Reebok 2006 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes ›179

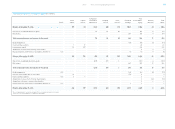

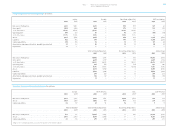

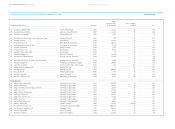

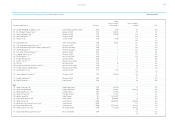

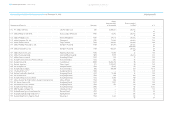

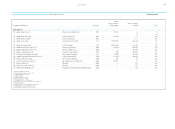

Management Share Option Plan (MSOP)1)

Tranche I (1999) Tranche II (2000) Tranche III (2001) Tranche IV (2002) Tranche V (2003)

Share price Exercise Exercise Exercise Exercise Exercise

in € Number price in € Number price in € Number price in € Number price in € Number price in €

Originally issued 266,550 335,100 342,850 340,850 88,000

Outstanding as at Jan. 1, 2005 163,450 — 17,450 21.75 55,700 37.95 204,550 90.85 82,500 —

Forfeited during the period 5,900 135.11 350 2.56 1,500 2.56 3,700 38.00 2,500 2.56

Exercised during the period

May 2005 137.44 0 — 3,950 2.56 23,400 2.56 56,255 72.67 0 —

Aug. 2005 143.48 82,950 116.26 800 2.56 9,500 2.56 71,700 2.56 41,900 2.56

Nov. 2005 155.80 13,450 153.96 2,100 2.56 3,400 2.56 21,950 38.76 14,400 2.56

Outstanding as at Dec. 31, 2005 61,150 153.96 10,250 2.56 17,900 2.56 50,945 38.76 23,700 2.56

Exercisable as at Dec. 31, 2005 61,150 153,96 10,250 2.56 17,900 2.56 50,945 38.76 23,700 2.56

Outstanding as at Jan. 1, 2006 61,150 153.96 10,250 2.56 17,900 2.56 50,945 38.76 23,700 2.56

Forfeited during the period 1,450 107.14 400 4.00 400 4.00 1,350 26.84 0 4.00

Exercised during the period

May 2006 2) 149.20 32,200 107.14 1,150 4.00 2,850 4.00 10,320 4.00 10,150 4.00

Aug. 2006 2) 146.52 0 — 0 — 1,750 4.00 4,250 32.68 4,000 4.00

Nov. 2006 2) 149.84 0 — 650 4.00 750 4.00 4,400 43.84 1,750 4.00

Expired during the period 27,500 107.14 0 — 0 — 0 — 0 —

Outstanding as at Dec. 31, 2006 2) 0 — 8,050 4.00 12,150 4.00 30,625 43.84 7,800 4.00

Exercisable as at Dec. 31, 2006 2) 0 — 8,050 4.00 12,150 4.00 30,625 43.84 7,800 4.00

1) In the table the exercise period is relevant, not the payment date.

2) Due to the share split effective May 2006, one option is now equivalent to four shares (see also Note 22).

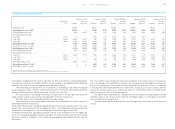

The expense recognized in the income statement for 2006 arising from share-based payment

transactions amounted to € 0 million (2005: € 0.5 million) and is recorded within the operating

expenses. The contra-entry to the expense was recorded in equity.

The remaining contractual lives for stock options outstanding at the end of the period

are presented as follows: Tranche II (2000) until July 2007, Tranche III (2001) untill July 2008,

Tranche IV (2002) until July 2009 and Tranche V (2003) until July 2010.

For stock options outstanding at the end of the period it is not possible to disclose the

range of exercise prices because they are dependent on future share prices.

No stock options were issued during the year under review.

The stock options may only be exercised subject to the attainment of at least one of the

following performance objectives:

(1) Absolute Performance: During the period between the issuance and exercise of the stock

options, the stock market price for the adidas AG share – calculated upon the basis of the total

shareholder return approach – has increased by an annual average of at least 8%.

(2) Relative Performance: During the same period, the stock market price for the adidas AG

share must have developed by an annual average of 1% more favorably than the stock market

prices of a basket of competitors of the adidas Group globally and in absolute terms may not

have fallen.

The stock options may only be exercised against payment of the exercise price. The exercise

price corresponds to the arithmetical mean of the closing prices of the adidas AG share over

the last 20 trading days of the respective exercise period, less a discount, which is composed

of the absolute and relative performance components. In any case, the exercise price shall be

at least the lowest issue price as stated in § 9 section 1 of the German Stock Corporation Act

(AktG), currently € 1.00 (i.e. € 4.00 per option).

The option terms and conditions stipulate that the stock options may be used for existing

common shares in lieu of new shares from the contingent capital, or in the place of common

shares the discount is paid in cash.

The new shares participate in profits from the beginning of the year in which they are

issued.

› Notes – Additional Information