Kodak 2008 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2008 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

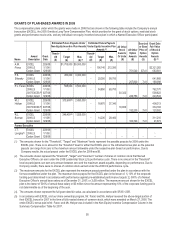

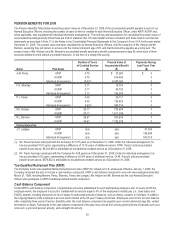

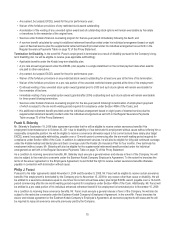

(1) This table includes only those grants outstanding as of December 31, 2008; stock options that expired prior to the end of fiscal

2008 are excluded from this table.

(2) This column represents outstanding grants of restricted stock and the earned 2007 Leadership Stock award (including dividend

equivalents) held by our Named Executive Officers.

(3) The market value of shares, units or other rights that have not vested was calculated using a stock price of $6.58 (closing price

of Kodak stock on December 31, 2008, the last trading day of the year).

(4) There are no unearned Leadership Stock awards outstanding as of December 31, 2008.

(5) These options were granted on December 12, 2006 and will vest in equal annual installments on the first three anniversaries of

the grant date.

(6) These options were granted on December 11, 2007 and will vest in equal annual installments on the first three anniversaries of

the grant date.

(7) These options were granted on December 9, 2008 and will vest in equal annual installments on the first three anniversaries of

the grant date.

(8) These options were granted on February 1, 2006 and will vest in equal annual installments on the first three anniversaries of the

grant date.

(9) These options were granted on October 16, 2007 and will vest in equal annual installments on the first three anniversaries of the

grant date.

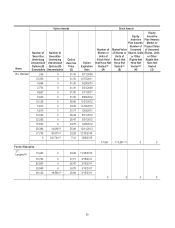

(10) Represents outstanding stock options for Mr. Langley: outstanding stock options continue to vest in accordance with their original

vesting schedule for an involuntary termination with approved reason; all stock options must be exercised prior to the earlier of 1)

the expiration date of original term of the stock option or 2) three years from Mr. Langley's termination date.

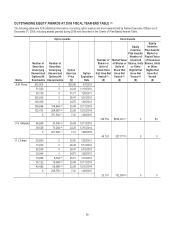

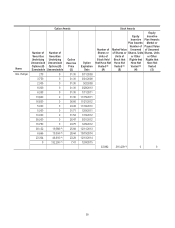

(11) Mr. Perez's unvested stock awards include: 1) the remaining 30,000 unvested shares of a restricted stock award granted on

June 1, 2005, which will vest on June 1, 2010; 2) the remaining 18,992 unvested shares of a restricted stock award granted on

February 27, 2007, which will vest in substantially equal installments on February 27, 2009 and February 27, 2010; and 3)

77,762 shares resulting from the 2007 Leadership Stock cycle which will vest on December 31, 2009 (includes unvested

dividend equivalents).

(12) Mr. Sklarsky's unvested stock awards include: 1) the remaining 25,000 unvested shares of a restricted stock award granted on

October 30, 2006, which will vest on October 30, 2010 and 2) 24,723 shares resulting from the 2007 Leadership Stock cycle

which will vest on December 31, 2009 (includes unvested dividend equivalents).

(13) Mr. Faraci's unvested stock awards include: 1) the remaining 5,000 unvested shares of a restricted stock award granted on

December 6, 2004, which will vest on December 6, 2009; 2) the remaining 3,592 unvested shares of a restricted stock award

granted on February 27, 2007, which will vest in substantially equal installments on February 27, 2009 and February 27, 2010;

and 3) 14,509 shares resulting from the 2007 Leadership Stock cycle which will vest on December 31, 2009 (includes unvested

dividend equivalents).

(14) Ms. Hellyar’s unvested stock awards include: 1) a restricted stock award of 15,000 shares, granted on July 17, 2006, which will

vest in substantially equal installments on July 17, 2009 and July 17, 2011; 2) the remaining 3,593 unvested shares of a

restricted stock award granted on February 27, 2007, which will vest in substantially equal installments on February 27, 2009 and

February 27, 2010; and 3) 14,299 shares resulting from the 2007 Leadership Stock cycle which will vest on December 31, 2009

(includes unvested dividend equivalents).

(15) Mr. Berman’s unvested stock awards include: 1) the remaining 6,667 shares of a restricted stock award granted on

December 10, 2004, which will vest in substantially equal installments on December 10, 2009 and December 10, 2011 and 2)

10,894 shares resulting from the 2007 Leadership Stock cycle which will vest on December 31, 2009 (includes unvested

dividend equivalents).