,530 69,535 170,571 7.8% 17.0% 34.0% 18.8% 1,033 - 1,511 7,721 £24.0 $51.4 - - 20.3% 8.9% 14.3% 17.0% 5,048 - 9,250 28,137 698 1,732 2,008 (14,203) 9,486 17,898 23,937 111,722 10,620 - 22,895 57,442 Vodafone Group Plc Annual Report 2006... -

Page 8

... reach but we have also transformed our industry by becoming a leader in innovation, introducing groundbreaking services such as Vodafone live! with 3G, thereby setting standards for the mobile industry as a whole. It has been a remarkable achievement. 6 Vodafone Group Plc Annual Report 2006 -

Page 9

... Vodafone Germany. This charge does not impact this year's reported cash ï¬,ows or distributable reserves, out of which we are making returns to shareholders. However, in this challenging market the Chief Executive has spent a great deal of time reviewing the management structure and future planning... -

Page 10

... in our mobile operations. Excluding the net beneï¬t from acquisitions, disposals and exchange rate movements, we achieved organic revenue growth of 7% in mobile and 8% for the Group as a whole. Strong performances in Spain and several of our emerging markets, including South Africa, Egypt and... -

Page 11

... mobile only offering by innovating and delivering total communications solutions; • To actively manage our portfolio to maximise returns; and • To align our ï¬nancial policies regarding capital structure and shareholder returns to support our strategy. Vodafone Group Plc Annual Report 2006... -

Page 12

... in emerging markets • Innovate and deliver on our customers' total communications needs • Actively manage our portfolio to maximise returns • Align capital structure and shareholder returns policy to strategy CEO Key focus Bill Morrow Leverage regional scale to reduce costs and stimulate... -

Page 13

... additional revenue market share between the 2005 and 2008 ï¬nancial years, measured against our established principal competitors in Germany, Italy, Spain and the UK. Our strategic changes also have implications on returns to shareholders and our capital structure. We have previously indicated an... -

Page 14

... 2006, changes to the organisational structure were effected with the objective of focusing the Group's mobile businesses according to different market and customer requirements. The Company's ordinary shares are listed on the London Stock Exchange and the Company's ADSs are listed on the New York... -

Page 15

...; South Africa - Vodacom; Switzerland - Swisscom Mobile; US - Verizon Wireless. (3) All ownership percentages are stated as at 31 March 2006 and exclude options, warrants or other rights or obligations of the Group to increase or decrease ownership in any venture as detailed in "Financial Position... -

Page 16

... up to seven times faster than a dial-up modem. Vodafone has expanded its service offering on 3G networks with high speed internet and e-mail access, video telephony, full track music downloads, mobile TV and other data services in addition to existing voice and data services. The Group has secured... -

Page 17

...services more accessible to people with special communication needs. Vodafone has undertaken significant research to better understand the levels of exclusion relating to use of mobile technology, which is helping to inform relevant areas of the business. A new Social Investment Fund has been formed... -

Page 18

... company markets and two Partner Markets. At 31 March 2006, the service was supported by ten global devices and a varied number of local devices in the controlled markets. Roaming services When travelling abroad roaming allows mobile phone users to make and receive calls using another mobile network... -

Page 19

... the Group. These provide cost structures that support the development of our roaming customer propositions, promote the mutual development of roaming services with our Partner Markets, and deliver significant cost savings. Managed roaming, the network technology that automatically directs Vodafone... -

Page 20

... Connect data card Vodafone Mobile Connect 3G/GPRS data card Vodafone Wireless Office Vodafone live! with 3G Vodafone Push Email Vodafone Passport One Vodafone The One Vodafone initiatives are aimed at achieving cost savings and enhancing revenue for the Group's controlled mobile businesses... -

Page 21

... range of fixed line telephone services to residential and business customers as well as special corporate services ranging from internet and customer relations management to internet and intranet hosting services. The new entity, Neuf Cegetel, has the largest alternative broadband network in France... -

Page 22

...The acquisition of Eircell Limited, a mobile network operator in Ireland, following a public offer for shares which closed in May 2001. The acquisition of the Group's operations in Japan. The Group's initial investment in Japan resulted from the AirTouch merger and between the date of the merger and... -

Page 23

... on proposals for a regulation which will include both retail price regulation aimed at ensuring that the costs of calls when roaming are no more than equivalent domestic calls and the regulation of wholesale prices charged between mobile Vodafone Group Plc Annual Report 2006 21 Business -

Page 24

... international roaming and, in January 2005, the Commission issued a statement of objections following its investigation of the German market. In both cases, the statement of objections was addressed to both the national mobile operating subsidiaries and to the Company and, in both cases, Vodafone... -

Page 25

... review of the call termination market, the NRA has found that all mobile network operators have SMP. The NRA has imposed obligations of cost orientation and nondiscrimination on all operators and accounting separation and transparency on Vodafone and O2. The NRA is also considering the use of price... -

