Reebok 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

llllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllll

llllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

ll

llllll

lllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

adidas Group ›081

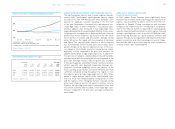

Net Income From Continuing Operations Grows 14%

The Group’s net income from continuing operations increased

14% to € 496 million in 2006 from € 434 million in 2005. The

Group’s strong sales increase was the main driver of this

improvement. In addition, net income was positively impacted

by the lower tax rate, which declined 2.3 percentage points to

31.4% in 2006 (2005: 33.7%), mainly due to a more favorable

earnings mix throughout the Group as well as a one-time tax

benefit in the fourth quarter of 2006 (see Note 28, p. 174).

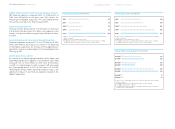

No Income/Loss From Discontinued Operations

In 2006, no income or loss from discontinued operations was

incurred. This compares to a loss from discontinued opera-

tions in the amount of € 44 million in 2005 related to the

Salomon business segment, which was divested in October

2005.

Minority Interests Increase by 74%

The Group’s minority interests increased 74% to € 13 million in

2006 from € 7 million in the prior year. This increase primarily

reflects higher minority interests related to the adidas joint

venture in Korea in the first eight months of the year before

the adidas Group assumed full ownership of the subsidiary on

September 1, 2006. In addition, the first-time consolidation of

the Reebok business impacted this development.

Net Income Attributable to Shareholders Increases 26%

The Group’s net income attributable to shareholders increased

26% to € 483 million in 2006 from € 383 million in the prior

year. This improvement reflects the outstanding performance

of the adidas and TaylorMade-adidas Golf segments as well

as the non-recurrence of losses from discontinued opera-

tions related to the Salomon business in 2005.

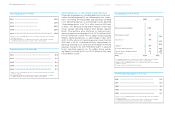

Basic and Diluted Earnings Per Share Up 16% and 17%

On June 6, 2006, adidas AG conducted a share split in a ratio

of 1:4, with each existing adidas AG share being divided into

four shares (see Our Share, p. 34). All numbers of shares

have been restated. The Group’s basic earnings per share

from continuing and discontinued operations increased 16%

to € 2.37 in 2006 versus € 2.05 in 2005 despite the capital

increase conducted on November 3, 2005. The Group’s total

number of shares outstanding increased by 489,840 shares in

2006 to 203,536,860 as a result of shares from stock options

exercised as part of Tranches II, III and IV of the Management

Share Option Plan (MSOP) of adidas AG, as well as the con-

version of one tranche of the convertible bond (see Note 22,

p. 165). Consequently, the average number of shares used in

the calculation of basic earnings per share was 203,386,104

(2005 average: 186,947,832). Diluted earnings per share from

continuing and discontinued operations in 2006 increased

17% to € 2.25 from € 1.93 in the prior year. The dilutive effect

mainly results from approximately 16 million potential addi-

tional shares that could be created in relation to our outstand-

ing convertible bond, for which conversion criteria were met

for the first time at the end of 2004.

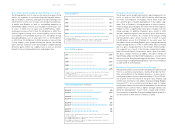

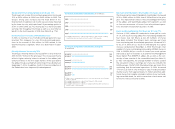

Net Income Attributable to Shareholders by Quarter

€ in millions

Q1 20051)

Q1 20062)

Q2 20051)

Q2 20063)

Q3 20051)

Q3 20063)

Q4 20051)

Q4 20064)

105)

144)

66)

82)

215)

244)

(4)

13)

1) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards.

3) Including Reebok business segment.

4) Including Reebok business segment, excluding Greg Norman wholesale business

from December 1, 2006 onwards.

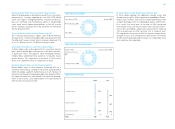

Net Income Attributable to Shareholders € in millions

2002

2003

2004

2005

20061)

229

260

314

383

483

1) Including Reebok business segment from February 1, 2006 onwards, excluding

Greg Norman wholesale business from December 1, 2006 onwards.

» Income Statement