Reebok 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group ›073

Regionally Mixed Development of Sporting Goods Industry

The sporting goods industry had a mixed regional develop-

ment in 2006. The European sporting goods industry largely

focused on the 2006 FIFA World Cup™, which helped to com-

pensate for subdued consumer spending in the first half

of the year. Nonetheless, footwear sales decreased at low-

single-digit rates in 2006 compared to the previous year,

whereas apparel sales increased at low-single-digit rates,

largely driven by the increased football offering. From a coun-

try perspective, strong growth in Spain and Italy was offset by

promotional market conditions particularly in the UK, which

led to declines in volume and price points. Average selling

prices fell across the region with the exception of Germany

and Spain. The sporting goods industry in North America

was dominated by a shift towards sport fusion styles which

gained strongly on the back of significant losses in the clas-

sics category. The footwear market increased by low-single-

digit rates in 2006 compared to the prior year, whereas the

apparel market grew at high-single-digit rates. In addition to

the sport fusion category, skateboarding increased markedly,

whereas basketball and running decreased compared to the

prior year. Amongst retailers, industry growth was strongest

in the sporting goods and family footwear channels, whereas

athletic specialty sales declined moderately. Average sell-

ing prices increased marginally across the industry. In the

Asian sporting goods market, consumer demand and retail

sentiment remained strong throughout the region, so that

the industry grew by high-single-digit rates in 2006. Stag-

nation in Japan and the region’s other industrialized coun-

tries was more than compensated by strong growth in China

and the region’s other emerging markets. Average selling

prices were stable in most of the region’s countries. In Latin

America, the sporting goods industry developed in line with

the overall economy and recorded a mid-single-digit sales

increase compared to the prior year. Average selling prices

were stable.

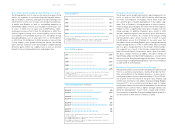

Exchange Rate Development1) € 1 equals

Average Average

rate Q1 Q2 Q3 Q4 rate

2005 2006 2006 2006 2006 2006

USD 1.2453 1.2104 1.2713 1.2660 1.3170 1.2562

GBP 0.6839 0.6964 0.6921 0.6777 0.6715 0.6820

JPY 136.91 142.42 145.75 149.34 156.93 146.08

1) Spot rates at quarter-end

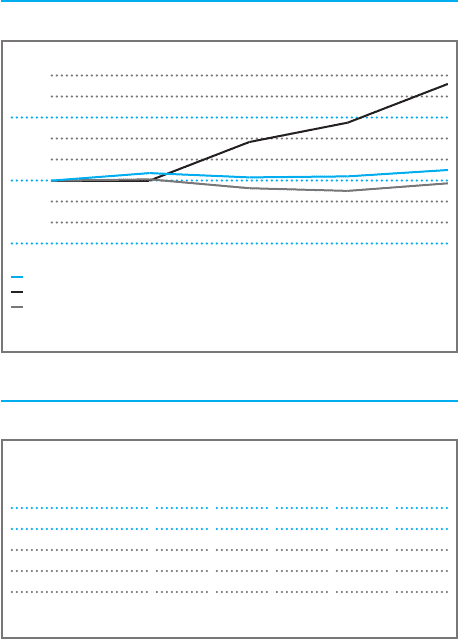

Quarterly Consumer Confidence Development by Region

130

100

70

Dec. 05 Mar. 06 Jun. 06 Sep. 06 Dec. 06

USA, Source: Conference Board

Euro Zone, Source: European Commission

Japan, Source: Economic and Social Research Institute, Government of Japan

1) Index: December 31, 2005 = 100

adidas Group Outpaces Industry and

Overall Economic Growth

In 2006, adidas Group revenues grew significantly faster

than both the economy and the sporting goods industry in all

regions, even excluding the effects from the first-time con-

solidation of Reebok. Private consumption and consumer

confidence are important factors contributing to the develop-

ment of our industry. In 2006, as expected, the sporting goods

industry outperformed the economy in most regions, boosted

by major sporting events such as the 2006 FIFA World Cup™,

and increasing demand for sports-inspired footwear and

apparel. Through our strong product offering, driven by major

product innovations and attractive designs in several catego-

ries, we were able to grow faster than our major competitors

in terms of both sales and profitability.

» Economic and Sector Development