Page 26

... initiated the process to issue a new 2G licence. In January 2006, three companies submitted offers which are now under consideration. Mobile number portability for contract customers was implemented by the mobile network operators in January 2006. South Africa A new Electronic Communications Bill... -

Page 27

... Page Performance Introduction Critical Accounting Estimates Key Performance Indicators Operating Results - Group Overview - Review of Operations - US GAAP Reconciliation - Summary of Key Performance Indicators for Principal Markets Financial Position and Resources - Balance Sheet - Equity Dividends... -

Page 28

... charges based on the allocation to indefinite lived and finite lived intangible assets. On the acquisition of mobile network operators, the identifiable intangible assets may include licences, customer bases and brands. The fair value of these assets is 26 Vodafone Group Plc Annual Report 2006 -

Page 29

...31 to the Consolidated Financial Statements), legal proceedings to recover VAT in relation to 3G licence fees (see "Contingencies" on page 39) and potential tax losses in respect of a write down in the value of investments in Germany (see note 6 to the Consolidated Financial Statements). The amounts... -

Page 30

... services, including data services and information provision, fees for connecting users of other fixed line and mobile networks to the Group's network, revenue from the sale of equipment, including handsets, and revenue arising from the Group's Partner Market agreements. Deferral period Customer... -

Page 31

...previous financial year. Customers The Group highly values its customers and strives to delight them. As a result, customer based KPIs are important measures for internal performance analysis. Management also believes that certain of these measures provide useful information for investors regarding... -

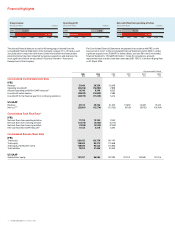

Page 32

...in the Group's mobile business. Favourable exchange rate movements benefited reported growth for the Group by 1.0% whilst the net impact of acquisitions and disposals improved reported growth by 0.1%. Mobile telecommunications Years ended 31 March 2006 2005 £m £m Change % Total service revenue... -

Page 33

... calls from other mobile networks was offset by the impact of termination rate cuts, particularly in the second half of the current financial year. Change % Net financing costs before dividends from investments Potential interest charges arising on settlement of outstanding tax issues Changes... -

Page 34

... non-messaging data revenue. Vodafone maintained its leadership in the 3G market, demonstrated by Vodafone live! with 3G customers generating over 3.1 million full track music downloads in the current financial year for Vodafone, more than any other mobile network operator in Germany. The number of... -

Page 35

... Vodafone live! and Vodafone Mobile Connect data cards and attractive data promotions were the main contributors to 45.2% growth in non-messaging data revenue. In local currency, adjusted operating profit fell by 1.3% due to the impact of an increase in Group charges for the use of brand and related... -

Page 36

...data card service. Verizon Wireless' next-generation EV-DO network is currently available to about 150 million people, approximately half the US population. This investment has paved the way for the launch of innovative new data services in areas such as full track music downloads and location based... -

Page 37

... on an organic basis. The net impact of acquisitions in the Czech Republic, India, Romania and South Africa and the disposal of the Group's Swedish operations during the year ended 31 March 2006 increased reported revenue growth by 6.8%. Favourable exchange rate movements accounted for 1.7% of the... -

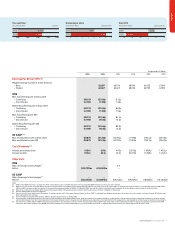

Page 38

.../(loss) 145 211 123 (85) 17.9 Common functions include the results of Partner Markets and unallocated central Group costs and charges. Adjusted operating profit increased primarily due to a revision of the charges made to Vodafone operating companies for the use of the Vodafone brand and related... -

Page 39

... - Prepaid - Contract - Blended Total voice minutes (millions) Vodafone live! active devices ('000) 3G devices ('000) (1) (1)(2) 13,521 50.4 94.3 20.9 15.1 56.9 35.6 23,835 5,514 902 11,472 53 94.6 21.9 15.1 57.4 34.5 17,793 2,992 88 Vodafone Group Plc Annual Report 2006 37 Performance Notes... -

Page 40

...billion (2005: £0.1 billion) in relation to the deficit on defined benefit pension schemes - refer to note 25 to the Consolidated Financial Statements. Current liabilities Current liabilities increased to £15.5 billion from £14.6 billion. Equity Dividends The table below sets out the amounts of... -

Page 41

... or building society account in the United Kingdom. In accordance with the Company's Articles of Association, the sterling: euro exchange rate will be determined by the Company shortly before the payment date. The Company will pay the ADS Depositary, The Bank of New York, its dividend in US dollars... -

Page 42

... on 25 July 2006. Shares can be purchased on market on the London Stock Exchange at a price not exceeding 105% of the average middle market quotation for such shares on the five business days prior to the date of purchase and otherwise in accordance with the rules of the Financial Services Authority... -

Page 43

... items noted above, share purchases, equity dividend payments and £34 million of foreign exchange movements. This represented approximately 24% of the Group's market capitalisation at 31 March 2006 compared with 11% at 31 March 2005. Average net debt at month end accounting dates over the 12 month... -

