Reebok 2006 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements ›

178 ANNUAL REPORT 2006 › adidas Group ›

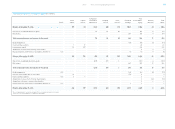

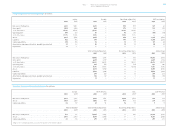

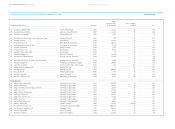

31 » Additional Cash Flow Information

As at September 30, 2005, the Salomon business segment was divested (see also Note 3). Gen-

erally, the fair value of the net assets approximated the book value of the net assets disposed.

The assets and liabilities were as follows at the date of the disposal:

In 2005, discontinued operations used cash in investing activities in an amount of € 9 million

and provided cash through financing activities in an amount of € 1 million.

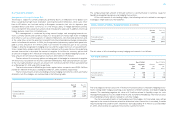

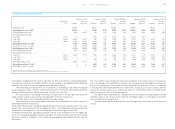

32 » Commitments and Contingencies

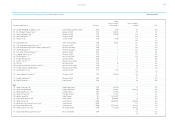

Other Financial Commitments

The Group has other financial commitments for promotion and advertising contracts, which

mature as follows:

Commitments with respect to advertising and promotion maturing after five years have

remaining terms of up to eleven years from December 31, 2006.

Information regarding commitments under lease and service contracts is also included

in these Notes (see Note 23).

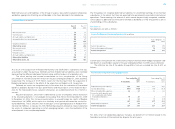

Litigation

The Group is currently engaged in various lawsuits resulting from the normal course of busi-

ness, mainly in connection with license and distribution agreements as well as competition

issues. The risks regarding these lawsuits are covered by provisions when a reliable estimate

of the amount of the obligation can be made (see Note 17). In the opinion of management,

the ultimate liabilities resulting from such claims will not materially affect the consolidated

financial position of the Group.

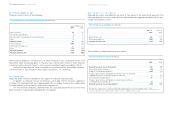

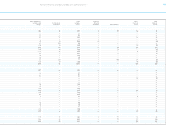

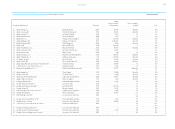

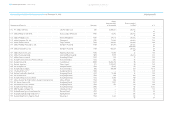

33 » Equity Compensation Benefits

Management Share Option Plan (MSOP) of adidas AG

Under the Management Share Option Plan (MSOP) adopted by the shareholders of adidas AG

on May 20, 1999, and amended by resolution of the Annual General Meeting on May 8, 2002,

and on May 13, 2004, the Executive Board was authorized to issue non-transferable stock

options for up to 1,373,350 no-par-value bearer shares to members of the Executive Board of

adidas AG as well as to managing directors/senior vice presidents of its related companies and

to other executives of adidas AG and its related companies until August 27, 2004. The granting

of stock options was able to take place in tranches not exceeding 25% of the total volume for

each fiscal year.

There is a two-year vesting period for the stock options and a term of approximately

seven years upon their respective issue.

Cash Flow of Disposed Subsidiaries € in millions

Sept. 30, 2005

Cash (10)

Inventories (219)

Receivables and other current assets (271)

Property, plant and equipment (50)

Goodwill and other intangible assets (139)

Investments and other long-term assets (0)

Accounts payable and other liabilities 202

Short-term borrowings 0

Long-term bank borrowings 10

Total value of assets/liabilities disposed (477)

Less: cash of disposed subsidiaries 10

Total value of assets/liabilities disposed, net of cash (467)

Financial Commitments for Promotion and Advertising € in millions

Dec. 31 Dec. 31

2006 2005

Within 1 year 364 222

Between 1 and 5 years 970 922

After 5 years 218 302

Total 1,552 1,446