Kodak 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

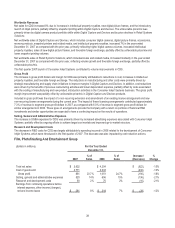

Worldwide Revenues

For the year ended December 31, 2007, net sales decreased by 3% compared with 2006, primarily as a result of unfavorable

price/mix across all segments and significant industry-related volume declines, driven largely by Film Capture and Traditional

Photofinishing within FPEG. These declines were partially offset by significant volume growth in Digital Capture within CDG, volume

growth within GCG, favorable foreign exchange across all segments, and increases in intellectual property royalties.

Gross Profit

Gross profit improved in the year ended December 31, 2007 in both dollars and as a percentage of sales, due largely to reduced

manufacturing and other costs as a result of a number of factors, as well as increased intellectual property royalties within CDG. In

addition, foreign exchange was a positive contributor to gross profit as a result of the weak U.S. dollar’s net impact on revenues and

costs. The decreases in manufacturing and other costs were due to a combination of the impact of the Company's cost reduction

initiatives, strategic manufacturing and supply chain initiatives within CDG, lower restructuring-related charges, and lower

depreciation expense, partially offset by increased silver and aluminum costs. The unfavorable price/mix was driven by product

portfolio shifts in Digital Capture and Devices within CDG, and across the businesses within FPEG.

Included in gross profit for 2007 were a non-recurring extension and amendment of an existing license arrangement and new non-

recurring license arrangements. The impact of these licensing arrangements contributed approximately 2.3% of revenue to

consolidated gross profit dollars in 2007, as compared with 1.7% of revenue to consolidated gross profit dollars for similar

arrangements in 2006. These types of arrangements provide the Company with a return on portions of historical R&D investments

and similar opportunities are expected to have a continuing impact on the results of operations.

Selling, General and Administrative Expenses

The year-over-year decrease in consolidated SG&A in dollars and as a percent of sales was primarily attributable to significant

Company-wide cost reduction actions, partially offset by increased advertising costs related to Consumer Inkjet Systems and the

impacts of foreign exchange.

Research and Development Costs

The decrease in R&D costs was primarily driven by the continuing realignment of resources, as well as the timing of development of

new products.

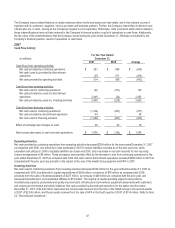

Restructuring Costs, Rationalization and Other

The most significant charge within restructuring costs was a $238 million impairment charge related to the sale of the Company's

Xiamen, China facility in the second quarter. These costs, as well as the restructuring-related costs reported in cost of goods sold,

are discussed in further detail under the "Restructuring Costs, Rationalization And Other" section.

Other Operating (Income) Expenses, Net

The Other operating (income) expenses, net category includes gains and losses on sales of capital assets and certain asset

impairment charges. The year-over-year increase in Other operating (income) expenses, net was largely driven by gains on sales of

capital assets and businesses in 2007 of $158 million, partially offset by asset impairments including the impairment of an intangible

asset of $46 million in connection with the Company’s plan to dispose of its stake in Lucky Film Co. Ltd.

Interest Expense

Lower Interest expense was primarily due to lower debt levels resulting from the full payoff of the Company's Secured Term Debt in

the second quarter of 2007, partially offset by higher interest rates in 2007 as compared with 2006.

Other Income (Charges), Net

The Other income (charges), net category includes interest income, income and losses from equity investments, and foreign

exchange gains and losses. The increase in Other income (charges), net in 2007 as compared with 2006 was primarily attributable

to increased interest income due to higher cash balances resulting from the proceeds on the sale of the Health Group (See Note 22,

“Discontinued Operations” in the Notes to Financial Statements) and higher interest rates. This increase was partially offset by an

impairment of an equity method investment.

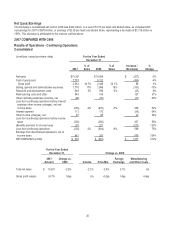

Income Tax (Benefit) Provision

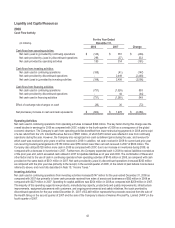

(dollars in millions) For the Year Ended

December 31,

2007 2006

Loss from continuing operations before income taxes ($256) ($583)

(Benefit) provision for income taxes ($51) $221

Effective tax rate 19.9% (37.9)%