Reebok 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

049

Operating Margin as Key Performance Indicator of

Operational Progress

Operating margin (defined as operating profit as a percent-

age of net sales) is our Group’s most important measure of

operational success as it combines the quality of our top-line

development with our ability to drive efficiencies through our

business. The primary drivers enhancing the Group’s oper-

ating margin are continued gross margin improvements and

operating expense control. Operating expense control is par-

ticularly important as we strive to leverage the Group’s growth

through to the bottom line. To control operating expenses,

Management has set clear guidelines for both variable and

fixed cost pillars. We plan our marketing working budget as a

percentage of targeted sales each year and constantly monitor

deviations. Over the last few years, our efforts have focused

on optimizing the split between communication (includ-

ing advertising, retail presentation and public relations) and

promotional expenditure. By concentrating on well-selected

premium partnerships with top events, associations, leagues,

clubs and athletes, we have been able to reduce the Group’s

relative promotion spend. As a result, we are improving the

balance between promotional and brand communication

within the marketing working budget. We also aim to reduce

operating overhead expenses as a percentage of sales by

continuously improving internal processes through efficiency

programs in our sales, distribution, finance, IT and other gen-

eral administration functions.

Tight Operating Working Capital Management

Due to a comparatively low level of fixed assets required in

our business, operating working capital management is a

major focus of our efforts to improve the efficiency of the

Group’s balance sheet. We have made major strides in this

area through tight working capital management focused on

continuously improving our Group’s inventories, accounts

receivable and accounts payable. Our key metric is operating

working capital as a percentage of net sales. Monitoring the

development of this key metric facilitates the measurement

of our progress in improving the efficiency of our business

cycle. Inventory levels and ageing are controlled to ensure

fast replenishment and to keep our product offering current.

Accounts receivable are managed by continuously improving

collection efforts to reduce Days of Sales Outstanding (DSO).

Likewise, we strive to optimize payment terms with our sup-

pliers to best manage our accounts payable.

Capital Expenditure Targeted to Maximize Future Returns

Improving the effectiveness of the Group’s capital expenditure

is another lever to maximize the Group’s free cash flow. Plan-

ning and control are of particular importance as we strive to

select capital projects that enable our Group to meet targeted

commercial and operational goals. We limit capital expendi-

ture levels through disciplined budget monitoring and focused

expenditure on our core strategies. Our capital expenditure is

controlled with a top-down, bottom-up approach. We evalu-

ate potential return on planned investments utilizing the net

present value or internal rate of return method, in relation to

the cost of capital. Specific investments are assessed accord-

ing to the principles of risk-weighted returns.

adidas Group ›» Internal Group Management System

1) Excluding goodwill and finance leases.

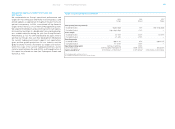

Key Financial Metrics

Gross margin = Gross profit

Net sales × 100

Operating margin = Operating profit

Net sales × 100

Average operating

working capital =

Sum of operating

working capital

at quarter-end

4

Operating working capital

in % of net sales =

Average operating

working capital

Net sales × 100

Capital expenditure1) =

Additions of property,

plant and equipment plus

intangible assets