Reebok 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllll

llllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllll

› Group Business PerformanceGroup Management Report ›

086 ANNUAL REPORT 2006 › adidas Group ›

Net Debt Position Better Than Target at € 2.231 Billion

Net debt at December 31, 2006 was € 2.231 billion, up

€ 2.782 billion versus a net cash position of € 551 million in

the prior year. This increase was driven by the payment of

around € 3.2 billion for the acquisition of Reebok International

Ltd. (USA), paid on January 31, 2006. This amount included

the buyback of employee stock options and Reebok’s convert-

ible bond. In addition, expenditure of around € 170 million for

the buyback of Reebok’s major properties in the USA and in

Europe influenced this development (see Note 5, p. 156). The

net debt position at year-end was significantly better than our

original target of around € 2.5 billion, communicated at the

beginning of 2006. The Group’s financial leverage was 78.9%

at the end of 2006, clearly below our year-end target of 100%.

On a net debt basis, the utilization of the available credit facil-

ities for the Group at the end of 2006 was 32%.

Financing Structure Further Diversified

In 2006, we continued to diversify the Group’s financing struc-

ture. Bank borrowings increased 170% to € 275 million from

€ 102 million in the prior year and the total amount of our

private placements increased 215% to € 1.784 billion in 2006

(2005: € 567 million). The current value of the convertible bond

increased 2% to € 375 million in 2006 from € 366 million in the

prior year, reflecting the accrued interest on the debt compo-

nent in accordance with IFRS requirements. As a result, gross

borrowings increased to € 2.578 billion at the end of 2006 from

€ 1.035 billion in the prior year (see Note 16, p. 160).

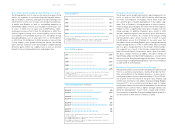

2006 2005

Total cash and short-term financial assets 347 1,586

Bank borrowings 275 102

Commercial paper 144 0

Asset-backed securities 0 0

Private placements 1,784 567

Convertible bond 375 366

Gross total borrowings 2,578 1,035

Net cash (net borrowings) (2,231) 551

Financing Structure € in millions

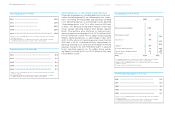

Net Cash (Net Borrowings) by Quarter1) € in millions

Q1 2005

Q1 20062)

Q2 2005

Q2 20062)

Q3 2005

Q3 20062)

Q4 2005

Q4 20062)

(700)

(2,952)

(613)

(2,829)

(657)

(2,728)

551)

(2,231)

1) At end of period.

2) Including Reebok business.

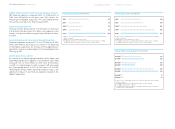

Net Cash (Net Borrowings) € in millions

2002

20031)

20041)

2005

20062)

(1,498)

(1,018)

(665)

551)

(2,231)

1) Restated due to application of amendment to IAS 39.

2) Including Reebok business.

Interest Rate Development1) in %

2002

2003

2004

2005

2006

3.2

2.7

3.4

4.0

4.8

1) Weighted average interest rate of gross borrowings.

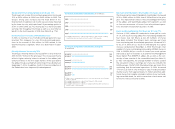

Financial Leverage in %

2002

20031)

20041)

2005

20062)

138.5)

79.2)

43.1)

(20.5)

78.9)

1) Restated due to application of IAS 32/IAS 39 and amendment to IAS 19.

2) Including Reebok business.