Reebok 2006 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

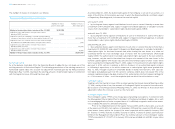

› Notes to the Consolidated Balance SheetNotes ›161

The adidas AG share first traded above 110% (€ 28.05) of the conversion price of € 25.50 on

more than 20 trading days within the last 30 trading days in the fourth quarter of 2004. Con-

sequently, bond holders have had the right to convert their convertible bonds into equity since

January 1, 2005. An early redemption or conversion of the convertible bond is currently not

expected.

Gross borrowings increased by € 1.543 billion in 2006 compared to a decline of € 85 mil-

lion in 2005.

Borrowings are denominated in a variety of currencies in which the Group conducts its

business. The largest portions of effective gross borrowings (before liquidity swaps for cash

management purposes) as at December 31, 2006 are denominated in euros (51%; 2005: 76%)

and US dollars (44%; 2005: 16%).

Month-end weighted average interest rates on borrowings in all currencies ranged from

4.2% to 5.3% in 2006 and from 3.7% to 4.2% in 2005.

As at December 31, 2006, the Group had cash credit lines and other long-term financing

arrangements totaling € 6.9 billion (2005: € 5.1 billion); thereof unused credit lines accounted

for € 4.4 billion (2005: € 4.1 billion). In addition, the Group had separate lines for the issuance

of letters of credit in an amount of approximately € 0.3 billion (2005: € 0.4 billion).

The Group’s outstanding financings are unsecured.

The private placement and convertible bond documentation each contains a negative-

pledge clause. Additionally, the private placement documentation contains minimum equity

covenants. As at December 31, 2006, actual shareholders’ equity was well above the amount

of the minimum equity covenant.

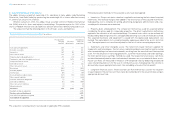

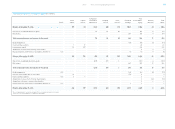

The amounts disclosed as borrowings represent outstanding borrowings under the following

arrangements with aggregated expiration dates as follows:

As all short-term borrowings are based upon long-term arrangements, the Group reports

them as long-term borrowings.

The borrowings related to our outstanding convertible bond changed in value, reflecting

the accruing interest on the debt component in accordance with IFRS requirements.

Gross Borrowings as at December 31, 2006 € in millions

Between Between

Up to 1 and 3 3 and 5 After

1 year years years 5 years Total

Bank borrowings

incl. commercial paper 144 0 275 0 419

Private placements 109 610 474 591 1,784

Convertible bond 0 0 375 0 375

Total 253 610 1,124 591 2,578

Gross Borrowings as at December 31, 2005 € in millions

Between Between

Up to 1 and 3 3 and 5 After

1 year years years 5 years Total

Bank borrowings 0 0 102 0 102

Private placements 31 294 65 177 567

Convertible bond 0 0 366 0 366

Total 31 294 533 177 1,035