Reebok 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

085

Treasury

Treasury System and Responsibilities

Our Group’s treasury policy governs all treasury-related

issues, including banking policy and approval of bank rela-

tionships, global financing arrangements and liquidity/asset

management, currency and interest risk management as well

as the management of intercompany cash flows. Responsi-

bilities are arranged in a three-tiered approach:

» The Treasury Committee, consisting of members of the

Executive Board and other senior executives, decides upon

the Group’s treasury policy and provides strategic guidance

for managing treasury-related topics. The Treasury Committee

approves all major changes to our treasury policy.

» The Group Treasury department is responsible for specific

centralized treasury transactions and for global implementa-

tion of our Group’s treasury policy.

» On a subsidiary level, local managing directors and finan-

cial controllers are responsible for managing treasury matters

in the respective subsidiaries. Brand and regional controlling

ensures that the transactions of the individual business units

are in compliance with the Group’s treasury policy.

Centralized Treasury Function

In accordance with our Group’s treasury policy, more than

90% of our worldwide credit lines are managed by the Group

Treasury department. Portions of the lines are allocated to the

Group’s subsidiaries and backed by parental guarantees. As

a result of this centralized liquidity management, the Group

is well positioned to allocate resources efficiently throughout

the organization. The Group’s debt is generally unsecured and

includes standard financial covenants which are reviewed on

a quarterly basis. We maintain good relations with numer-

ous partner banks, thereby avoiding a strong dependency on

any single institution. Banking partners of the Group and our

subsidiaries are required to have at least a BBB+ long-term

investment grade rating by Standard & Poor’s or an equivalent

rating by another leading rating agency (see Note 24, p. 171).

To optimize the Group’s cash position and ensure optimal allo-

cation of liquid financial resources, subsidiaries are required

to transfer excess cash to the Group’s headquarters.

Number and Volume of Financing Instruments Increased

The acquisition of Reebok International Ltd. (USA) strongly

increased the Group’s financing requirements. As a result, we

increased the number and volume of certain financing instru-

ments. By issuing private placements in the USA, in Europe

and in Asia in a total amount of around € 1.3 billion in 2006,

we continued to diversify the Group’s financing structure. This

further reduced our dependency on single credit institutions

and country-specific factors. In addition, long-term financial

flexibility is ensured by a currently unutilized € 2.0 billion syndi-

cated loan as well as additional unutilized bilateral credit lines

at different banks in an amount of € 2.4 billion (see Note 16,

p. 160). The Group’s currency split of gross borrowings was

also further diversified in 2006. We significantly increased our

US dollar-denominated financing to reflect the acquisition of

US dollar-based assets related to Reebok. We monitor the

ongoing need for available credit lines based on the current

level of debt as well as future financing requirements.

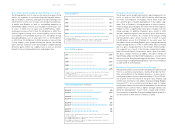

Total Credit Facilities € in millions

2006 2005

Total 6,935 5,140

Short-term lines

Medium-term committed lines

Private placements

Convertible bond

2,776

2,000

1,784

375

2,194

2,013

567

366

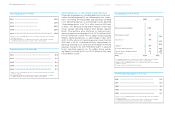

Remaining Time to Maturity of Available Facilities € in millions

2006 2005

Total 6,935 5,140

< 1 year

1 to 3 years

3 to 5 years

> 5 years

2,879

985

2,480

591

2,227

308

2,427

178

» Balance Sheet and Cash Flow Statement

» Treasury

adidas Group ›