Reebok 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

lllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

adidas Group ›077

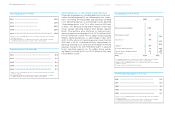

Cost of Sales Growth Largely in Line with Revenue Increase

Our Group defines cost of sales as the amount we pay to third

parties for expenses associated with producing and deliver-

ing our products. Similarly, although only representing a very

small portion of total cost of sales, own-production expenses

at adidas and Reebok as well as assembling expenses at

TaylorMade-adidas Golf are also included in the Group’s cost

of sales. In 2006, cost of sales was € 5.589 billion, repre-

senting an increase of 63% from € 3.439 billion in 2005. This

reflects higher sourcing costs necessitated by the first-time

consolidation of the Reebok business. For the adidas Group

excluding Reebok, cost of sales grew 15% to € 3.943 billion

in 2006 from € 3.439 billion in 2005, broadly in line with the

strong organic sales growth during the period. Increasing

labor and raw material costs were largely compensated by

efficiency gains within our supply chain as well as positive

impacts from an improved business and product mix.

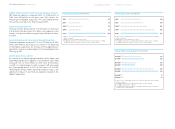

Group Gross Profit Increases 41%

The Group’s gross margin declined 3.6 percentage points to

44.6% of sales in 2006 (2005: 48.2%), mainly reflecting the

first-time consolidation of Reebok, which more than off-

set a positive gross margin development in the adidas seg-

ment. Due to Reebok’s strong presence in North America,

where average gross margins are lower than in other regions,

Reebok carries a significantly lower gross margin than the

Group average. In addition, Reebok’s gross profit in 2006

includes negative impacts from purchase price allocation in

an amount of € 76 million. As a result of the Group’s strong

top-line growth, gross profit rose by 41% in 2006 to reach

€ 4.495 billion versus € 3.197 billion in the prior year. For

the adidas Group excluding Reebok, gross margin decreased

0.4 percentage points to 47.8% in 2006 (2005: 48.2%), mainly

due to a gross margin decline in the Group’s HQ/Consolida-

tion segment as a result of the Group’s cooperation agree-

ment with Amer Sports Corporation, which more than offset

the gross margin increase at adidas. The gross margin of

TaylorMade-adidas Golf declined marginally as a result of the

inclusion of the Greg Norman apparel business. Gross profit

for the Group excluding Reebok grew by 13% to € 3.605 billion

in 2006 (2005: € 3.197 billion).

Royalty and Commission Income Grows Strongly

Royalty and commission income for the adidas Group increased

94% on a currency-neutral basis, mainly driven by the first-

time consolidation of the Reebok business. In euro terms,

royalty and commission income increased by 91% to € 90 mil-

lion in 2006 from € 47 million in the prior year. Royalty and

commission income for the adidas Group excluding Reebok

increased 19% on a currency-neutral basis due to higher

royalty and commission income at brand adidas. An increased

number of units sold as well as higher average royalty rates

drove this development. In euro terms, royalty and commis-

sion income for the adidas Group excluding Reebok grew 18%

to € 56 million in 2006 from € 47 million in 2005.

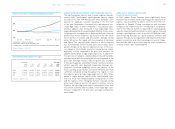

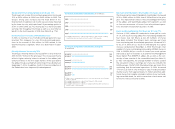

Gross Profit € in millions

2002

2003

20041)

20051)

20062)

2,819

2,814

2,813

3,197

4,495

1) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards, excluding

Greg Norman wholesale business from December 1, 2006 onwards.

Gross Margin in %

2002

2003

20041)

20051)

20062)

43.2

44.9

48.0

48.2

44.6

1) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards, excluding

Greg Norman wholesale business from December 1, 2006 onwards.

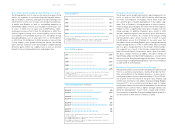

Gross Profit by Quarter € in millions

Q1 20051)

Q1 20062)

Q2 20051)

Q2 20063)

Q3 20051)

Q3 20063)

Q4 20051)

Q4 20064)

805

1,107

743

1,084

934

1,327

716

976

1) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards.

3) Including Reebok business segment.

4) Including Reebok business segment, excluding Greg Norman wholesale business

from December 1, 2006 onwards.

» Income Statement