Kodak 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

On December 12, 2008, Moody’s placed Kodak’s credit ratings on review for possible downgrade. On February 10, 2009, Moody’s

lowered the Company’s Corporate rating from B1 to B3, its Secured rating from Ba1 to Ba3 and its Senior Unsecured rating from B2

to Caa1, and maintained its negative outlook.

The Company does not have any rating downgrade triggers that would accelerate the maturity dates of its debt. However, the

Company could be required to increase the dollar amount of its letters of credit or provide other financial support up to an additional

$64 million at the current credit ratings. As of the filing date of this Form 10-K, the Company has not been requested to materially

increase its letters of credit or other financial support. Additional downgrades in the Company’s credit rating or disruptions in the

capital markets could impact borrowing costs and the nature of its funding alternatives.

The Company’s Secured Credit Agreement (“Secured Credit Agreement”) contains various affirmative and negative covenants

customary in a facility of this type, including two quarterly financial covenants: (1) a consolidated debt for borrowed money to a

rolling four-quarter sum of consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) (subject to

adjustments to exclude any extraordinary income or losses, as defined by the Secured Credit Agreement, interest income and

certain non-cash items of income and expense) ratio of not greater than: 3.5 to 1 as of December 31, 2006 and thereafter, and (2) a

consolidated EBITDA to consolidated interest expense (subject to adjustments to exclude interest expense not related to borrowed

money) ratio, on a rolling four-quarter basis, of no less than 3.0 to 1. As of December 31, 2008, the Company maintained a

substantial cash balance and was in full compliance with all covenants, including the two financial covenants, associated with its

Secured Credit Agreement. The Company maintains this credit arrangement in order to provide additional financial flexibility. As of

December 31, 2008, there was no debt outstanding and $131 million of letters of credit issued, which are not considered debt for

borrowed money under the agreement, but do reduce the Company’s borrowing capacity under the Secured Credit Agreement by

this amount.

Based on the Company’s current financial forecasts, it is reasonably likely that the Company could breach its financial covenants in

the first quarter of 2009 unless an appropriate amendment or waiver is obtained. The Company is currently negotiating with its

lenders to ensure it has continued access to a Secured Credit Agreement, with the goal to have an amended credit facility in place

by the end of the first quarter.

In the event that the Company is unable to successfully re-negotiate the terms of the Secured Credit Agreement, and the Company

breaches the financial covenants, the Company may be required to cash collateralize approximately $131 million of outstanding

letters of credit. A breach of the financial covenants would not accelerate the maturity of any of the Company’s existing outstanding

debt. However, should the Company lose access to its revolving credit facility under the Secured Credit Agreement, it would lose the

additional financial flexibility provided by the facility. Based on its current financial position and expected economic performance, the

Company does not believe that its liquidity will be materially affected by an inability to access external sources of financing.

However, the Company’s goal is to complete its negotiation and amendment prior to covenant compliance testing for the first quarter

of 2009.

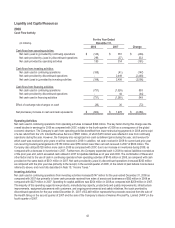

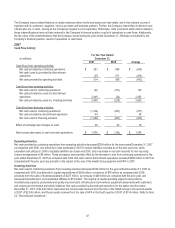

Contractual Obligations

The impact that our contractual obligations are expected to have on the Company's liquidity and cash flow in future periods is as

follows:

As of December 31, 2008

(in millions) Total 2009 2010

2011

2012 2013 2014+

Long-term debt (1) $ 1,302 $ 50 $ 620

$43

$40$536$13

Interest on debt 300 72 69

52

53 44 10

Operating lease obligations 387 96 81

65

49 28 68

Purchase obligations (2) 921 479 207

122

49 33 31

Total (3) (4) (5) $ 2,910 $ 697 $ 977

$ 282

$ 191 $ 641 $ 122

(1) Represents maturities of the Company's long-term debt obligations as shown on the Consolidated Statement of Financial

Position. See Note 8, "Short-Term Borrowings and Long-Term Debt" in the Notes to Financial Statements.

(2) Purchase obligations include agreements related to supplies, production and administrative services, as well as marketing and

advertising, that are enforceable and legally binding on the Company and that specify all significant terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the

transaction. Purchase obligations exclude agreements that are cancelable without penalty. The terms of these agreements

cover the next one to thirteen years. See Note 10, "Commitments and Contingencies," in the Notes to Financial Statements.