Page 44

...any time up to and including 15 August 2006. The option gives Price Communications, Inc. the right to exchange its preferred limited partnership interest in Verizon Wireless of the East LP for either equity of Verizon Wireless (if an initial public offering of such equity occurs), or common stock of... -

Page 45

...mobile handsets or higher than anticipated prices of new handsets. In addition, even if these services are introduced in accordance with expected time schedules, there is no assurance that revenue from such services will increase ARPU or maintain profit margins. Vodafone Group Plc Annual Report 2006... -

Page 46

... of radiowaves the case. With continued growth in the use of data services as more customers utilise 3G from mobile telephones, transmitters and associated services, including video calling and full track music downloads, the Vodafone Mobile Connect data card, new business focused offerings and the... -

Page 47

... 2006 financial year on an organic basis, with the impact of pricing pressures, additional customer investment and changes in termination rates offsetting initiatives to drive further cost efficiencies, excluding the impact of any one off business restructuring costs. Group capitalised fixed asset... -

Page 48

... in new markets; the ability of the Group to offer new services and secure the timely delivery of high quality, reliable GPRS and 3G handsets, network equipment and other key products from suppliers; the Group's ability to develop competitive data content and services that will attract new customers... -

Page 49

... other companies; it is used by management for planning, reporting and incentive purposes; and it is useful in connection with discussion with the investment analyst community and debt rating agencies. • • • The Group believes that the presentation of operating free cash flow is useful and... -

Page 50

... companies operating in the mobile telecommunications business. This performance indicator is commonly used in the mobile telecommunications industry and by Vodafone management to compare net subsidies provided to acquire and retain customers to prior periods and internal forecasts. "Net acquisition... -

Page 51

... internal forecasts. Management believes that this measure provides useful information for investors regarding trends in net subsidies to acquire customers for mobile telecommunications services from period to period. The total of trade commissions, loyalty scheme and equipment costs, net of related... -

Page 52

...Chief Technology Officer responsible for the rollout of 3G, the consolidation of data centres and service platform operations and the establishment of the Global Supply Chain organisation. Prior to joining the Group, he was a member of the Management Board of RWE AG. 6. Andy Halford, Chief Financial... -

Page 53

... the Board on 1 May 2006, having retired from his role as Chief Executive of Hermes Pensions Management Limited, a position he had held since 2002. Previously he was Hermes' Chief Investment Officer, having been Managing Director of AMP Asset Management and the Chief International Investment Officer... -

Page 54

... performance lifts, technology management and company restructuring. Frank Rovekamp, Global Chief Marketing Officer, aged 51, was appointed to this position and joined the Executive Committee on 1 May 2006. He joined Vodafone four years ago as Marketing Director and a Member of the Management Board... -

Page 55

... that its corporate governance guidelines are generally responsive to, but may not address all aspects of, the relevant NYSE rules. Vodafone Group Plc Annual Report 2006 53 The Combined Code The Company's ordinary shares are listed in the United Kingdom on the London Stock Exchange. As such... -

Page 56

..., the structure and capability of the Board, strategic alignment, Board dynamics and the skills brought to the Board by each director. A series of questionnaires has also been developed to facilitate the evaluation processes for each Board Committee. 54 Vodafone Group Plc Annual Report 2006 -

Page 57

...capital projects; approving annual budgets and operating plans; devising and reviewing the Group's corporate governance structure; Group financial structure (including tax and treasury policy); approving statutory accounts and shareholder communications; Group risk management; and material contracts... -

Page 58

... made in the analysis. Post investment appraisals of the Group's investments are conducted on a periodic and timely basis. The Board reviews a half-yearly report detailing any significant legal actions faced by Group companies. The Executive Committee monitors legal, environmental and regulatory... -

Page 59

... the annual audit. The financial statements were reviewed in the light of these reports and the results of that review reported to the Board. Risk management and internal control The Committee reviewed the process by which the Group evaluated its control environment, its risk assessment process and... -

Page 60

... a dialogue with the Group's people. In addition to the more traditional channels, the Group increasingly uses its own products and services, such as SMS and audio based messaging, and is currently trialling 3G video based internal communications media in some local markets. This is the natural... -

Page 61

... to Vodafone Passport. For the Vodafone Mobile Connect data card tariffs, which offer high speed internet connection to laptops, a monthly roaming bundle was developed to make roaming costs more predictable. Governance • In November 2005, Vodafone adopted a group wide privacy policy that... -

Page 62

... and text message applications could increase productivity, improve patient health and enable greater access to health services in the developed and developing world. Further information is available at www.vodafone.com/healthcare. Reuse and recycling Mobile phones, accessories and the networks on... -

Page 63

... provide the greatest degree of alignment with the Company's strategic goals and that are clear and transparent to both directors and shareholders. The performance measures adopted incentivise both operational performance and share price growth. Vodafone Group Plc Annual Report 2006 61 Governance -

