Reebok 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operational Risks

Sourcing Risks

Raw material and labor costs account for approximately 80%

of the Group’s cost of sales. Hence, the adidas Group faces

risks from significant increases of these costs and also

from business interruptions at one of our major suppliers,

which would have a material impact on the Group’s ability

to meet short-term customer demand. For example, finan-

cial difficulties and subsequent closure of three factories in

Indonesia supplying footwear to Reebok reduced the Group’s

net income by around € 8 million in 2006. To mitigate the risk

of higher sourcing costs, we exploit economies of scale from

our higher sourcing volume following the Reebok acquisi-

tion. To reduce the risk of business interruptions, we work

with vendors who demonstrate reliability, quality, innovation

and continuous improvement. By doing so, we are confident

that our strategic supply partners will be most competitive

in the medium and long term in offsetting price increases. In

addition, we pursue a regionally balanced sourcing strategy

and collaborate closely with our vendors in search of new,

innovative materials. As a result, we assess sourcing risks as

having a medium likelihood of occurrence and a low potential

financial loss.

Customer Risks

Customer risks arise from our dependence on key custom-

ers who could exert bargaining power resulting in consider-

able margin pressure and product cancellations. To limit this

risk, the adidas Group has a broad distribution strategy. As a

result, no customer at brands adidas, Reebok and TaylorMade

accounted for more than 10% of brand sales in 2006. Further,

following the Reebok acquisition, we are actively reducing the

brand’s dependence on key accounts by strengthening our

business in the sporting goods and athletic specialty retail

channels. A strong reduction of business with one of our

brands’ biggest retailers, which we regard as unlikely, could

nonetheless adversely impact regional sales and profitability

to a medium extent.

IT Risks

A Group-wide breakdown of IT systems or a significant loss of

data could result in considerable disruptions to our business.

In order to mitigate these risks, we perform scheduled back-

ups and engage in proactive maintenance. System security

and reliability are tested via internal tests and external audits

on a regular basis. Periodic reviews of the Group’s systems

architecture ensure that the Group meets changing busi-

ness requirements and fulfills the highest safety standards.

In 2006, the downtime of our major IT applications was well

below 1% of total running time. This gives us confidence in

the assessment of IT risks as having a low likelihood of occur-

rence, but a significant potential financial impact.

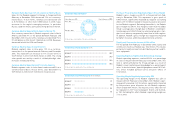

Overall Risk

Central risk management aggregates all risks reported by

brand, regional and headquarter functions. Based on the com-

pilation of risks explained within this report and the current

business outlook, adidas Group Management does not fore-

see any individual or aggregate risks which could materially

jeopardize the ongoing business health and viability of the

Group. In comparison to the prior year, portfolio and own-

retail risks increased in importance due to the magnitude

of expected synergies from the Reebok integration and the

higher share of own-retail activities at brand adidas. However,

financing and brand image risks have become less prevalent

as we have completed the financing of the Reebok transac-

tion and now have a broader portfolio of brands addressing

distinct consumer groups. As a result, management regards

the Group’s overall risk exposure as largely unchanged. This

assessment is supported by the continued positive responses

to our financing demands, as in 2006 the adidas Group issued

several private placements in various regions and currencies

that were all oversubscribed (see Treasury, p. 85). The adidas

Group therefore has not sought an official rating by one of

the leading rating agencies. We believe that the Group’s earn-

ing power forms a solid basis for our future business devel-

opment. As outlined above, we have taken appropriate pre-

cautions against typical business risks that could negatively

affect our financial standing and profitability situation.

101