Kodak 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

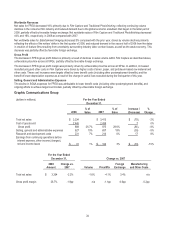

Worldwide Revenues

For the year ended December 31, 2008, net sales decreased by 9% compared with 2007 due primarily to the significant economic

deterioration in the fourth quarter in which the Company’s revenues were 24% lower than in the prior year quarter. The impact of the

downturn was particularly severe to the Company because of the normal seasonality of its sales, which are typically highest in the

last four months of the year. For the full year, the downturn led to unfavorable price/mix across all segments and accelerated volume

declines in Film Capture and Traditional Photofinishing within FPEG. These declines were partially offset by volume increases in

CDG, and Document Imaging within GCG, and favorable foreign exchange across all segments. Within CDG, Digital Capture and

Devices and Consumer Inkjet Systems experienced significant increases in volume in 2008, primarily related to new product

introductions in 2007 and throughout 2008.

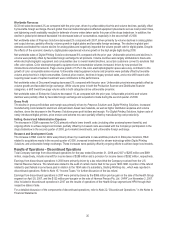

Gross Profit

Gross profit declined in 2008 in both dollars and as a percentage of sales, due largely to the broad deterioration late in the year in

sales volume, as well as unfavorable price/mix across all segments, partially offset by reductions in manufacturing and other costs

within CDG, and favorable foreign exchange. The improvements in manufacturing and other costs were driven by manufacturing

efficiencies within CDG, the benefit of lower depreciation expense as a result of the change in useful lives executed during the first

quarter of 2008 that benefited FPEG, lower benefit costs (including other postemployment benefits), and lower restructuring-related

charges, partially offset by increased silver, aluminum, paper, and petroleum-based raw material and other costs.

Included in gross profit was a non-recurring amendment of an intellectual property licensing agreement and a new non-recurring

intellectual property licensing agreement within Digital Capture and Devices. These licensing agreements contributed approximately

2.4% of consolidated revenue to consolidated gross profit dollars in 2008, as compared with 2.3% of consolidated revenue to

consolidated gross profit dollars for non-recurring agreements in the prior year.

In the first quarter of 2008, the Company performed an updated analysis of expected industry-wide declines in the traditional film and

paper businesses and its useful lives on related assets. This analysis indicated that the assets will continue to be used in these

businesses for a longer period than previously anticipated. As a result, the Company revised the useful lives of certain existing

production machinery and equipment, and manufacturing-related buildings effective January 1, 2008. These assets, which were

previously set to fully depreciate by mid-2010, are now being depreciated with estimated useful lives ending from 2011 to 2015. The

change in useful lives reflects the Company’s estimate of future periods to be benefited from the use of the property, plant, and

equipment. As a result of these changes, for full year 2008 the Company reduced depreciation expense by approximately $107

million, of which approximately $95 million benefited loss from continuing operations before income taxes. The net impact of the

change in estimate to loss from continuing operations for the year ended December 31, 2008 was a reduced loss of $93 million, or

$.33 on a fully-diluted loss per share basis.

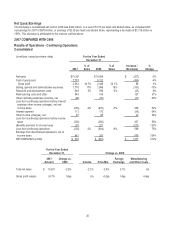

Selling, General and Administrative Expenses

The year-over-year decrease in consolidated selling, general and administrative expenses (“SG&A”) was primarily attributable to

company-wide cost reduction actions, and lower benefit costs (including other postemployment benefits – see below), partially offset

by unfavorable foreign exchange, a contingency accrual related to employment litigation matters of approximately $20 million, and

costs associated with the Company’s participation in the drupa tradeshow in the second quarter of 2008.

Research and Development Costs

The decrease in consolidated research and development costs (“R&D”) compared with prior year was primarily attributable to

company-wide cost reduction actions and significantly reduced spending in 2008 within CDG due to the introduction of consumer

inkjet printers in 2007. These decreases in R&D spending were partially offset by investments in new workflow products in Enterprise

Solutions and stream technology within Digital Printing Solutions, and R&D related acquisitions made in the second quarter of 2008,

both within GCG.

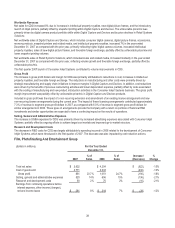

Postemployment Benefit Plan Changes

In the third quarter of 2008, the Company amended certain of its U.S. postemployment benefits effective as of January 1, 2009. As a

result of these plan changes, curtailment and other gains of $94 million were recognized in the third quarter of 2008. The gains are

reflected in the Consolidated Statement of Operations as follows: $48 million in cost of goods sold, $27 million in SG&A, and $19

million in R&D. The impact of these gains is not reflected in segment results. Refer to Note 18, “Other Postretirement Benefits” and

Note 23, “Segment Information.”

Restructuring Costs, Rationalization and Other

These costs, as well as the restructuring and rationalization-related costs reported in cost of goods sold, are discussed under the

"Restructuring Costs, Rationalization And Other" section.