Kodak 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

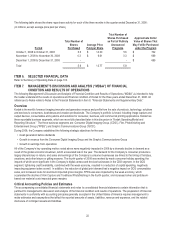

32

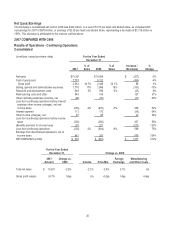

Consumer Digital Imaging Group

(dollars in millions) For the Year Ended

December 31,

2008

%of

Sales

2007

%of

Sales

Increase /

(Decrease)

%

Change

Total net sales $ 3,088

$ 3,247

$ (159) -5%

Cost of goods sold 2,495

2,419

76 -3%

Gross profit 593 19.2%

828

25.5% (235) -28%

Selling, general and administrative expenses 555 18%

595

18% (40) -7%

Research and development costs 215 7%

250

8% (35) -14%

Loss from continuing operations before

interest expense, other income (charges),

net and income taxes $ (177)-6%

$(17)

-1% $ (160) 941%

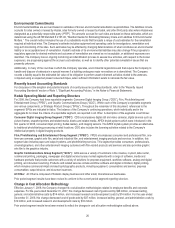

For the Year Ended

December 31, Change vs. 2007

2008

Amount

Change vs.

2007 Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other Costs

Total net sales $ 3,088 -4.9% 8.6%

-14.6%

1.1% n/a

Gross profit margin 19.2% -6.3pp n/a

-13.4pp

0.7pp 6.4pp

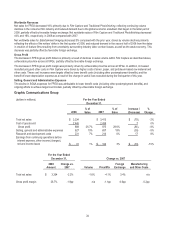

Worldwide Revenues

Net sales for CDG decreased 5% in 2008 primarily as a result of the sharp decline in global consumer demand experienced in the

fourth quarter of 2008. The economic downturn negatively impacted all industries that rely on consumer discretionary spending.

CDG net sales in the fourth quarter declined from 42% of CDG’s full-year revenue for 2007 to only 31% of full-year revenue for 2008.

Volume increases in 2008 attributable to products introduced in 2007 and throughout 2008 were more than offset by unfavorable

price/mix, as reduced demand resulted in downward price pressure and a shift in consumer demand to lower-priced products.

However, Kodak continued to maintain or increase its market share position in key product categories in which it participates.

Net sales for CDG decreased primarily due to unfavorable price/mix in Digital Capture and Devices, partially offset by volume growth

in Consumer Inkjet and Digital Capture and Devices, and favorable foreign exchange across all SPGs.

Net worldwide sales of Digital Capture and Devices, which includes consumer digital still and video cameras, digital picture frames,

accessories, memory products, snapshot printers and related media, and intellectual property royalties, decreased 7% in the year

ended December 31, 2008 as compared with the prior year. This decrease primarily reflects unfavorable price/mix for digital

cameras and digital picture frames, volume declines in snapshot printing, and lower intellectual property royalties (see gross profit

discussion below), partially offset by increased volumes for digital cameras and digital picture frames as well as favorable foreign

exchange. Digital picture frames were introduced at the end of the first quarter of 2007.

Net worldwide sales of Consumer Inkjet Systems, which includes inkjet printers and related consumables, increased in the year

ended December 31, 2008, primarily reflecting volume improvements due to the launch of the product line at the end of the first

quarter of 2007 and the introduction of the second generation of printers in the first quarter of 2008, partially offset by unfavorable

price/mix. Sell-through of inkjet printers for the full year more than doubled compared with the prior year, resulting in an estimated

installed base of more than 1 million printers as of December 31, 2008.

Net worldwide sales of Retail Systems Solutions, which includes kiosks and related media and APEX drylab systems, increased 1%

in the year ended December 31, 2008 as compared with the prior year, reflecting higher equipment and media volumes as well as

favorable foreign exchange, partially offset by unfavorable price/mix.