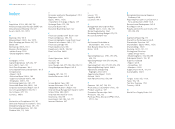

Reebok 2006 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sell-Through

An indicator of how fast retailers are selling a particular product to the consumer.

Shareholder Value

A management concept that focuses strategic and operational decision-making on steadily

increasing a company’s value for shareholders.

Sourcing

The process of managing external suppliers in order to commercialize, produce and deliver

final products to customers.

Sport Fusion

Footwear and apparel products mixing performance-oriented features and casual styles.

Stakeholders

All parties that have a direct or indirect interest in a company’s performance and results. For

the adidas Group, this includes credit providers, shareholders, consumers, retailers, distribu-

tors, licensees, supply chain business partners, employees, international sports bodies, non-

governmental organizations, the media, etc.

Synergies

Additional savings or revenue growth when one combined enterprise is created from two or

more separate parts.

TechFit™ Powerweb

A technology in adidas compression apparel which improves joint alignment and muscle bal-

ance, the link between key muscle groups to maximize power generation. Through strategi-

cally placed TPU powerbands, key body parts are linked together, further enhancing posture

and athletic performance.

Thermal Bonding

A technology which interlocks the fibers of a football through the use of heat energy. The heat

in the thermal bonding process softens the surface of the fiber. At the melting point, fibers in

contact with each other will form strong bonds, which hold the fabric together. As a result,

footballs are more consistent in shape. Thermal bonding serves as replacement technology

for hand-sewn footballs.

Top-Down, Bottom-Up

A strategy of information and knowledge processing. Information and empowerment of man-

agement decisions is delegated from top to bottom in a first step. After going into more detail

on the bottom level the final information /decision is transported back to the top.

Weighted Average Cost of Capital (WACC)

The adidas Group calculates the cost of capital according to the debt/equity structure, utilizing

a weighted average cost of capital (WACC) formula. The cost of equity is computed utilizing a

risk-free rate, market risk premium and a beta factor. The cost of debt is calculated through

the risk-free rate, credit spread and average tax rate.

Working Capital

A company’s short-term disposable capital used to finance the day-to-day operations. See also

Operating Working Capital.

Working capital = total current assets – total current liabilities.

Working Capital Turnover

Shows how often a working capital item was used in and replaced by the generation of sales

in the period under review. The ratio shows how long working capital is tied up and thus is an

indicator of the volume of capital needed to generate sales. The higher the ratio, the more

positive it is deemed to be.

Working capital turnover = net sales / working capital.

WTO

World Trade Organization.

199