Reebok 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

› Structure and StrategyGroup Management Report ›

048 ANNUAL REPORT 2006 › adidas Group ›

Free Cash Flow

Internal Group

Management System

The adidas Group’s central planning and controlling system

is designed to continually increase the value of our Group

and brands to maximize shareholder value. By improv-

ing our top- and bottom-line performance and optimizing

the use of our capital employed, we aim to maximize free

cash flow generation, which is our principal financial goal.

Management utilizes a variety of decision-making tools to

assess our current performance and to align future stra-

tegic and investment decisions to exploit commercial and

organizational opportunities.

Free Cash Flow as Internal Group Management Focus

The cornerstone of our Group’s Internal Management Sys-

tem is our focus on free cash flow generation, which is an

important contributor to driving increases in shareholder

value. Free cash flow is comprised of operating components

(operating profit, change in operating working capital and

capital expenditures) as well as non-operating components

such as financial expenses and taxes. To maximize free cash

flow from our operating activities, we strive to increase Group

sales but also the Group’s gross and operating margins. To

implement this principle across our multi-brand organiza-

tion, brand management has direct responsibility for improv-

ing operating profit and the management of operating work-

ing capital and capital expenditure. Non-operating items

such as financial expenses and taxes are managed centrally

by the Group Treasury and Tax departments. To keep Group

and brand management focused on ongoing performance

improvement, variable compensation of the responsible man-

agers is linked to both operating profit and operating working

capital development.

Sales and Gross Margin Development Important

Performance Drivers

An essential element of our future operating performance is

maintaining and developing our strong top line. To achieve

this, Management focuses on identifying and exploiting op-

portunities that not only enhance growth, but also have

potential to increase gross margin (defined as gross profit as

a percentage of net sales) at the same time. Major levers for

gross margin improvement are ongoing improvements of the

Group’s product mix, the expansion of our high-margin own-

retail activities as well as the optimization of the geographic

mix of our business. In addition, the minimization of clear-

ance activities and ongoing supply chain efficiency gains, are

drivers for gross margin improvements of our Group.

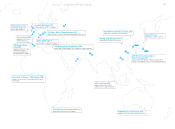

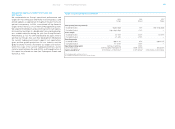

Free Cash Flow Components

Operating

Profit

Operating

Working

Capital

Capital

Expendi-

tures1)

Non-

Operating

Components

1) Excluding goodwill and finance leases.