Reebok 2006 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.195

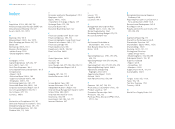

Credit Spread

A risk premium which represents the yield difference between risk-free government bonds

and corporate bonds with the same duration. A potential investor demands an additional yield

(risk premium = credit spread) for the higher risk of default with corporate bonds versus gov-

ernment bonds.

Currency-Neutral

Financial figures translated at prior-year exchange rates. This indicates increases or decreases

to reported figures by eliminating variances arising from currency translation, thus reflecting

the underlying business performance.

Current Asset Intensity of Investments

The percentage of total assets tied up in current assets.

Current asset intensity of investments = current assets / total assets.

Days of Sales Outstanding (DSO)

The average time of receipt of outstanding payments from customers.

Diluted Earnings per Share (Diluted EPS)

A performance indicator used to gauge a company’s earnings per share, assuming that all

stock options, options and conversion rights related to a convertible bond are exercised, which

would result in an increase of the number of shares outstanding.

Diluted EPS = (net income + interest expense on convertible bonds net of tax) / (weighted

average number of shares outstanding during the year + weighted share options + shares from

assumed conversion of convertible bonds).

Directional Accounts

High-profile boutiques and metropolitan accounts that target trendsetting sports lifestyle con-

sumers.

Discontinued Operations

Operations that have been or will be divested by the company and therefore will not contribute

to future economic development. For the adidas Group this roughly equals the Salomon busi-

ness segment that was divested in October 2005. See also Net Income from Continuing Opera-

tions and Continuing Operations.

D&O Liability Insurance

Pecuniary damage liability insurance a company concludes for its directors and officers to

protect against costs associated with litigation.

Earnings per Share (EPS)

A performance indicator that expresses a company’s net income in relation to the number of

ordinary shares issued.

Earnings per share = net income / weighted average number of shares outstanding during the

year.

EBITDA

Earnings before interest, taxes, depreciation and amortization.

Effective Tax Rate

Indicates the actual tax rate paid by a company. Calculated by dividing taxes actually paid by

income before taxes.

Emerging Markets

Economies that are small, but that have the potential for growth in size and importance in

coming years. For the adidas Group, emerging markets are the developing countries of Asia,

Eastern Europe, Latin America and Africa.

Equity Ratio

Shows the role of shareholders’ equity within the financing structure of a company.

Equity ratio = shareholder’s equity / total assets.

Equity-To-Fixed-Asset Ratio

Defines the percentage of non-current assets financed by equity.

Equity-to-fixed-asset ratio = equity / non-current assets.

Fair Factory Clearinghouse (FFC)

A collaborative industry effort involving international manufacturers to create a system for

managing and sharing workplace condition information. Its objectives are to improve the fac-

tory’s social compliance audits through use of a global data management system, to facilitate

exchange of information and advance and promote education and knowledge about the current

status of workplace conditions.

Fair Value

Amount at which assets are traded fairly between business partners. Fair value is often identi-

cal to market price.

Family Footwear Channel

This North American retail distribution channel caters for affordable footwear across all age

groups.

Finance Lease

A method of acquiring an asset that involves a series of rental payments extending over the

expected lifetime of the asset.

Financial Leverage

This ratio reflects the role of borrowings within the financing structure of a company.

Financial leverage = net total borrowings / shareholders’ equity.

ForMotion™

Apparel and footwear technology that enhances the natural movement of sport for greater

comfort, fit and control while athletes are in motion.