Page 64

... shares, net of tax. The Remuneration Committee reviews and sets the base award performance targets on an annual basis, taking into account business strategy. The performance measures for the 2006 financial year relate to adjusted operating profit, total service revenue, free cash flow and customer... -

Page 65

... is currently held in a notional fund outside the Company pension scheme. During the 2006 financial year, Sir Julian Horn-Smith, Peter Bamford, and Andy Halford, being UK based directors, were contributing members of the Vodafone Group Pension Scheme, which is a UK defined benefit scheme approved... -

Page 66

Board's Report to Shareholders on Directors' Remuneration continued The maximum that can be saved each month is £250 and savings plus interest may be used to acquire shares by exercising the related option. The options have been granted at up to a 20% discount to market value. UK based executive ... -

Page 67

... value of the base share awards under the Vodafone Group Short Term Incentive Plan applicable to the year ended 31 March 2006. These awards are in relation to the performance achievements against targets in adjusted operating profit, total service revenue, free cash flow and customer delight... -

Page 68

... as base award and enhancement shares to the Company's senior management, other than executive directors, is 514,603. For a description of the performance and vesting conditions, see "Short and medium term incentive: annual deferred share bonus" on page 62. 66 Vodafone Group Plc Annual Report 2006 -

Page 69

...some cases local performance conditions attach to the awards. Share options The following information summarises the directors' options under the Vodafone Group Plc Savings Related Share Option Scheme, the Vodafone Group 1998 Sharesave Scheme, the Vodafone Group Plc Executive Share Option Scheme and... -

Page 70

... New York Stock Exchange. The number and option price have been converted into the equivalent amounts for the Company's ordinary shares. Details of the options exercised by directors of the Company in the year ended 31 March 2006 are as follows: Options exercised during the year Number Market price... -

Page 71

... Vodafone Group Profit Sharing Scheme and the Vodafone Share Incentive Plan, but which excludes interests in the Vodafone Group Share Option Schemes, the Vodafone Group Short Term Incentive or in the Vodafone Group Long Term Incentives, are shown below: 26 May 2006 31 March 2006 1 April 2005 or date... -

Page 72

... longer term plans, the directors are satisfied that, at the time of approving the financial statements, it is appropriate to adopt the going concern basis in preparing the financial statements. By Order of the Board Stephen Scott Secretary 30 May 2006 70 Vodafone Group Plc Annual Report 2006 -

Page 73

... Notes to the Consolidated Financial Statements 1. Basis of preparation 2. Significant accounting policies 3. Segmental analysis 4. Operating (loss)/profit 5. Investment income and financing costs 6. Taxation 7. Equity dividends 8. (Loss)/earnings per share 9. Intangible assets 10. Impairment 11... -

Page 74

... Consolidated Statement of Recognised Income and Expense for the years ended 31 March Note 2006 $m 2006 £m 2005 £m Gains on revaluation of available-for-sale investments, net of tax Exchange differences on translation of foreign operations Actuarial losses on defined benefit pension schemes... -

Page 75

... Related parties Current taxation liabilities Trade and other payables Provisions for liabilities and charges Liabilities included in disposal group held for sale Total equity and liabilities The Consolidated Financial Statements were approved by the Board of directors on 30 May 2006 and were signed... -

Page 76

...shares Equity dividends paid Dividends paid to minority shareholders in subsidiary undertakings Interest paid Net cash flows from financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of the financial year Exchange...Vodafone Group Plc Annual Report 2006 -

Page 77

...and equity instruments issued by the Group in exchange for control of the acquiree, plus any costs directly attributable to the business combination. The acquiree's identifiable assets and liabilities are recognised at their fair values at the acquisition date. Vodafone Group Plc Annual Report 2006... -

Page 78

... data services and information provision, fees for connecting users of other fixed line and mobile networks to the Group's network, revenue from the sale of equipment, including handsets and revenue arising from Partner Market Agreements. Access charges and airtime used by contract customers... -

Page 79

... in sterling using exchange rates prevailing on the balance sheet date. Income and expense items and cash flows are translated at the average exchange rates for the period and exchange differences arising are recognised directly in equity. Such translation Vodafone Group Plc Annual Report 2006 77 -

Page 80

... date of the equity-settled share-based payments is expensed on a straight-line basis over the vesting period, based on the Group's estimate of the shares that will eventually vest and adjusted for the effect of non market-based vesting conditions. Fair value is measured using a binomial pricing... -

Page 81

... by location of customer. Inter-segment sales are charged at arms length prices. Germany £m Italy £m Spain £m UK £m US £m Mobile telecommunications Other Common Total mobile functions £m £m £m Other operations Germany Other £m £m Group £m 31 March 2006 Service revenue Equipment and... -

Page 82

... Financial Statements continued 3. Segmental analysis continued Germany £m Italy £m Spain £m UK £m US £m Mobile telecommunications Other Common Total mobile functions £m £m £m Other operations Germany Other £m £m Group £m Segment liabilities(1) Unallocated liabilities: Current... -

