Kodak 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

The Company also sponsors unfunded defined benefit plans for certain U.S. employees, primarily executives. The benefits of these

plans are obtained by applying KRIP provisions to all compensation, including amounts being deferred, and without regard to the

legislated qualified plan maximums, reduced by benefits under KRIP. Employees covered by the Cash Balance plan also receive an

additional benefit equal to 3% of their annual pensionable earnings. The Company suspended this additional benefit for 2009.

Many subsidiaries and branches operating outside the U.S. have defined benefit retirement plans covering substantially all

employees. Contributions by the Company for these plans are typically deposited under government or other fiduciary-type

arrangements. Retirement benefits are generally based on contractual agreements that provide for benefit formulas using years of

service and/or compensation prior to retirement. The actuarial assumptions used for these plans reflect the diverse economic

environments within the various countries in which the Company operates.

The measurement date used to determine the pension obligation for all funded and unfunded U.S. and Non-U.S. defined benefit

plans is December 31.

Information regarding the major funded and unfunded U.S. and Non-U.S. defined benefit plans follows:

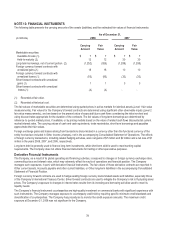

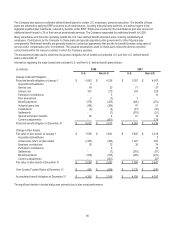

(in millions) 2008 2007

U.S. Non-U.S. U.S. Non-U.S.

Change in Benefit Obligation

Projected benefit obligation at January 1 $ 4,963 $ 4,236 $ 5,557 $ 4,067

Acquisitions/divestitures 3 - - 4

Service cost 54 20 71 27

Interest cost 307 219 304 205

Participant contributions - 6 - 10

Plan amendment 3 (7) 7 -

Benefit payments (576) (255) (408) (274)

Actuarial (gain) loss (186) (396) 47 51

Curtailments (2) (2) (97) (33)

Settlements - (7) (579) (51)

Special termination benefits 36 4 61 14

Currency adjustments - (801)-216

Projected benefit obligation at December 31 $ 4,602 $ 3,017 $ 4,963 $ 4,236

Change in Plan Assets

Fair value of plan assets at January 1 $ 7,098 $ 3,641 $ 6,820 $ 3,419

Acquisitions/divestitures - - - 2

Actual (loss) return on plan assets (1,453) (495) 1,227 260

Employer contributions 29 72 38 74

Participant contributions - 6 - 10

Settlements - (7) (579) (57)

Benefit payments (576) (255) (408) (274)

Currency adjustments - (601)- 207

Fair value of plan assets at December 31 $ 5,098 $ 2,361 $ 7,098 $ 3,641

Over (Under) Funded Status at December 31 $ 496 $ (656) $ 2,135 $ (595)

Accumulated benefit obligation at December 31 $ 4,392 $ 2,936 $ 4,708 $ 4,097

The significant decline in funded status was primarily due to plan asset performance.