Reebok 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

llllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllll

lllllllllll

adidas Group ›079

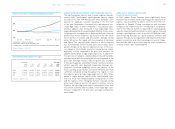

Marketing Working Budget Down as a Percentage of Sales

Our Group’s marketing working budget is well balanced

between the major marketing components, which are com-

munication (including advertising, retail presentation and

public relations) and promotion partnerships. Marketing

working budget as a percentage of sales declined 1.3 per-

centage points to 12.9% in 2006 from 14.2% in the prior year,

mainly reflecting the first-time consolidation of Reebok.

Reebok’s marketing working budget as a percentage of sales

is significantly lower than Group average as a result of the

smaller portion of sales generated by performance products

in the Reebok segment. Excluding Reebok, marketing work-

ing budget as a percentage of sales declined 0.1 percent-

age points to reach 14.1%. This was related to a significant

decline of marketing expenditure as a percentage of sales

at TaylorMade-adidas Golf which more than compensated

higher marketing expenditures at brand adidas related to the

2006 FIFA World Cup™.

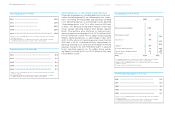

Operating Overheads Decrease as a Percentage of Sales

Group operating overheads include overhead costs related to

marketing, sales, logistics, research and development as well

as central finance and administration functions. Operating

overhead expenses as a percentage of sales declined 0.2 per-

centage points to 23.8% in 2006 from 24.0% in the prior year

as a result of the first-time consolidation of Reebok. Exclud-

ing Reebok, operating overheads as a percentage of sales

were stable at 24.0% as a result of lower administrative costs

within the Group’s headquarter functions which more than

offset higher own-retail expenditures at brand adidas.

No Amortization of Goodwill and Trademarks Incurred

In accordance with International Financial Reporting Stan-

dards, intangible assets with unlimited useful lives (goodwill

and trademarks) are tested annually and additionally when

there are indications of potential impairment. In 2006, as well

as in 2005, no impairment was incurred.

Operating Profit Grows 25%

Group operating margin declined 1.9 percentage points to

8.7% of sales in 2006 (2005: 10.7%). This mainly reflects the

first-time consolidation of the Reebok business, which carries

a significantly lower operating margin than the Group aver-

age. The segment’s operating margin also includes a nega-

tive impact from purchase price allocation on cost of sales

and operating expenses in a total amount of € 89 million. The

first cost synergies related to the Reebok integration, which

we expect to positively impact the Group’s operating margin

from 2007 onwards, were offset by one-time costs in 2006.

As a result of strong sales growth, however, operating profit

for the adidas Group rose 25% in 2006 to reach € 881 million

versus € 707 million in 2005. For the adidas Group exclud-

ing Reebok, the operating margin decreased 0.2 percentage

points to 10.5% in 2006 from 10.7% in the prior year. An oper-

ating margin decline in the Group’s HQ/Consolidation seg-

ment as a result of the Group’s cooperation agreement with

Amer Sports Corporation more than offset operating margin

increases at both adidas and TaylorMade-adidas Golf. Operat-

ing profit for the adidas Group excluding Reebok grew by 12%

to € 789 million in 2006 from € 707 million in the prior year.

Operating Profit € in millions

20021)

20031)

20042)

20052)

20063)

477

490

584

707

881

1) Excluding royalty and commission income as well as goodwill amortization.

2) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

3) Including Reebok business segment from February 1, 2006 onwards, excluding

Greg Norman wholesale business from December 1, 2006 onwards.

Operating Margin in %

20021)

20031)

20042)

20052)

20063)

7.3

7.8

10.0

10.7

8.7

1) Excluding royalty and commission income as well as goodwill amortization.

2) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

3) Including Reebok business segment from February 1, 2006 onwards, excluding

Greg Norman wholesale business from December 1, 2006 onwards.

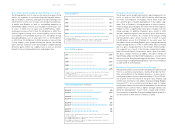

Operating Profit by Quarter € in millions

Q1 20051)

Q1 20062)

Q2 20051)

Q2 20063)

Q3 20051)

Q3 20063)

Q4 20051)

Q4 20064)

205

248

152

173

315

409

35

52

1) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards.

3) Including Reebok business segment.

4) Including Reebok business segment, excluding Greg Norman wholesale business

from December 1, 2006 onwards.

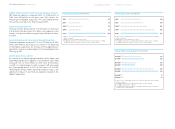

» Income Statement