Page 83

... assets: Deferred tax assets Trade and other receivables Unallocated current assets: Cash and cash equivalents Trade and other receivables Taxation recoverable Total assets 1,035 125,837 66 126,876 14,922 141,798 1,184 Financials 364 3,769 44 38 147,197 Vodafone Group Plc Annual Report 2006... -

Page 84

... the Consolidated Financial Statements continued 3. Segmental analysis continued Germany £m Italy £m Spain £m UK £m US £m Continuing Discontinued Mobile telecommunications Other operations operations operations Other Common Total Germany Other mobile functions £m £m £m £m £m £m £m Group... -

Page 85

... the work performed by the Audit Committee in order to safeguard auditor independence when non audit services are provided is set out in the Corporate Governance section on page 57. In the year ended 31 March 2006, the Audit Committee pre-approved all services. Vodafone Group Plc Annual Report 2006... -

Page 86

...to the Consolidated Financial Statements continued 5. Investment income and financing costs Investment income Available-for-sale investments: Dividends received Loans and receivables Fair value adjustments recognised in the income statement: Derivatives - foreign exchange contracts and interest rate... -

Page 87

... titled "Performance - Operating Results - Group Overview - 2006 financial year compared to 2005 financial year - Taxation." 2006 £m 2005 £m (Loss)/profit before tax on continuing operations as shown in the income statement Expected tax (credit)/ charge on profit from continuing operations at UK... -

Page 88

... the Group's future tax charge include one-off restructuring benefits, the resolution of open issues, future planning opportunities, corporate acquisitions and disposals, changes in tax legislation and rates, and the use of brought forward tax losses. In particular, the Group's subsidiary Vodafone... -

Page 89

... share) 2006 £m 2005 £m 1,386 1,367 2,753 728 1,263 1,991 Proposed or declared after the balance sheet date and not recognised as a liability: Final dividend for the year ended 31 March 2006: 3.87 pence per share (2005: 2.16 pence per share) 2,327 1,386 Vodafone Group Plc Annual Report 2006... -

Page 90

... relating to the initial shareholder agreement has been retained in the Group's balance sheet as at 31 March 2006. Fair value movements are determined by the reference to the quoted share price of Vodafone Egypt. For the year ended 31 March 2006, a charge of £105 million was recognised. The capital... -

Page 91

...80,999 14,632 14,488 1,233 1,106 647 555 69,118 97,148 The net book value at 31 March 2006 and expiry dates of the most significant purchased licences, are as follows: Expiry date 2006 £m Germany UK December 2020 December 2021 5,165 5,245 Financials Vodafone Group Plc Annual Report 2006 89 -

Page 92

Notes to the Consolidated Financial Statements continued 9. Intangible assets continued Goodwill, analysed by reportable segment, is as follows: Germany £m Italy £m Japan £m Spain £m UK £m Other mobile operations £m Other operations Germany £m Total £m Cost: 1 April 2004 Exchange movements ... -

Page 93

... Italy The carrying value of goodwill of the Group's mobile operations in Germany and Italy, with each representing a reportable segment, has been impaired due to Vodafone having revised its view of longer term trends for these businesses given certain developments in the current market environment... -

Page 94

... have been applied in the value in use calculations as follows: Pre-tax risk adjusted discount rate 2006 2005 % % Long term growth rate 2006 2005 % % Germany Italy Spain 10.1 10.1 9.0 9.6 9.2 9.3 1.1 1.5 3.3 2.7 4.1 3.4 Impact of a reasonbly possible change in a key assumption For those cash... -

Page 95

... as held for sale Exchange movements Charge for the year Disposal of businesses Disposals Reclassifications 31 March 2006 Net book value: 31 March 2006 31 March 2005 Note: (1) The depreciation charge for the year includes £1,114 million in relation to discontinued operations. (1) 1,193... -

Page 96

... share capital is comprised solely of partners' capital rather than share capital. (3) Vodafone Romania S.A., Vodafone Albania Sh.A. and Vodafone Holding GmbH have a 31 December year end. Accounts are drawn up to 31 March 2006 for inclusion in the Consolidated Financial Statements. (4) Share capital... -

Page 97

... S.A.(4) Safaricom Limited(5) Vodacom Group (Pty) Limited Vodafone Fiji Limited Vodafone Omnitel N.V.(6) Mobile network and fixed line operator Mobile network operator Mobile network operator Holding company Mobile network operator Mobile network operator India Poland Kenya South Africa Fiji... -

Page 98

...values of listed securities are based on quoted market prices, and include the Group's 3.3% investment in China Mobile (Hong Kong) Limited, which is listed on the Hong Kong and New York stock exchanges and incorporated under the laws of Hong Kong. China Mobile (Hong Kong) Limited is a mobile network... -

Page 99

... receivables approximate their fair value. Trade and other receivables are predominantly non-interest bearing. Vodafone Group Plc Annual Report 2006 97 Financials Concentrations of credit risk with respect to trade receivables are limited due to the Group's customer base being large and unrelated... -

