Reebok 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

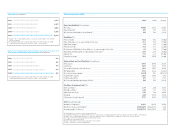

» Deliver double-digit currency-neutral sales growth

(high-single-digit growth for the Group excl. Reebok)

» Bring major new concepts, technology evolutions and

revolutions to market

» Grow currency-neutral sales at adidas and

TaylorMade-adidas Golf in all regions

» Gross margin range 44 – 46% (47 – 48% excl. Reebok)

» Operating margin around 9% (10 – 10.5% excl. Reebok)

» Continue to optimize working capital management

» Capital expenditure range € 300 million – € 350 million

(excluding extraordinary investments related to Reebok)

» Reduce debt after financing of Reebok acquisition

» Deliver double-digit net income growth versus 2005

level of € 383 million

» Further increase shareholder value

» Group sales reach € 10.1 billion; currency-neutral growth

of 53% (14% excluding Reebok)

» Major 2006 product launches:

› adidas: +F50 TUNIT football boot, adidas_1 basketball

shoe, Adilibria women’s apparel collection, integrated

training system by adidas and Polar

› Reebok: Trinity KFS running shoe, Rbk 9k Pump Skate

› TaylorMade-adidas Golf: r7® irons, TaylorMade® Tour

Preferred® (TP) golf balls

» Currency-neutral sales increase 14% at adidas and 22%

at TaylorMade-adidas Golf; currency-neutral sales grow

in all regions

» Gross margin: 44.6% (47.8% excl. Reebok)

» Operating margin: 8.7% (10.5% excl. Reebok)

» Operating working capital as a percentage of net sales

reduced by 0.2pp to 25.8% (excluding Reebok reduced by

2.5pp to 23.5%)

» Capital expenditure: € 277 million (excluding

extraordinary investments related to Reebok)

» Net borrowings reduced to € 2.231 billion;

year-end financial leverage: 78.9%

» Highest ever net income attributable to shareholders

at € 483 million (+26%)

» Dividend increase of 29% proposed; adidas AG share

price underperforms DAX-30 and MSCI World Textiles,

Apparel and Luxury Goods Index

» Mid-single-digit currency-neutral sales growth

» Bring major new concepts, technology evolutions and

revolutions to market

» Currency-neutral sales to grow at all brands and for

all regions

» Gross margin range 45 – 47%

» Operating margin around 9%

» Reduce operating working capital as a percentage of

net sales to below 25%

» Capital expenditure range € 300 million – € 400 million

» Reduce year-end net borrowings to below

€ 2 billion

» Net income to grow double-digit, approaching 15%

» Further increase shareholder value

TARGETS 2007TARGETS 2006 RESULTS 2006