Reebok 2006 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

› Notes to the Consolidated Balance SheetNotes ›157

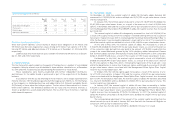

The excess of the acquisition cost paid over the net of the amounts of the fair values assigned

to all assets acquired and liabilities assumed, taking into consideration the respective deferred

taxes, is referred to as goodwill. Any acquired asset that does not meet the identification and

recognition criteria for an asset is included in the amount recognized as goodwill.

Based on the expected cost of sales and operating expenses synergy potential, the good-

will arising on this acquisition was allocated to the cash-generating units adidas and Reebok

in an amount of € 699 million and € 466 million, respectively, and is converted in functional

currencies as appropriate.

If this acquisition had occurred on January 1, 2006, total Group net sales would have been

€ 10.2 billion and net income would have been € 448 million for the year ending December 31,

2006.

The acquired Reebok subsidiaries contributed € 92 million to the Group’s operating profit

for the period from February to December 2006. The contribution to the net income cannot be

disclosed due to the advanced integration of the financing and tax activities.

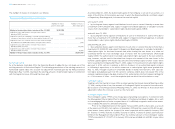

Effective September 1, 2006, the adidas Group assumed full ownership of its brand

adidas subsidiary in Korea, adidas Korea Ltd., Seoul (Korea), by purchasing the remaining 49%

of shares for an amount of € 30 million. The additional net income for the Group for the period

from September to December 2006 was € 1 million.

Effective September 1, 2006, the adidas Group sold its 92% of shares in P.T. Trigaris

Sportindo (adidas Indonesia) in connection with a restructuring of the Indonesian business.

Notes to the Consolidated Balance Sheet

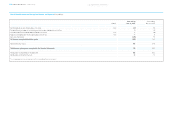

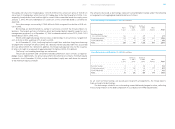

6 » Cash and Cash Equivalents

Cash and cash equivalents consist of cash at banks and on hand as well as short-term bank

deposits.

7 » Short-Term Financial Assets

Short-term financial assets are classified at “fair value through profit or loss”. They comprise

investment funds as well as marketable equity securities. Changes in the fair value are recog-

nized in the income statement as they occur.

The majority of marketable securities relates to commercial paper and certificates of

deposit.

8 » Accounts Receivable

Accounts receivable consist mainly of the currencies US dollar, euro, Japanese yen and British

pound and are as follows:

Specific allowances relate to accounts receivable totaling € 46 million as at December 31,

2006.

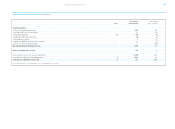

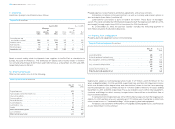

Accounts Receivable € in millions

Dec. 31 Dec. 31

2006 2005

Accounts receivable, gross 1,527 1,046

Less: allowance for doubtful accounts 112 81

Accounts receivable, net 1,415 965