Reebok 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

llllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

lllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllllll

071

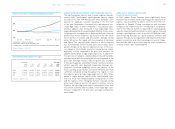

First-Time Consolidation of Reebok Impacts R&D Expenses

Given the short product lifecycles in the sporting goods

industry, R&D costs at the adidas Group are recognized as

expense in the period in which they are incurred and are not

capitalized. The increase in employees, primarily as a result

of the acquisition of Reebok, drove R&D expenses higher by

56% to € 98 million in 2006 (2005: € 63 million). For the Group

excluding Reebok, R&D expenses increased 14% to € 72 mil-

lion. In 2006, R&D expenses represented 2.6% of total operat-

ing expenses versus 2.4% in the prior year. R&D expenses as

a percentage of sales increased slightly to 1.0% from 0.9%

in 2005. Other related expenses for product development and

market research, for example, were incurred as part of the

Group’s other operating overheads.

Active Trademark and Patent Protection Policy

To capitalize on the Group’s R&D achievements, we seek to

gain trademark and patent protection for our key products,

technologies and innovations in all major markets for foot-

wear, apparel and hardware. We hold registered trademark

rights or have applied for trademark protection for the Group’s

brands and other proprietary names in most countries around

the world. Our business is not dependent upon any single pat-

ent or licensed technology. As part of our business policy, we

rigorously defend the adidas Group’s trademarks and patents

by monitoring and prosecuting infringements of trademark

and patent rights around the world (see Risk Report, p. 96).

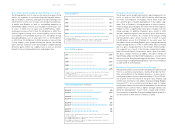

Successful Product Introductions Highlight R&D Strength

Developing industry-leading technologies is only one aspect

of being an innovation leader. Even more important is the suc-

cessful commercialization of those technological innovations.

The majority of the adidas Group’s sales in 2006 were gen-

erated with products newly introduced in the course of the

year. At brand adidas, products launched in 2006 accounted

for 79% of brand sales. Only 5% of total sales were gener-

ated with products introduced three or more years ago. Two

examples of how adidas transformed technological innova-

tions into commercial success in 2006 are the first modu-

lar football boot +F50 TUNIT and the +Teamgeist™ match

ball of the 2006 FIFA World Cup™. After being launched in

the market in March 2006, sales of the +F50 TUNIT football

boot clearly surpassed our original targets. Similarly, after

successfully launching the +Teamgeist™ in December 2005

featuring a completely new 14-panel configuration, sales fig-

ures clearly exceeded our original targets. An example of how

Reebok successfully commercialized R&D efforts in 2006 is

the Trinity KFS running shoe introduced in 2006, featuring

both the innovative KFS upper material construction and DMX

cushioning. This shoe was very well received at retail and won

the prestigious Global Runner’s World Editor’s Choice award.

In the TaylorMade-adidas Golf segment, current products (i.e.

products launched in the last 18 months, which is the typical

product lifecycle in golf) represented 79% of total sales. Prod-

ucts that had been brought to market three or more years ago

accounted for 8% of TaylorMade-adidas Golf sales. As in prior

years, all our brands will launch several new highlight prod-

ucts during the course of 2007 featuring major technologies

(see Subsequent Events and Outlook, p. 106).

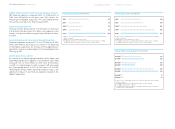

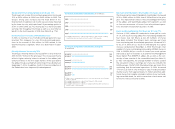

R&D Expenses € in millions

20021)

20031)

20042)

20052)

20063)

85

86

59

63

98

1) Including Salomon business segment which was more research intensive due to its

significant hard goods exposure.

2) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

3) Including Reebok business segment from February 1, 2006 onwards, excluding Greg

Norman wholesale business from December 1, 2006 onwards.

R&D Expenses in % of Net Sales

20021)

20031)

20042)

20052)

20063)

1.3

1.4

1.0

0.9

1.0

1) Including Salomon business segment which was more research intensive due to its

significant hard goods exposure.

2) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

3) Including Reebok business segment from February 1, 2006 onwards, excluding Greg

Norman wholesale business from December 1, 2006 onwards.

R&D Expenses in % of Operating Expenses

20021)

20031)

20042)

20052)

20063)

3.6

3.7

2.6

2.4

2.6

1) Including Salomon business segment which was more research intensive due to its

significant hard goods exposure.

2) Figures reflect continuing operations as a result of the divestiture of the Salomon

business segment.

3) Including Reebok business segment from February 1, 2006 onwards, excluding Greg

Norman wholesale business from December 1, 2006 onwards.

» Research & Development

Corporate Functions ›