Page 100

... exchange swaps Option contracts Other derivatives Fair value hedges: Interest rate swaps 260 310 365 408 19 30 1 - 50 - 42 - 1 43 2006 £m 2005 £m The fair values of these financial instruments are calculated by discounting the future cash flows to net present values using appropriate market... -

Page 101

... savings contract and usually at a discount of 20% to the then prevailing market price of the Company's shares. Invitations to participate in this scheme are usually made annually. Vodafone Group executive schemes The Company has a number of discretionary share option plans, under which awards are... -

Page 102

... life Months Vodafone Group Savings Related and Sharesave Scheme: £0.01 - £1.00 £1.01 - £2.00 Vodafone Group Executive Schemes: £1.01 - £2.00 £2.01 - £3.00 Vodafone Group 1999 Long Term Stock Incentive Plan: £0.01 - £1.00 £1.01 - £2.00 £2.01 - £3.00 Other Share Option Plans: £0.01... -

Page 103

... cost relating to non-vested awards not yet recognised, which is expected to be recognised over a weighted average period of two years. Financials Vodafone Group Plc Annual Report 2006 101 No cash was used to settle equity instruments granted under share-based payment schemes. The average share... -

Page 104

...21. Transactions with equity shareholders Share premium account £m Capital redemption reserve £m Own shares held £m Additional paid in capital £m 1 April 2004 Issue of new shares Purchase of own shares Own shares released on vesting of share awards Share-based payment charge, inclusive of tax... -

Page 105

...The present value of minimum lease payments under finance lease arrangements under which the Group has leased certain of its equipment is analysed as follows: 2006 £m 2005 £m Within one year In two to five years In more than five years 7 31 37 11 64 66 Vodafone Group Plc Annual Report 2006 103 -

Page 106

...255 148 129 357 1,017 364 587 121 125 121 1,600 - - 528 - 260 208 - - 245 258 512 454 265 13,190 Fair values are calculated using discounted cash flows with a discount rate based upon forward interest rates available to the Group at the balance sheet date. 104 Vodafone Group Plc Annual Report 2006 -

Page 107

...on national LIBOR equivalents or government bond rates in the relevant currencies. The figures shown in the tables above take into account interest rate swaps used to manage the interest rate profile of financial liabilities. At 31 March 2006, the Group had entered into foreign exchange contracts to... -

Page 108

...to-market revaluations of interest rate and other derivatives and the potential interest on outstanding tax issues. Foreign exchange management As Vodafone's primary listing is on the London Stock Exchange, its share price is quoted in sterling. Since the sterling share price represents the value of... -

Page 109

... of the UK employees are members of the Vodafone Group Pension Scheme (the "main scheme"), which was closed to new entrants from 1 January 2006. This is a tax approved defined benefit scheme, the assets of which are held in an external trustee-administered fund. The investment policy and strategy of... -

Page 110

...funding contributions from sponsoring employers are appropriate to meet the liabilities of the schemes over the long term. The deficit in respect of other schemes at 31 March 2006 primarily relates to internally funded schemes in Italy and the United States. 108 Vodafone Group Plc Annual Report 2006 -

Page 111

... 66 The scheme has no investments in the Group's equity securities or in property currently used by the Group. History of experience adjustments 2006 £m Germany 2005 £m UK 2005 £m Other 2005 £m Total 2005 £m 2006 £m 2006 £m 2006 £m Experience adjustments on scheme liabilities: Amount... -

Page 112

... amounts outstanding for trade purchases and ongoing operating expenses. The fair values of the derivative financial instruments are calculated by discounting the future cash flows to net present values using appropriate market interest and foreign currency rates prevailing at the year end. Included... -

Page 113

..., a further 0.9% of Vodafone Romania S.A. was acquired for consideration of £16 million. From the dates of acquisition, these entities contributed a profit of £26 million to the net loss of the Group. 78.99 99.87 99.99 99.99 99.99 99.99 99.99 Vodafone Group Plc Annual Report 2006 111 Financials -

Page 114

... in Bharti Airtel Limited. Results of the acquired entity have been proportionately consolidated in the income statement from the dates of acquisition. From the date of acquisition, the entity contributed a loss of £8 million to the net loss of the Group. 112 Vodafone Group Plc Annual Report 2006 -

Page 115

... 2006, the Group completed the acquisition of substantially all the assets and business of Telsim Mobil Telekomunikasyon ("Telsim") from the Turkish Savings Deposit and Investment Fund. The cash paid on this date was US$4.67 billion (£2.6 billion). It is impracticable to provide further information... -

Page 116

... tax asset Total assets Current taxation liability Short and long-term borrowings Trade and other payables Deferred tax liabilities Other liabilities Total liabilities 2006 £m 3,957 4,546 29 161 131 1,113 655 10,592 (1) (677) (1,579) (246) (40) (2,543) 114 Vodafone Group Plc Annual Report 2006 -

