Reebok 2006 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.149

Consolidated Statement of Recognized Income and Expense ›

Notes ›

Notes

adidas AG (formerly adidas-Salomon AG), a listed German stock corporation, and its subsidiar-

ies design, develop, produce and market a broad range of athletic and sports lifestyle products.

The Group’s headquarters are located at Adi-Dassler-Str. 1, 91074 Herzogenaurach, Germany.

The adidas Group has divided its operating activities by major brand into three segments:

adidas, Reebok and TaylorMade-adidas Golf. The business of Reebok International Ltd. (USA)

and its subsidiaries is consolidated within the adidas Group as of February 1, 2006, and has a

material impact on the Group’s financial position, results of operations and cash flows.

adidas branded products include footwear, apparel and hardware, such as bags and balls.

The products are designed and developed by adidas and are almost exclusively manufactured

by subcontractors on behalf of adidas.

Reebok branded products also include footwear, apparel and hardware, such as bags and

balls. The products are designed and developed by Reebok and are almost exclusively manu-

factured by subcontractors on behalf of Reebok.

TaylorMade develops and assembles or manufactures high-quality golf clubs, balls and

accessories. adidas Golf branded products include footwear, apparel and accessories. Maxfli

is specialized in golf balls and golf accessories.

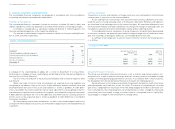

1 » General

The accompanying consolidated financial statements of adidas AG and its subsidiaries (col-

lectively the “adidas Group” or the “Group”) as at December 31, 2006, are prepared in accor-

dance with International Financial Reporting Standards (IFRS), as adopted by the European

Union, and the additional requirements of German commercial law pursuant to § 315a section

1 HGB. The Group applied all International Financial Reporting Standards and Interpretations

of the International Financial Reporting Interpretations Committee effective as at December

31, 2006.

New standards, amendments to standards and interpretations applicable for the finan-

cial year ending December 31, 2006:

» IAS 1 / IAS 19 Amendment – Actuarial Gains and Losses, Group Plans and Disclosures

(effective date: January 1, 2006): This amendment was already adopted in the 2005 financial

year.

» IAS 21 Amendment – The Effects of Changes in Foreign Exchange Rates (effective date:

January 1, 2006): This amendment had no impact on the Group’s financial statements.

» IAS 39 Amendment – Cash Flow Hedge Accounting of Forecast Intra-group Transactions

(effective date: January 1, 2006): This amendment had no impact on the Group’s financial

statements.

» IAS 39 Amendment – The Fair Value Option (effective date: January 1, 2006): This amend-

ment had no impact on the Group’s financial statements.

» IAS 39 / IFRS 4 Amendment – Financial Guarantee Contracts (effective date: January 1,

2006): This amendment had no impact on the Group’s financial statements.

» IFRS 6 Exploration for and Evaluation of Mineral Resources (effective date: January 1,

2006): This new standard had no impact on the Group’s financial statements.

» IFRIC 4 Determining whether an Arrangement Contains a Lease (effective date: January 1,

2006): This interpretation had no impact on the Group’s financial statements.

» IFRIC 5 Rights to Interests arising from Decommissioning, Restoration, and Environmental

Rehabilitation Funds (effective date: January 1, 2006): This interpretation had no impact on the

Group’s financial statements.

» IFRIC 6 Liabilities arising from Participating in a Specific Market – Waste Electrical and

Electronic Equipment (effective date: December 1, 2005): This interpretation had no impact on

the Group’s financial statements.

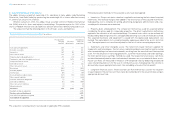

Several new standards, amendments to standards and interpretations will be effective for

financial years after December 31, 2006, and have not been applied in preparing these consoli-

dated financial statements:

» IAS 1 Amendment – Capital Disclosures (effective date: January 1, 2007): The Group is cur-

rently analyzing the potential effects of this amendment.

» IFRS 7 Financial Instruments: Disclosures (effective date: January 1, 2007): This new stan-

dard will require extensive additional disclosures with respect to the Group’s financial instru-

ments.

» IFRS 8 Operating Segments (effective date: January 1, 2009): The Group is currently analyz-

ing the potential effects of this new standard.

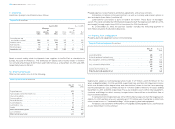

» IFRIC 7 Applying the Restatement Approach under IAS 29 Financial Reporting in Hyper-

inflationary Economies (effective date: March 1, 2006): This interpretation is not expected to

have any impact on the Group’s financial statements.

» IFRIC 8 Scope of IFRS 2 (effective date: May 1, 2006): The Group is currently analyzing the

potential effects of this interpretation.

» IFRIC 9 Reassessment of Embedded Derivatives (effective date: June 1, 2006): The Group is

currently analyzing the potential effects of this interpretation.

» IFRIC 10 Interim Financial Reporting and Impairment (effective date: November 1, 2006):

This interpretation is not expected to have any impact on the Group’s financial statements.

» IFRIC 11 IFRS 2 – Group and Treasury Share Transactions (effective date: March 1, 2007):

This interpretation is not expected to have any impact on the Group’s financial statements.

» IFRIC 12 Service Concession Arrangements (effective date: January 1, 2008): This interpre-

tation is not expected to have any impact on the Group’s financial statements.

An entity shall apply the new standards, amendments to standards and interpretations for an-

nual periods beginning on or after the effective date.

The consolidated financial statements have been prepared on the historical cost ba-

sis, with the exception of certain items such as cash and cash equivalents, available-for-sale

financial assets, derivative financial instruments and receivables, which are measured at

fair value.

The consolidated financial statements are presented in euros and all values are rounded

to the nearest million.