Reebok 2006 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.› Notes to the Consolidated Balance SheetNotes ›167

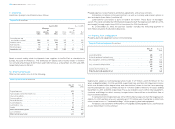

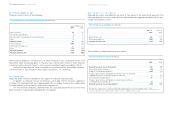

After implementation of the Capital Increase 2006 and the share split, the nominal amount of

the Contingent Capital 1999/I initially totaled € 1,722,328 and was divided into 1,722,328 no-

par-value bearer shares. As a result of the exercise of 66,670 stock options and the issuance of

266,680 no-par-value bearer shares associated with the exercise periods which ended in July

and October for Tranche II (2000), Tranche III (2001), Tranche IV (2002) and Tranche V (2003) of

the Management Share Option Plan, the nominal amount of the Contingent Capital 1999/I at

the balance sheet date amounted to € 1,455,648 and was divided into 1,455,648 no-par-value

shares.

In January 2007, the nominal value of the Contingent Capital 1999/I was reduced to

€ 1,425,448, divided into 1,425,448 no-par-value shares, as a result of the exercise of 7,550

stock options in November 2006 and the issuance of 30,200 no-par-value bearer shares as-

sociated with the expired exercise period for Tranche II (2000), Tranche III (2001), Tranche IV

(2002) as well as Tranche V (2003) of the Management Share Option Plan. On February 16,

2007, the nominal value of the Contingent Capital 1999/I amounted to € 1,425,448, divided into

1,425,448 no-par-value shares.

The change to the nominal capital and the nominal value of the Contingent Capital 1999/I

resulting from the issuance of shares between the implementation of the Capital Increase

2006 and the end of January 2007, was filed with the Commercial Register on January 29, 2007,

by way of a declaratory entry.

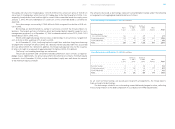

Contingent Capital 2003/II

As at the balance sheet date, the nominal capital is conditionally increased by up to an ad-

ditional € 35,998,040, divided into no more than 35,998,040 no-par-value bearer shares (Con-

tingent Capital 2003/II, § 4 section 6 (former section 5) of the Articles of Association). This is

the Contingent Capital which formerly amounted to € 23,040,000 and was then adjusted to

€ 36,000,000 as a result of the Capital Increase 2006. It will be implemented only to the extent

that the holders of the subscription or conversion rights or the persons obligated to exer-

cise the subscription or conversion duties based on the bonds with warrants or convertible

bonds, which are issued by the Company or a wholly-owned direct or indirect subsidiary of the

Company pursuant to the authorization of the Executive Board by the shareholder resolution

dated May 8, 2003, in the version of the shareholder resolution dated May 11, 2006, make use

of their subscription or conversion right or, if they are obligated to exercise the subscrip-

tion or conversion rights, they meet their obligations to exercise the warrant or convert the

bond. The Executive Board is authorized, subject to Supervisory Board approval, to fully sus-

pend the shareholders’ rights to subscribe the bonds with warrants and/or convertible bonds,

if the Executive Board has concluded following an examination in accordance with its legal

duties that the issue price of the bonds with warrants and/or convertible bonds is not signifi-

cantly below the hypothetical market value computed using recognized financial calculation

methods. This authorization to suspend the subscription rights applies, however, only with

respect to the bonds with warrants and/or convertible bonds with subscription or conversion

rights to the shares having a pro rata amount of the registered share capital totaling a maxi-

mum of approximately € 18,125,000.

During 2006, the Contingent Capital 2003/II was reduced by € 1,960 to the aforemen-

tioned value, as a result of the exercise of the conversion right from one bond amounting to

€ 50,000 and the issuance of 1,960 no-par-value shares.

The change to the nominal capital and the nominal value of the Contingent Capital 2003/II,

resulting from the issuance of shares between the implementation of the Capital Increase

2006 and the end of January 2007, was filed with the Commercial Register on January 29, 2007,

by way of a declaratory entry.

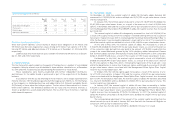

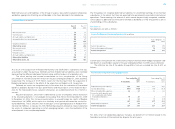

Contingent Capital 2006

As a result of the resolution adopted by the Annual General Meeting on May 11, 2006, the

nominal capital of adidas AG at the balance sheet date is conditionally increased by up to

€ 20,000,000, divided into no more than 20,000,000 no-par-value bearer shares (Contingent

Capital 2006; § 4 section 7 of the Articles of Association). The contingent capital increase will

be implemented only to the extent that the holders of the subscription or conversion rights or

the persons obligated to exercise the subscription or conversion duties based on the bonds

with warrants or convertible bonds, which are issued or guaranteed by the Company or a Group

company pursuant to the authorization of the Executive Board by the shareholder resolution

dated May 11, 2006, make use of their subscription or conversion right or, if they are obligated

to exercise the subscription or conversion rights, they meet their obligations to exercise the

warrant or convert the bond. The Executive Board is authorized, subject to Supervisory Board

approval, to fully suspend the shareholders’ rights to subscribe the bonds with warrants and/

or convertible bonds, if the bonds with warrants and/or convertible bonds are issued at a price

which is not significantly below the market value of these bonds. The limit for subscription

right exclusions of 10% of the registered stock capital according to § 186 section 3 sentence

4 together with § 221 section 4 sentence 2 of the German Stock Corporation Act has been

observed. To date, no shares have been issued from the Contingent Capital 2006.

By resolution of the Annual General Meeting of May 11, 2006, relating to Contingent Capi-

tal 2006, Contingent Capital 2004 was cancelled.

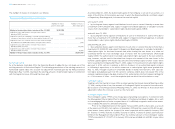

Acquisition of Treasury Shares

By resolution of the Annual General Meeting held on May 11, 2006, the shareholders of adidas

AG cancelled the authorization to repurchase treasury shares resolved upon on May 4, 2005,

which had not been used, and resolved upon a new authorization of the Executive Board to

acquire treasury shares in an aggregate amount of up to 10% of the nominal capital for any

permissible purpose and within the legal framework until November 10, 2007. The authori-

zation can be used by the Company but also by Group companies or by third parties, on the

account of the Company or Group companies. The Executive Board is authorized to use the

treasury shares repurchased on the basis of this authorization for the following purposes:

» Subject to Supervisory Board approval, for the resale of shares via the stock exchange or

via a tender offer to all shareholders for cash at a price not significantly below the stock mar-

ket price of the shares with the same features.

» Subject to Supervisory Board approval, for the purpose of acquiring companies, parts of

companies or participations in companies.

» Subject to Supervisory Board approval, as consideration for the acquisition, also through

Group companies, of industrial property rights such as patents, brands, names and logos of

athletes, sports clubs and other third parties or for the acquisition of licenses relating to such

rights.