Reebok 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

035

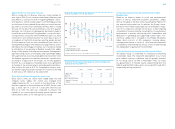

adidas AG Share Price Under Pressure

After a strong start in January, when our share reached its

year-high of € 44.00, the share price declined in February and

early March as a result of concerns regarding Reebok’s short-

term business outlook. Analyst reports commenting positively

on the future of the combined Group after our annual Investor

Day led to a recovery that continued until May. After a strong

increase on the day of the announcement of our first quarter

earnings, our share price subsequently declined strongly in

line with the overall market. Despite adidas’ successful spon-

soring activities around the 2006 FIFA World Cup™, our share

continued to lack momentum after the event due to fears of

a slowdown of the North American sporting goods market.

Positive impulses from our well-received half year results at

the beginning of August only temporarily supported our share.

Starting at the end of August, however, our share price rallied

in anticipation of an upswing at Reebok ahead of the adidas

Group’s third quarter earnings announcement. Management

reported strong results of the adidas and TaylorMade-adidas

Golf segments but also announced additional investments into

the Reebok segment to accelerate the brand’s revitalization,

resulting in a reduction of the Group’s net income guidance

for 2007. As a consequence, the adidas share lost significantly

on the day of the announcement and underperformed there-

after to finish the year at € 37.73. Compared to the prior year,

our market capitalization decreased to € 7.7 billion at the end

of 2006 versus € 8.1 billion at the end of 2005.

Share Split and Name Change Effective in June

Since June 6, 2006, our shares have traded under the new

company name “adidas AG”, which was changed from

“adidas-Salomon AG” as a result of the divestiture of the

Salomon segment in the fourth quarter of 2005. On the same

day, a share split in a ratio of 1: 4 became effective (see

Note 22, p. 165). The split was conducted to enhance the

liquidity of our share especially among private investors and

had no dilutive effect as no new capital was raised.

Strong Sustainability Track Record Reflected in Index

Memberships

Rated as an industry leader in social and environmental

affairs as well as long-term economic parameters, adidas

AG was included in the Dow Jones Sustainability Indexes for

the seventh consecutive time. In addition, the Group’s mem-

bership in the FTSE4Good Europe was reconfirmed. Compa-

nies in this index are selected on the basis of their ongoing

commitment to environmental sustainability, strong financial

performance, a positive relationship with stakeholders and

dedication to upholding and supporting human rights. Fur-

thermore, adidas AG is included in the Ethibel Excellence

Index, which consists of 280 companies showing above-

average performance in terms of social and environmental

sustainability and meeting the ethical criteria established by

the independent organization Forum Ethibel.

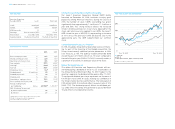

adidas AG Historically Outperforms Benchmark Indices

The adidas Group is committed to continuously enhancing

shareholder value. The long-term development of our share

price reflects investor confidence and the growth potential

of our Group. Since our IPO in November 1995, our share

has gained 334%. It thereby clearly outperformed both the

DAX-30 and the MSCI Index, which increased 200% and 148%

respectively during the period.

Our Share ›

High and Low Share Prices per Month1)

45

40

35

30

Jan. 2006 Dec. 2006

30-day moving average

High and low share prices per month

1) Figures adjusted for 1: 4 share split conducted on June 6, 2006.

Historical Performance of the adidas AG Share and Important

Indices at Year-End 2006 in %

1 year 3 years 5 years since IPO

adidas AG (6) 67 79 334

DAX-30 22 66 28 200

MSCI World Textiles,

Apparel & Luxury

Goods 24 74 130 148

43.4741.25

38.4336.03

41.5236.34

39.8436.40

37.4935.14

38.5535.30

38.5634.66

39.2534.86

43.3836.92

41.8738.43

43.7840.81

44.0040.38