Reebok 2006 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements ›

160 ANNUAL REPORT 2006 › adidas Group ›

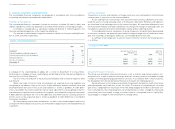

16 » Borrowings and Credit Lines

In response to the increased financing needs due to the acquisition of Reebok Interna-

tional Ltd. (USA), the Group adjusted its financing policy. In 2005, the German Commercial

Paper Program was increased by € 1.25 billion to € 2.0 billion. Additionally, the international

medium-term syndicated loan was increased to € 2.0 billion from € 750 million, with extended

maturities. Furthermore, the number of banks participating in the Commercial Paper Program

as well as the syndicated loan was extended. Additionally, in January 2006, the Group issued

a US private placement with a transaction volume of US $ 1.0 billion. Bilateral credit lines with

core banks in an amount of approximately € 2.4 billion as well as the € 400 million convertible

bond issued by adidas International Finance B.V. in 2003 supplement the diversification of the

Group’s financing structure.

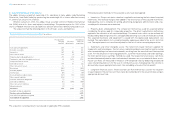

With settlement on October 8, 2003, adidas issued a € 400 million convertible bond

through its wholly-owned Dutch subsidiary, adidas International Finance B.V. The bond was

guaranteed by adidas AG and issued in tranches of € 50,000 each with a maturity up to 15 years.

The bond is, at the option of the respective holder, subject to certain conditions, convertible

from and including November 18, 2003, up to and including September 20, 2018, into ordinary

no-par-value bearer shares of adidas AG at the conversion price of € 25.50 which was fixed

upon issue. The coupon of the bond is 2.5% and is payable annually in arrears on October

8 of each year, commencing on October 8, 2004. The bond is convertible into approximately

four million no-par-value shares.

The convertible bond is not callable by the issuer until October 2009. It is callable there-

after, subject to a 130% trigger between October 2009 and October 2012 and subject to a

115% trigger between October 2012 and 2015. The convertible bond is unconditionally callable

thereafter. Investors have the right to convert the bond in October 2009, October 2012 and

October 2015.

The fair values of the liability component and the equity conversion component were

determined on the issuance of the bond. The fair value of the liability component, included in

long-term borrowings, was calculated using a market interest rate of approximately 4.6% for

an equivalent straight bond without conversion rights. Due to the retrospective application of

the amendment to IAS 39 and IAS 32, the liability and equity split of the convertible bond has

changed. As a result, the liability component as at the date of issuance increased by € 71.1 mil-

lion with an equivalent decrease in equity. The amount of the equity component, which is in-

cluded in equity in the capital reserve, amounts to € 44.1 million (less transaction costs of

€ 0.9 million). The liability component is valued on amortized cost basis.

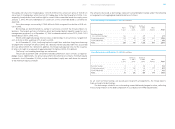

14 » Long-Term Financial Assets

Long-term financial assets include a 10% investment in FC Bayern München AG of € 77 million

which was made in July 2002. This investment is classified as available for sale and recorded

at fair value. This equity security does not have a quoted market price in an active market,

therefore other methods of reasonably estimating fair value as at December 31, 2006 were

used. Dividends are distributed instead of a regular payment of interest.

Additionally, long-term financial assets include investments which are mainly invested in

insurance products and are measured at fair value, as well as loans.

Fair value adjustments from impairment losses amount to € 8 million and € 15 million

for the years ending December 31, 2006 and 2005, respectively. As in the prior year these are

related to impairments of other financial assets to cover anticipated risks of default (see also

Note 27).

For details see Statement of Movements of Tangible and Intangible Assets and Financial

Assets (Attachment I to these Notes).

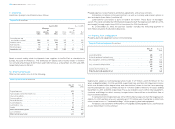

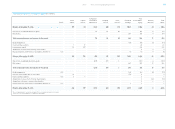

15 » Other Non-Current Assets

Other non-current assets consist of the following:

Prepaid expenses mainly include prepayments for long-term promotional contracts and ser-

vice contracts (see also Notes 32 and 23).

Other Non-Current Assets € in millions

Dec. 31 Dec. 31

2006 2005

Prepaid expenses 103 89

Interest rate options 3 7

Currency options 1 7

Security deposits 22 16

Sundry 5 4

Other non-current assets 134 123