Page 117

... Net cash flows from investing activities Net cash flows from financing activities Net increase in cash and cash equivalents Cash and cash equivalents at the beginning of the financial year Exchange loss on cash and cash equivalents Cash and cash equivalents at the end of the financial year 2006... -

Page 118

...Japan, which were sold on 27 April 2006. The total of future minimum sublease payments expected to be received under non-cancellable subleases is £60 million (2005: £51 million). Capital and other financial commitments 2006 £m Group 2005 £m Share of joint ventures 2006 2005 £m £m Contracts... -

Page 119

... SARL ("VIL"), under the Controlled Foreign Companies section of the UK's Income and Corporation Taxes Act 1988 ("the CFC Regime") relating to the tax treatment of profits earned by the holding company for the accounting period ended 31 March 2001. Vodafone 2's position is that it is not liable to... -

Page 120

... key management, being the directors and members of the Group Executive Committee, were as follows: 2006 £m 2005 £m Short term employee benefits Post-employment benefits: Defined benefit schemes Defined contribution schemes Share-based payments 26 2 2 16 46 18 2 1 22 43 118 Vodafone Group Plc... -

Page 121

... substantially all the assets and business of Telsim Mobil Telekomunikasyon ("Telsim") from the Turkish Savings Deposit and Investment Fund. The acquisition completed on 24 May 2006. The cash paid on this date was US$4.67 billion (£2.6 billion). Financials Vodafone Group Plc Annual Report 2006 119 -

Page 122

... using proportionate consolidation or under the equity method, extracted on a 100% basis from accounts prepared under IFRS at 31 March and for the years then ended, is set out below. Entities classified as associated undertakings Revenue Gross profit Profit for the financial year Non-current assets... -

Page 123

... for the years then ended, is set out below. 2006 £m 2005 £m Revenue Gross profit (Loss)/profit for the financial year Non-current assets Current assets Total assets Current liabilities Non-current liabilities Total liabilities Total equity shareholders' funds Total equity and liabilities 5,619... -

Page 124

... ended 31 March Reference 2006 $m 2006 £m 2005 Restated £m Revenue (IFRS) Items (decreasing)/increasing revenues: Discontinued operations Basis of consolidation Connection revenue Revenue (US GAAP) (Loss)/profit for the financial year (IFRS) Items (increasing)/decreasing net loss: Investments... -

Page 125

...recognised over the period that a customer is expected to remain connected to a network. Goodwill and other intangible assets associated with investments accounted for under the equity method 9,539 (11,997) 171 (2,287) 13,549 (14,615) 84 (982) Financials Vodafone Group Plc Annual Report 2006 123 -

Page 126

... is based on finite-lived intangible assets recognised at 31 March 2006 using foreign exchange rates on that date. It is likely that future amortisation charges will vary from the figures below, as the estimate does not include the impact of any future investments, disposals, capital expenditures... -

Page 127

... Share-based payments The Group adopted SFAS No. 123 (Revised 2004), "Share-based Payment", and related FASB staff positions on 1 October 2005. SFAS No. 123 (Revised 2004) eliminates the option to account for share-based payments to employees using the intrinsic value method and requires share-based... -

Page 128

...shareholders' funds (UK GAAP) Measurement and recognition differences: Intangible assets Proposed dividends Financial instruments Share-based payments Defined benefit pension schemes Deferred and current taxes Other Total equity shareholders' funds (IFRS) Profit for the year ended 31 March 2005 Loss... -

Page 129

... consolidated balance sheet and is no longer amortised. Under IAS 38, capitalised payments for licences and spectrum fees are amortised on a straight line basis over their useful economic life. Amortisation is charged from the commencement of service of the network. Under UK GAAP, the Group's policy... -

Page 130

... (6,938) Minority interest Loss for the financial year (602) (7,540) (45) 45 - 13,501 449 13,950 - - - 6,518 (108) Profit for the financial year attributable to minority interests 6,410 Profit for the financial year attributable to equity shareholders 128 Vodafone Group Plc Annual Report 2006 -

Page 131

...671 221 133,980 Current assets: Stocks Debtors 458 6,901 - (6,901) 372 5,148 Investments Cash at bank and in hand Total assets Capital and reserves: Called up share capital Share premium account Own shares held Other reserve Profit and loss account Total equity shareholders' funds Minority interests... -

Page 132

...112 Current assets: Stocks Debtors 430 7,698 - (7,698) 268 5,049 Investments Cash at bank and in hand Total assets Capital and reserves: Called up share capital Share premium account Own shares held Other reserve 4,286 52,284 (5,121) 99,556 - - - - - Profit and loss account Total equity shareholders... -

Page 133

... our review by the Listing Rules of the Financial Services Authority, and we report if it does not. We are not required to consider whether the board's statement on internal control covers all risks and controls, or form an opinion on the effectiveness of the Group's corporate governance procedures... -

