Reebok 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

036 ANNUAL REPORT 2006 › adidas Group ›

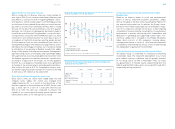

Strong Increase in Number of ADRs Outstanding

Our Level 1 American Depositary Receipt (ADR) facility

launched on December 30, 2004, continues to enjoy great

popularity among American investors. During the course of

2006, the number of Level 1 ADRs outstanding has grown

significantly from approximately 1.6 million to 11.3 million at

year-end 2006. This strong increase reflects the increased

interest of US-based investors in our share. Adjusted for the

share split which was also applied to our ADRs, the Level 1

ADR closed the year at US $ 25.20, representing an increase

of 6.6% versus the prior year (2005: US $ 23.64). Due to the

appreciating euro, the ADR outperformed our common

stock.

Convertible Bond Trades at a Premium

In 2006, the adidas Group further diversified sources of financ-

ing. As part of the financing of the Reebok acquisition, the

Group issued several additional private placements in 2006

(see Treasury, p. 85). The publicly traded convertible bond

closed the year at € 154.90, which is 4.1% lower compared to

the end of the prior year (2005: € 161.60). It currently trades at

a premium of around 5.2% above par value of the share.

Higher Dividend Proposed

The adidas AG Executive and Supervisory Boards will rec-

ommend paying a dividend of € 0.42 to our shareholders at

the Annual General Meeting on May 10, 2007. Subject to the

meeting’s approval, the dividend will be paid on May 11, 2007.

The proposed dividend per share represents an increase of

€ 0.095 per share (2005: € 0.325), showing our confidence in

the Group’s future business performance. The total payout of

€ 85 million (2005: € 66 million) reflects a payout ratio of 18%

(2005: 17%). The dividend proposal follows our dividend pol-

icy, under which the adidas Group intends to pay out between

15 and 25% of consolidated net income.

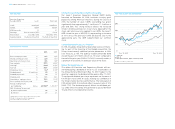

Five-Year Share Price Development1)

200

150

100

50

0

Dec. 31, 2001 Dec. 31, 2006

adidas AG

DAX-30

MSCI World Textiles, Apparel & Luxury Goods

1) Index: December 31, 2001 = 100

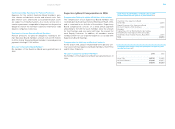

ADR Overview

American Depositary

Receipts (ADRs) Level I Rule 144A

CUSIP 00687A107 00687P104

Symbol ADDYY ADDDY

ADR/share ratio 2:1 2:1

Exchange Over the counter (OTC) Portal

Effective date December 2004 November 1995

Depositary bank The Bank of New York The Bank of New York

Share Ratios at a Glance

2006 2005

Basic earnings per share € 2.37 2.051)

Diluted earnings per share € 2.25 1.931)

Operating cash flow per share € 3.74 1.881)

Year-end price € 37.73 40.001)

Year-high € 44.001) 41.001)

Year-low € 34.66 27.781)

Dividend per share € 0.422) 0.3251)

Dividend payout € in millions 85 66

Dividend payout ratio % 18 17

Dividend yield % 1.11 0.81

Shareholders’ equity per share € 13.90 13.221)

Price-earnings ratio at year-end 16.8 20.7

Average trading volume

per trading day shares 2,039,5271) 1,696,3711)

DAX-30 ranking3) at year-end

by market capitalization 24 18

by turnover 21 21

1) Adjusted for 1: 4 share split conducted on June 6, 2006.

2) Subject to Annual General Meeting approval.

3) As reported by Deutsche Börse AG.