Reebok 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

037

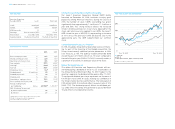

Our Share ›

2006 AGM Renews Authorization for Share Buyback

In addition to ratifying the actions of the Executive and Super-

visory Boards in 2005 and resolving upon the dividend, the

name change and the share split (see above), the Annual Gen-

eral Meeting also approved a change in adidas AG’s Articles of

Association to reflect changes in German company law regu-

lating the convocation of and the requirements for attending a

general meeting. Following the capital increase in November

2005, which utilized all outstanding authorized capital, new

authorized capital amounting to € 20 million was approved.

In addition, the Annual General Meeting renewed the exist-

ing authorization to repurchase own shares up to an amount

totaling 10% of the stock capital until November 10, 2007 (see

Reporting Pursuant to § 315 Section 2 No. 4 and Section 4

HGB, p. 114). Currently, however, the Group has no concrete

plans to make use of this authorization.

Investor Base in North America Significantly Strengthened

Based on the amount of invitations to our Annual General

Meeting in May 2006, we estimate that we currently have

around 85,000 shareholders. According to our latest owner-

ship analysis conducted in February 2007, known institutional

investors now account for approximately 96% (2006: 93%) of

our shares outstanding. As a result of the Reebok acquisition

and our stronger position in the North American market, insti-

tutional shareholdings in this region increased significantly to

37% (2006: 29%). German institutional investors accounted

for 12% of adidas AG shares (2006: 13%). The sharehold-

ings in the rest of Europe excluding Germany decreased to

40% (2006: 44%). 2% are held by institutional shareholders in

other regions of the world (2006: 3%). The adidas Group man-

agement, which comprises current members of the Executive

and Supervisory Boards, continues to hold less than 5% in

total. Smaller, undisclosed holdings, which also include pri-

vate investors, declined to 4% (2006: 7%).

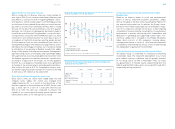

Strong Analyst Interest Continues

The adidas Group continued to receive strong interest from

analysts and investors in 2006. Around 30 analysts regularly

published research reports on adidas AG. The majority of

investors and analysts remain confident about the medium-

and long-term potential of our Group, although the recom-

mendation split as of December 31, 2006, reflects several

downgrades due to concerns about Reebok’s short-term

business outlook and the reduction of the Group’s 2007 net

income guidance on November 9. 38% of analysts recom-

mended investors to “buy” our share in their last publication

during the 12-month period (2005: 75%). 56% advised to hold

our share (2005: 25%). 6% issued a “sell” rating (2005: 0%).

Award-Winning Investor Relations Activities

adidas AG strives to maintain continuous close contact to insti-

tutional and private shareholders and analysts. In 2006, man-

agement and the Investor Relations team spent almost twenty

days on roadshows and presented at numerous national and

international conferences (see www.adidas-Group.com/inves-

tors for a detailed calendar of events). In April 2006, we invited

the financial community to our seventh annual Investor Day in

London, where Management presented the Group’s strategy

and future brand positioning. The effectiveness of our Group’s

Investor Relations activities was highlighted by the Institutional

Investor Magazine, whose surveys among buy-side and sell-

side analysts again ranked us as the best Investor Relations

program in our sector. In addition, we took second place in the

DAX-30 in the annual Investor Relations rankings conducted

by German business magazine Capital.

Extensive Financial Information Available Online

At www.adidas-Group.com/investors, we offer extensive in-

formation around our share as well as the Group’s strategy

and financial results. Our event calendar lists all conferences

we attend and provides all the presentations for download.

In addition to live webcasts of all major events such as our

Analyst Conference, the Annual General Meeting and our

Investor Day, we have started to offer podcasts of our quarterly

conference calls. In 2007, we will further improve our website

to best meet the information needs of our stakeholders.

1) At year-end 2006

Source: Bloomberg

Recommendation Split1)

Sell 6% Hold 56%

1) As at February 2007

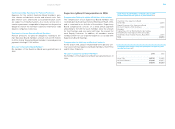

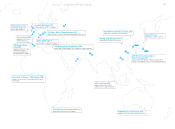

Shareholder Structure1)

Rest of the World 2% Rest of Europe

(excl. Germany) 40%

Buy 38%

Other, Undisclosed

Holdings 4%

North America 37%

Management < 5%

Germany 12%