Reebok 2006 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements ›

168 ANNUAL REPORT 2006 › adidas Group ›

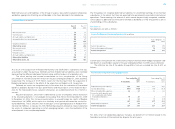

» To meet subscription or conversion rights or conversion obligations arising from bonds

with warrants and/or convertible bonds issued by the Company or any direct or indirect sub-

sidiary of the Company.

» To meet the Company’s obligations arising from the Management Share Option Plan 1999

(MSOP).

Furthermore, the Supervisory Board is authorized to assign or promise reacquired treasury

shares to Executive Board members as compensation by way of a stock bonus, subject to the

proviso that resale shall only be permitted following a retention period of at least two years

from the date of assignment.

This authorization has not been used to date.

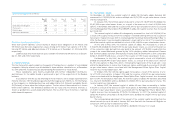

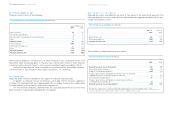

Convertible Bond

adidas International Finance B.V. issued a convertible bond with a nominal value of

€ 400,000,000 on October 8, 2003 divided into 8,000 convertible bonds with a nominal value of

€ 50,000 each. The convertible bond is due for repayment on October 8, 2018, if not previously

repaid or converted into adidas AG shares. adidas AG has assumed the unconditional and irre-

vocable guarantee with respect to payments of all amounts payable under the convertible bond

by adidas International Finance B.V. for this convertible bond. adidas AG has also taken over

the obligation to the holders of the convertible bond to supply shares to be delivered following

conversion of a convertible bond. The convertible bond entitles the holder to acquire shares in

adidas AG at a conversion price of an original € 102 per share, whereby the conversion ratio

results from dividing the nominal amount of a bond (€ 50,000) by the conversion price ruling

at the exercise date. The conversion price has been meanwhile adjusted to € 25.50 following

the stock split. The conversion right can be exercised by a bond holder between November 18,

2003 and September 20, 2018, whereby certain conversion restrictions apply. When the con-

version is exercised, the shares are to be obtained from contingent capital established by reso-

lution of the Annual General Meeting of adidas AG on May 8, 2003. adidas International Finance

B.V. is entitled to repay the convertible bond fully on or after October 8, 2009 although, in the

period from October 8, 2009 through October 7, 2015 only to the extent the market value of the

shares of adidas AG amounts to at least 130% (period from October 8, 2009 through October 7,

2012) or 115% (period from October 8, 2012 through October 7, 2015) of the conversion price

valid at that time over a certain reference period of time (as set out in the bond conditions).

The convertible bond was issued as a bearer bond and subscription rights of shareholders to

the bearer bonds were excluded. The shareholders have no subscription rights per se to the

shares for which the holders of the bonds have rights, due to security provided by contingent

capital. There were 7,999 bonds outstanding at December 31, 2006.

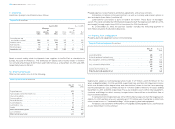

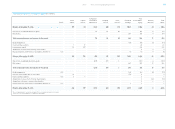

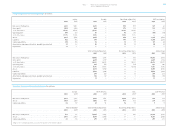

Reserves

Reserves within shareholders’ equity are as follows:

» Capital reserve: comprises the paid premium within the issue of share capital.

» Cumulative translation adjustments: this reserve comprises all foreign currency differ-

ences arising from the translation of the financial statements of foreign operations.

» Hedging reserve: comprises the effective portion of the cumulative net change in the fair

value of cash flow hedges related to hedged transactions that have not yet occurred as well as

of hedges of net investments in foreign subsidiaries.

» Other reserve: comprises the cumulative net change of actuarial gains or losses of defined

benefit plans, expenses recognized for share option plans as well as fair values of available-

for-sale financial assets.

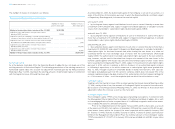

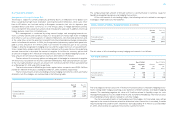

Distributable Profits and Dividends

Distributable profits to shareholders are determined by reference to the retained earnings of

adidas AG and calculated under German Commercial Law.

The Executive Board of adidas AG recommends a dividend of € 0.42 for 2006, subject to

Annual General Meeting approval. The dividend for 2005 was € 1.30 per share (but before the

implementation of the share split at a ratio of 1: 4).

Currently, 203,536,860 no-par-value shares carry dividend rights. It is proposed accord-

ingly that retained earnings of adidas AG as at December 31, 2006 be appropriated as follows:

Due to the possibility of share buybacks, the amount to be distributed to shareholders may

change, as a result of the change in the number of shares carrying dividend rights, prior to the

Annual General Meeting.

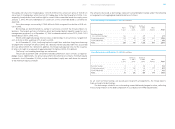

Appropriation of Retained Earnings of adidas AG € in millions

Retained earnings of adidas AG as at Dec. 31, 2006 85.6

Less: dividend of € 0.42 per share 85.5

Retained earnings carried forward 0.1