Page 134

... one year Capital and reserves Called up share capital Share premium account Capital redemption reserve Capital reserve Other reserves Own shares held Profit and loss account Equity shareholders' funds The Financial Statements were approved by the Board of directors on 30 May 2006 and were signed on... -

Page 135

... average costs method, is included in the net profit or loss for the period. New accounting standards The Company has adjusted its accounting policies to adopt the following new standards: FRS 17 "Retirement Benefits", FRS 20 "Share-based Payments", FRS 21 "Events after the Balance Sheet Date", FRS... -

Page 136

... the balance sheet when the Company becomes a party to the contractual provisions of the instrument. Share based payments The Group operates a number of equity settled share based compensation plans for the employees of subsidiary undertakings, using the Company's equity instruments. The fair value... -

Page 137

... Limited (2005: £nil). The investment is held at fair value. Shares in group undertakings Cost: 1 April 2005 Adjustment for adoption of FRS 20 1 April 2005, as restated Additions Capital contributions arising from share based payments Contributions received in relation to share based payments... -

Page 138

... undertakings. The Company does not incur a profit and loss account charge in relation to share based payments. Full details of share based payments, share option schemes and share plans are disclosed in note 20 to the Consolidated Financial Statements. 136 Vodafone Group Plc Annual Report 2006 -

Page 139

... share) Proposed or declared after the balance sheet date and not recognised as a liability: Final dividend for the year ended 31 March 2006: 3.87 pence per share (2005: 2.16 pence per share) 2006 £m 2005 £m 1,386 1,367 2,753 728 1,263 1,991 2,327 1,386 Vodafone Group Plc Annual Report 2006... -

Page 140

... and contingent liabilities Other guarantees principally comprise commitments to support disposed entities. Legal proceedings Details regarding certain legal actions which involve the Company are set out in note 31 to the Consolidated Financial Statements. 138 Vodafone Group Plc Annual Report 2006 -

Page 141

... Group Plc for the year ended 31 March 2006 which comprise the balance sheet and the related notes 1 to 10. These individual Company Financial Statements have been prepared under the accounting policies set out therein. The corporate governance statement and the directors' remuneration report... -

Page 142

...to The Bank of New York at the above address or telephone number. ADS holders can also, subject to passing an identity check, view their account balances and transaction history, sell shares and request certificates from their Global BuyDIRECT Plan at www.stockbny.com. Dividends Full details on the... -

Page 143

... download the Annual Report and the Annual Review & Summary Financial Statement 2006; Check the current share price; Calculate dividend payments; and Use interactive tools to calculate the value of shareholdings, look up the historic price on a particular date and chart Vodafone ordinary share price... -

Page 144

... 26 May 2006. The current authorised share capital comprises 78,000,000,000 ordinary shares of $0.10 each and 50,000 7% cumulative fixed rate shares of £1.00 each. Markets Ordinary shares of Vodafone Group Plc are traded on the London Stock Exchange and, in the form of ADSs, on the New York Stock... -

Page 145

... in this case should be to the Company, the Panel on Takeovers and Mergers and the UK Listing Authority through one of its approved regulatory information services no later than 12 noon on the business day following the date of the acquisition. Vodafone Group Plc Annual Report 2006 143 Shareholder... -

Page 146

... rights are deemed not to have been varied by the creation or issue of new shares ranking equally with or subsequent to that class of shares in sharing in profits or assets of the Company or by a redemption or repurchase of the shares by the Company. Taxation of dividends UK taxation Under current... -

Page 147

... has a holding period of more than one year. The gain or loss will generally be income or loss from sources within the United States for foreign tax credit limitation purposes. The deductibility of losses is subject to limitations. Vodafone Group Plc Annual Report 2006 145 Shareholder information -

Page 148

... 61 Board of Directors and Group Management 50 6D Employees Employees 58 Note 34 "Employees" 119 6E Share Ownership Board's Report to Shareholders on Directors' Remuneration - Directors' interests in the shares of the Company 66 Note 19 "Called up share capital" 98 Major Shareholders and Related... -

Page 149

... Offer and Listing 9A Offer and listing details 9B Plan of distribution 9C Markets 9D Selling shareholders 9E Dilution 9F Expenses of the issue Additional Information 10A Share capital 10B Memorandum and articles of association 10C Material contracts 10D Exchange controls 10E Taxation 10F Dividends... -

Page 150

Notes 148 Vodafone Group Plc Annual Report 2006 -

Page 151

Contact Details Investor Relations Telephone: +44 (0) 1635 664447 Media Relations Telephone: +44 (0) 1635 664444 Corporate Responsibility Fax: E-mail: Website: +44 (0) 1635 674478 [email protected] www.vodafone.com/responsibility We want to keep the environmental impact of the documents... -

Page 152

Vodafone Group Plc Registered office: Vodafone House The Connection Newbury Berkshire RG14 2FN England Registered in England No.1833679 Tel: +44 (0) 1635 33251 Fax: +44 (0) 1635 45713 www.vodafone.com