Kodak 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

NOTE 22: DISCONTINUED OPERATIONS

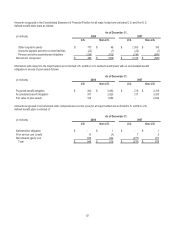

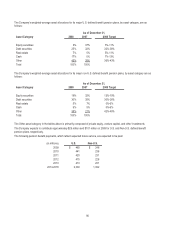

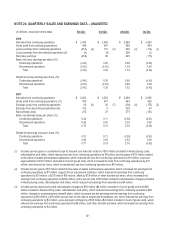

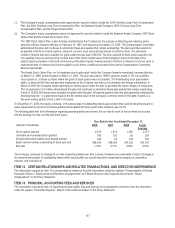

The significant components of earnings from discontinued operations, net of income taxes, are as follows:

For the Year Ended December 31,

(in millions) 2008 2007 2006

Revenues from Health Group operations $ - $ 754 $ 2,551

Revenues from HPA operations - 148 155

Total revenues from discontinued operations $ - $ 902 $ 2,706

Pre-tax income from Health Group operations $ - $ 27 $ 225

Pre-tax gain on sale of Health Group segment - 986 -

Pre-tax income from HPA operations - 8 12

Pre-tax gain on sale of HPA - 123 -

Benefit (provision) for income taxes related to discontinued operations 288 (262) (33)

All other items, net (3)(1)(1)

Earnings from discontinued operations, net of income taxes $ 285 $ 881 $ 203

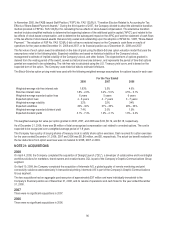

2008

Tax Refund

In the second quarter of 2008, the Company received a tax refund from the U.S. Internal Revenue Service. The refund was related

to the audit of certain claims filed for tax years 1993-1998. A portion of the refund related to past federal income taxes paid in

relation to the 1994 sale of a subsidiary, Sterling Winthrop Inc., which was reported in discontinued operations. The refund had a

positive impact on the Company’s earnings from discontinued operations, net of income taxes, for the year ended December 31,

2008 of $295 million. See Note 15, “Income Taxes,” for further discussion of the tax refund.

2007

Health Group segment

On April 30, 2007, the Company sold all of the assets and business operations of its Health Group segment to Onex Healthcare

Holdings, Inc. (“Onex”) (now known as Carestream Health, Inc.), a subsidiary of Onex Corporation, for up to $2.55 billion. The price

was composed of $2.35 billion in cash at closing and $200 million in additional future payments if Onex achieves certain returns with

respect to its investment.

The Company recognized a pre-tax gain of $986 million on the sale of the Health Group segment during 2007. This pre-tax gain

excludes the following: up to $200 million of potential future payments related to Onex's return on its investment as noted above;

potential charges related to settling pension obligations with Onex in future periods; and any adjustments that may be made in the

future that are currently under review.

The Company was required to use a portion of the initial $2.35 billion cash proceeds to fully repay its approximately $1.15 billion of

Secured Term Debt. In accordance with EITF No 87-24, “Allocation of Interest to Discontinued Operations,” the Company allocated

to discontinued operations the interest expense related to the Secured Term Debt because it was required to be repaid as a result of

the sale. Interest expense allocated to discontinued operations totaled $30 million for the year ended December 31, 2007.

HPA

On October 17, 2007, the shareholders of Hermes Precisa Pty. Ltd. (“HPA”), a majority owned subsidiary of Kodak (Australasia) Pty.

Ltd., a wholly owned subsidiary of the Company, approved an agreement to sell all of the shares of HPA to Salmat Limited. The sale

was approved by the Federal Court of Australia on October 18, 2007, and closed on November 2, 2007. Kodak received $139 million

in cash at closing for its shares of HPA, and recognized a pre-tax gain on the sale of $123 million.

2006

Earnings from discontinued operations for the year ended December 31, 2006 were primarily related to the operations of the Health

Group segment. Interest expense allocated to discontinued operations totaled $90 million for the year.