Reebok 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

087

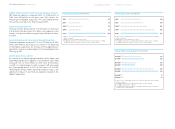

Interest Rate Increases Modestly

The weighted average interest rate on the Group’s gross bor-

rowings rose 0.8 percentage points to 4.8% in 2006 from 4.0%

in 2005, mainly as a result of the significant increase of our

US dollar-denominated financing, which carries interest rates

above euro-denominated financing. In addition, this reflects

an increased portion of longer-term fixed interest rate debt

financing arrangements in the total financing structure as a

result of the new financing instruments. This provides better

protection against expected increases of interest rates in the

short and long term. As a consequence, long-term fixed-rate

financing amounted to around 65% of total financing at the

end of 2006. Further, interest rates for the Group’s variable

financing, which amounted to around 35% of total financing at

the end of the year, increased due to higher market interest

rates in 2006.

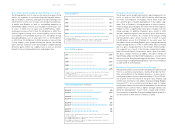

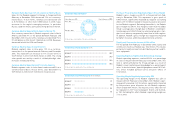

Currency Split of Gross Borrowings € in millions

2006 2005

Total 2,578 1,035

EUR

USD

JPY

All others

1,314

1,145

32

87

785

168

34

48

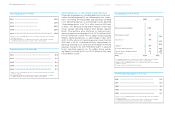

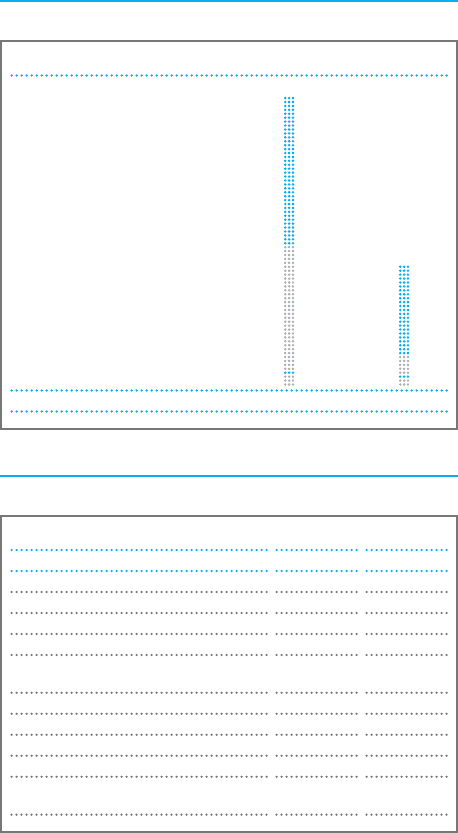

Issued Bonds at a Glance in millions

Issued Bonds Volume Coupon Maturity

Asian Private Placement USD 218 variable 2009

Asian Private Placement JPY 3,000 fixed 2009

Asian Private Placement EUR 26 variable 2010

Asian Private Placement AUD 16 variable 2010

German Private Placement EUR 150 fixed and 2010

variable

French Private Placement EUR 150 variable 2011 – 2012

US Private Placement USD 175 fixed 2015

US Private Placement USD 1,000 fixed 2009 – 2016

Convertible Bond EUR 400 2.5% 2018

Other Private Placements EUR 399 fixed and 2006 – 2012

variable

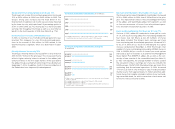

Currency Management Reflects Reebok Integration

As the adidas Group operates worldwide, currency manage-

ment is a key focus of the Group’s central Treasury depart-

ment. Because our Group sources the majority of products

from independent suppliers in Asia invoiced mainly in US

dollars, the adidas Group’s currency management focuses

on hedging the Group’s net US dollar deficit. In 2006, the

central Treasury department managed a net deficit of

around US $ 1.7 billion against the euro, which represents

an increase of approximately US $ 500 million from around

US $ 1.2 billion in the prior year. This reflects the increased

size of our business mainly as a result of the first-time inclu-

sion of Reebok in 2006. In relation to our sales, however,

the net US dollar deficit against the euro was reduced. As

outlined in our Group’s treasury policy, we have established

a rolling 12 to 18 months hedging system, under which a

large amount of the anticipated seasonal hedging volume

is secured six months prior to the start of a season. As a

result, we have already completed around 90% of our antici-

pated hedging needs for 2007 at rates slightly below those

of 2006. The use or combination of different hedging instru-

ments, such as currency options, swaps and forward con-

tracts, protects us against unfavorable currency movements,

while retaining the potential to benefit from future favorable

exchange rate developments (see Note 24, p. 171).

» Treasury

adidas Group ›