Reebok 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.061

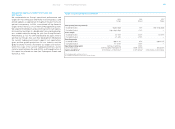

Corporate Functions ›» Global Operations

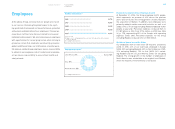

Asia Dominates Footwear Production

In 2006, Asia continued to be our most significant sourcing

region for footwear. 97% of our total footwear volume for the

adidas and Reebok brands was produced in this region (2005:

95% excluding Reebok). Production in Europe (incl. Africa) and

the Americas represented 3% of our sourcing volume (2005:

5% excluding Reebok). China represents our largest source

country with approximately 46% of the total volume followed

by Vietnam with 25% and Indonesia with 23%. In 2006, our

footwear suppliers produced 199 million pairs of adidas and

Reebok shoes, up 62% from 123 million pairs in 2005 as a

result of the inclusion of Reebok and strong organic growth

at brand adidas. Although supplier concentration visibly

increased in 2006 due to the acquisition of Reebok, our larg-

est footwear factory only produced approximately 11% of our

footwear sourcing volume for the adidas and Reebok brands.

The Rockport brand, which is not serviced by our Global

Operations function due to different sourcing requirements in

the brown shoe business, has a separate operations team.

Rockport sourced approximately 10 million pairs of footwear

in 2006, primarily from China, Indonesia and Vietnam.

Apparel Production Driven by Asia

Asia also represented the most significant portion of our

apparel source base with 76% of our total apparel volume

coming from the region in 2006 (2005: 78% excluding Reebok),

followed by Europe (incl. Africa) with 16% (2005: 16% exclud-

ing Reebok) and the Americas with 8% (2005: 6% excluding

Reebok). China and Indonesia were the largest source coun-

tries, representing 23% and 15% of total apparel production,

respectively. In total, our suppliers produced 230 million units

of apparel for all Group brands in 2006 (2005: 177 million

units excluding Reebok). The largest apparel factory pro-

duced approximately 8% of our total apparel volume in 2006.

The majority of Reebok apparel volumes were sourced at

our independent manufacturing partners through agents as

opposed to the direct sourcing which is common practice at

the adidas Group. As part of the integration of Reebok into our

Group’s supply chain, we will build in-house sourcing capa-

bilities while steadily reducing the number of agents involved

in the sourcing process.

Brand-Specific Hardware Production

The bulk of adidas and Reebok branded hardware products,

such as balls and bags, were produced in Asia, representing

97% of the volume in 2006 (2005: 96% excluding Reebok).

China remained our largest source country, representing 61%

of hardware production, followed by Vietnam with 19% and

Pakistan with 14%. The remaining 6% was sourced via other

Asian and European countries. The majority of our hardware

volume at TaylorMade and Reebok-CCM Hockey was also

produced in Asia. In addition, both brands sourced a small

portion of hardware products in the Americas and Europe.

At TaylorMade, the majority of golf club components were

manufactured in China and assembled by TaylorMade in the

USA, China and Japan.

Reebok Integration Drives Cost Savings

The integration of Reebok has brought several benefits to

our supply chain. Our integration efforts focus on maximiz-

ing our buying power, consolidating global contracts with our

third party logistics providers and building in-house apparel

capabilities at Reebok. In 2006, we established a new Global

Logistics function to work across all brands as a single point

of contact for negotiating with global service providers. One

example of this team’s early success was achieving signifi-

cant savings across our transportation contracts for 2006

and beyond. With respect to buying power, we initiated our

“World Class Buyer” program to maximize purchasing lever-

age across our brands. Consolidating volume across our first

and second tier suppliers and adopting costing best practices

will be the two primary drivers of cost savings in our Global

Operations function going forward. In apparel, we will lever-

age adidas best practices and technologies to build in-house

development and sourcing capabilities for Reebok. The busi-

ness has so far been channeled through agents. This change

will support Reebok apparel sales growth by ensuring more

reliable deliveries and consistent quality.