Reebok 2006 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

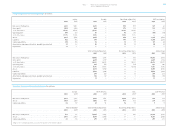

Consolidated Financial Statements ›

172 ANNUAL REPORT 2006 › adidas Group ›

Hedges of net investments in foreign entities were not renewed after maturity in January 2006,

due to the disposal of Salomon at the end of 2005. Therefore a positive effect of € 3 million will

remain in hedging reserves until the investment in the foreign entity is disinvested.

In order to determine the fair values of its derivatives that are not publicly traded, the

adidas Group uses accepted finance-related economic models based on market conditions

prevailing at the balance sheet date.

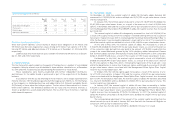

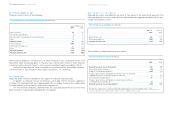

Management of Interest Rate Risk

The Group switched concentration from short-term financing to long-term financing, due to

increasing interest rates in 2005 and 2006. Therefore the Group is better protected against

future expected rising interest rates. As in 2005, no additional interest rate caps were entered

into in 2006 and maturing interest rate caps amounting to approximately € 530 million were

not renewed. Interest rate swaps amounting to approximately € 279 million and cross-currency

interest rate swaps amounting to € 10 million were entered into in 2006.

Interest rate hedges which were outstanding as at December 31, 2006 and 2005, respec-

tively expire as detailed below:

The summary above includes, in addition to the interest rate options amounting to € 50 million,

the notional amount of one long-term US dollar interest rate swap in an amount of € 76 million

(2005: € 85 million), two long-term cross-currency swaps in an amount of € 29 million (2005:

€ 23 million) and three interest rate swaps for a total of € 279 million. Both cross-currency

swaps and one long-term US dollar interest rate swap are classified as fair value hedges,

while the three interest rate swaps are classified as cash flow hedges.

The interest rate options had a negative fair value of € 0 million and negative € 1 million as at

December 31, 2006 and 2005, respectively.

The interest rate swaps and cross-currency interest rate swaps had a negative fair value

of € 7 million and € 10 million as at December 31, 2006 and 2005, respectively.

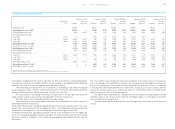

The risks hedged with fair value hedges occur from financing with private placements

in US dollars, Japanese yen and Australian dollars amounting to a notional equivalent of

€ 105 million. The aim of cross-currency swap hedges in Australian dollars and Japanese yen

was to turn the financing into euro and retain the financing method. The intent of the US dol-

lar interest rate swap was to obtain a variable financing. The negative fair value, which was

recorded directly in the income statement as incurred, had an amount of negative € 11 mil-

lion and was compensated by positive fair value effects of the hedged items in an amount of

€ 12 million.

All euro-denominated interest rate swaps qualify as cash flow hedges pursuant to IAS

39. They relate to euro private placements with variable interest rates in an amount of notional

€ 279 million. The objective behind the hedges is protection against increasing short-term

euro interest rates. The positive fair value of € 4 million was credited in hedging reserves.

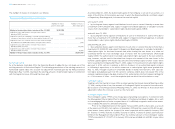

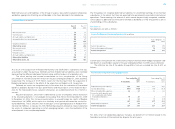

Management of Credit Risk

The Group Treasury department arranges currency and interest rate hedges, and invests cash,

with major banks of a high credit standing throughout the world, all being rated “A-” or higher

in terms of Standard & Poor’s long-term ratings (or a comparable rating from other rating

agencies).

There is no concentration of risk due to a broad distribution of business with approxi-

mately 30 banks. The result of the widely spread business is a maximum concentration of 6%

with one single bank, whereas the average concentration is below 4%. This leads to a maxi-

mum exposure of € 1 million in the event of default of one major bank.

Generally, foreign Group companies are authorized to work with banks rated “BBB+” or

higher. In exceptional cases, they are authorized to work with banks rated lower than “BBB+”.

To limit risk in these cases, restrictions such as limited amounts of cash deposits with these

banks are stipulated.

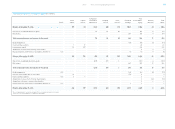

Expiration Dates of Interest Rate Hedges € in millions

Dec. 31 Dec. 31

2006 2005

Within 1 year 50 530

Between 1 and 3 years 19 50

Between 3 and 5 years 184 0

After 5 years 181 108

Total 434 688