Reebok 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

lllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

› Group Business PerformanceGroup Management Report ›

074 ANNUAL REPORT 2006 › adidas Group ›

Income Statement

First-Time Consolidation of Reebok Impacts 2006 Results

The business of Reebok International Ltd. (USA) and its sub-

sidiaries, which was acquired to broaden the adidas Group’s

product offering and to increase the Group’s long-term growth

opportunities, is consolidated within the adidas Group as of

February 1, 2006. The adidas Group’s 2006 reported financial

results were significantly impacted by this consolidation. Most

visible is the strong increase in Group sales. The Group’s gross

and operating margins, however, were negatively impacted

by Reebok’s lower than Group average margins as well as

accounting effects from purchase price allocation such as the

impact of fair values charged to expense in the income state-

ment (see Reebok Business Performance, p. 91). In addition,

the Group’s IBT was negatively impacted by the financing of

the Reebok acquisition, which led to a significant increase

of the Group’s financial expenses in 2006. The performance

of this business is shown in the Reebok segment. Reebok’s

results are not comparable with 2005 reported results for

several reasons (see Reebok Business Performance, p. 91).

As a consequence, no prior year figures for the Reebok seg-

ment are given at the Group level. However, to show Reebok’s

comparable development, prior year sales figures are pro-

vided in the Reebok section of this report.

Exceptional Factors Impact 2006 Operational Performance

In 2006, several other exceptional factors influenced the

reported operating results for the Group and the segments.

Over the course of the year, brand adidas was positively

influenced by strong sales related to the 2006 FIFA World

Cup™, which took place in our home market Germany and

for which adidas was Official Sponsor, Supplier and Licensee.

TaylorMade-adidas Golf was positively impacted by the inclu-

sion of the Greg Norman apparel business until the end of

November, when the business was divested. Sales recorded

in the HQ/Consolidation segment increased strongly, posi-

tively impacted by € 86 million of sales related to the Group’s

cooperation agreement with Amer Sports Corporation, under

which the adidas Group sources softgoods for Salomon at a

fixed buying commission for a limited period in an effort to

support the transfer of Salomon’s business activities to Amer

Sports Corporation. However, this agreement includes mar-

gins significantly below the Group’s average and therefore

negatively impacted the Group’s gross and operating margin

development in 2006. In addition, Reebok’s operating mar-

gin was negatively impacted by additional costs in connec-

tion with the closure of production facilities at manufactur-

ing partners in Indonesia in the fourth quarter of 2006. The

Group’s minority interests were impacted by the purchase of

the remaining 9% of shares from the joint venture partner of

the adidas subsidiary in India as well as by the purchase of

the remaining 49% of shares from the joint venture partner of

the adidas subsidiary in Korea, effective February 1, 2006 and

September 1, 2006, respectively (see Note 5, p. 156).

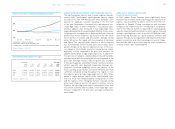

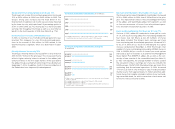

Net Sales by Quarter € in millions

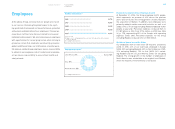

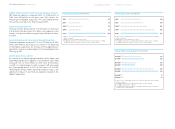

Net Sales € in millions

2002

2003

20041)

20051)

20062)

6,523

6,267

5,860

6,636

10,084

1) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards, excluding

Greg Norman wholesale business from December 1, 2006 onwards.

Q1 20051)

Q1 20062)

Q2 20051)

Q2 20063)

Q3 20051)

Q3 20063)

Q4 20051)

Q4 20064)

1,674

2,459

1,516

2,428

1,924

2,949

1,521

2,248

1) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards.

3) Including Reebok business segment.

4) Including Reebok business segment, excluding Greg Norman wholesale business

from December 1, 2006 onwards.